Fillable Rp 5217Nyc Form in PDF

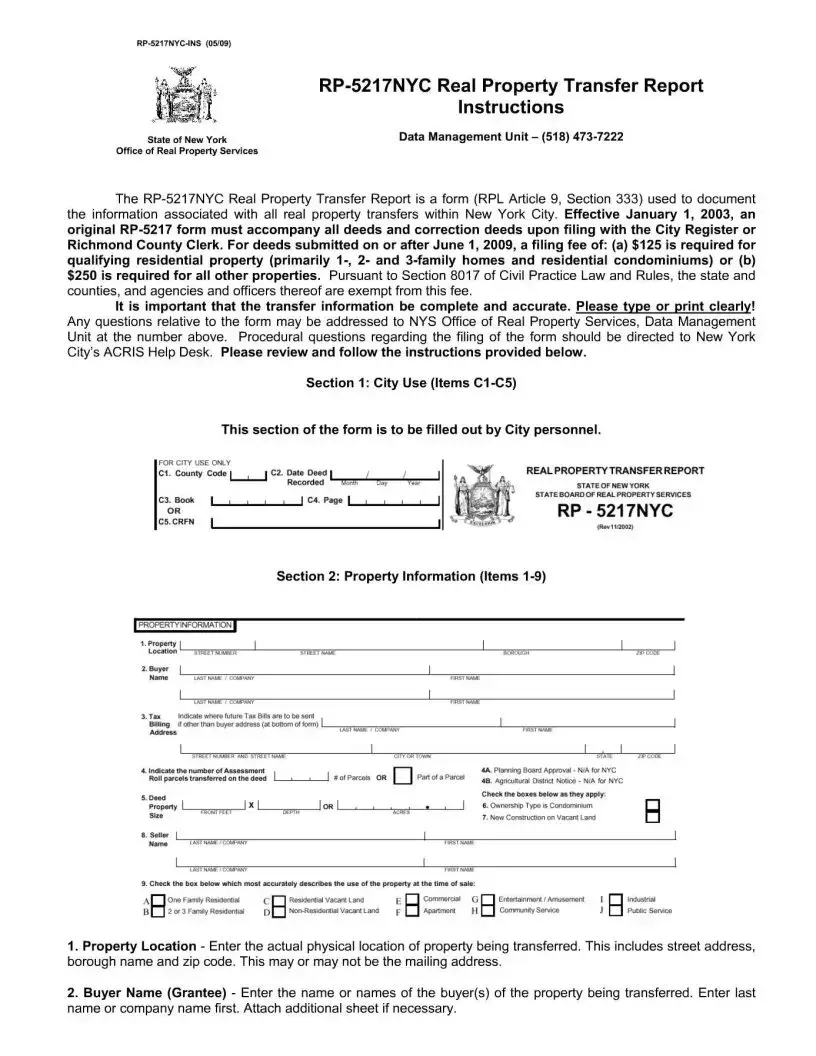

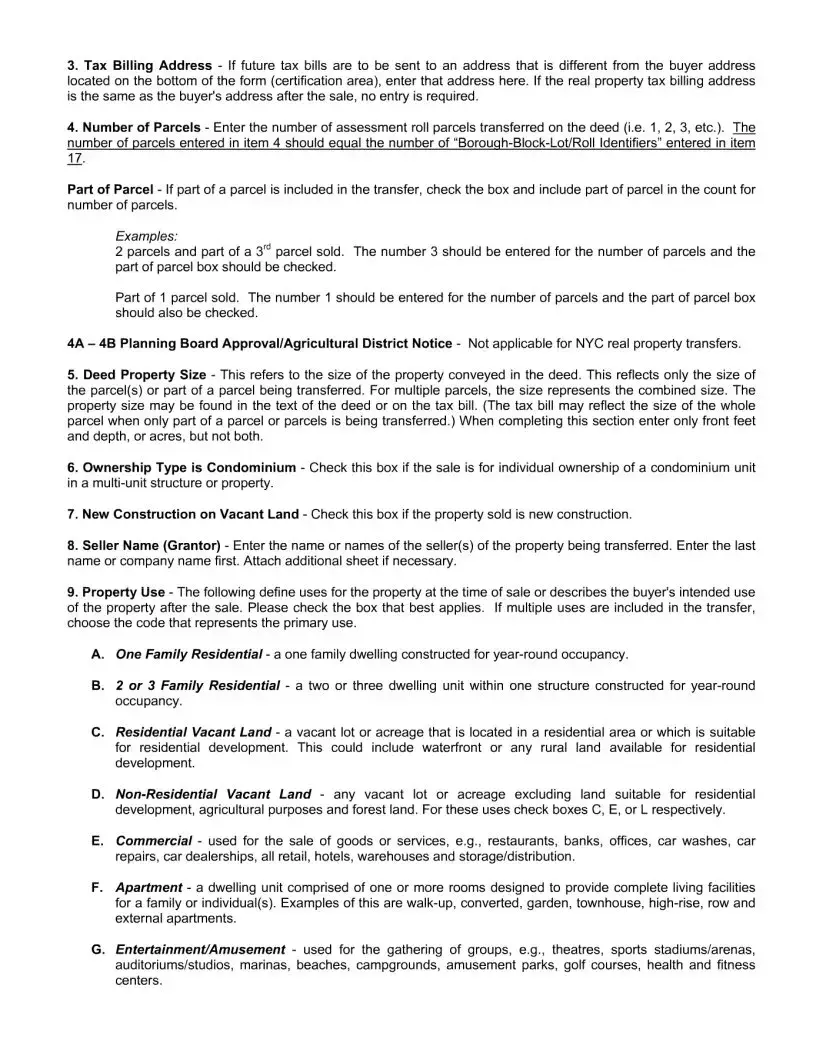

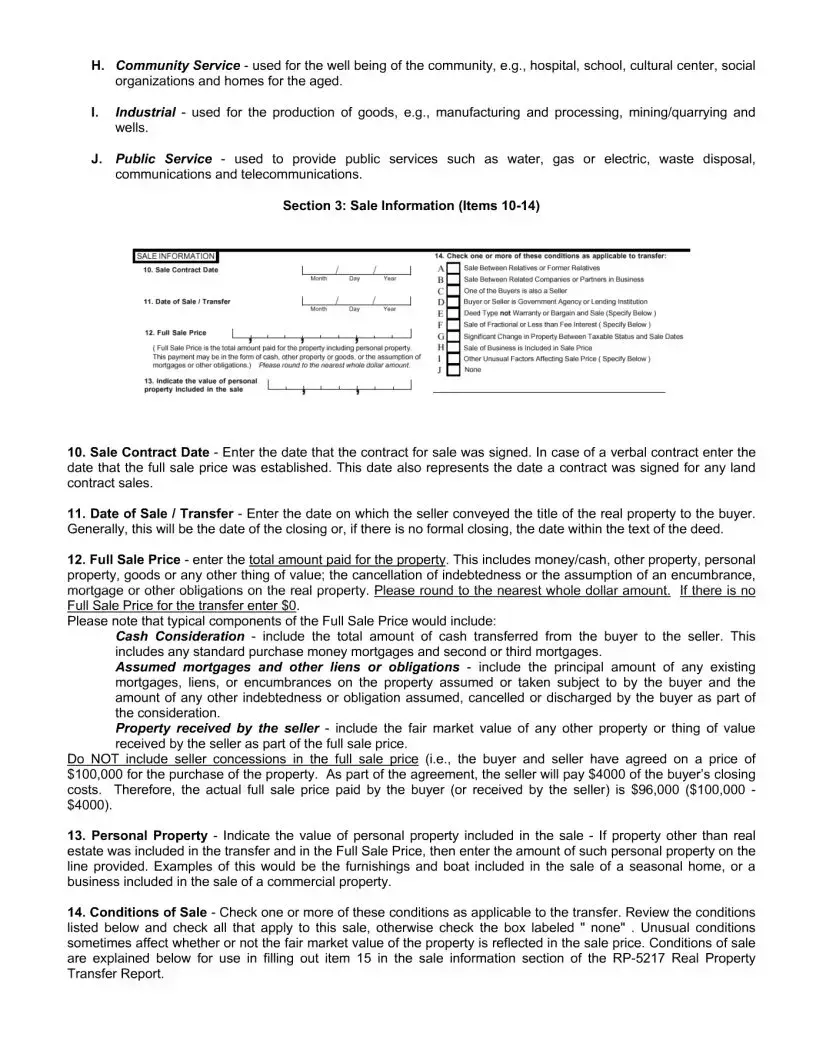

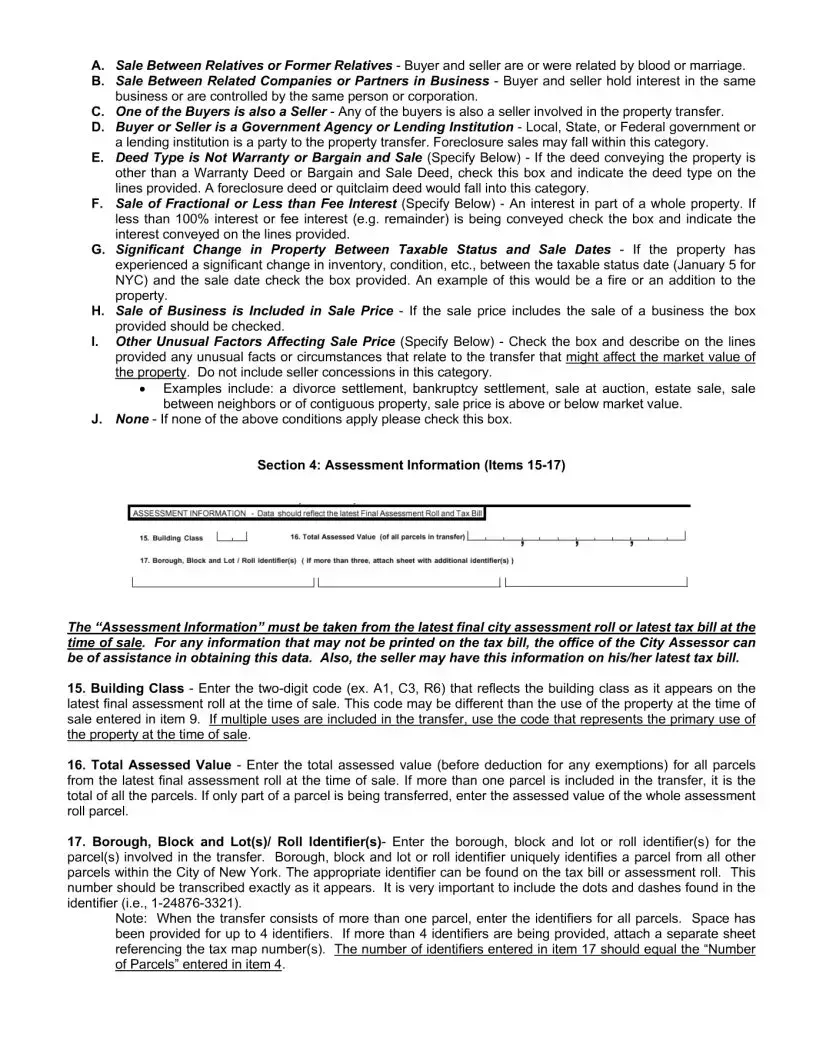

The RP-5217NYC Real Property Transfer Report plays a crucial role in documenting real estate transactions within New York City. This form is required for all property transfers and must be submitted alongside deeds and correction deeds when filing with the City Register or Richmond County Clerk. Since its implementation on January 1, 2003, it has ensured that vital information regarding property sales is accurately recorded. For transactions occurring after June 1, 2009, a filing fee is applicable, with different amounts based on the type of property being transferred. Residential properties, such as single-family homes and condominiums, incur a fee of $125, while all other properties require a fee of $250. However, state and county agencies are exempt from this charge. It is essential to complete the form with precise details, as inaccuracies can lead to complications in the transfer process. The form consists of several sections, including city use information, property details, and sale information, each designed to capture specific data necessary for the transaction. For any questions regarding the form or its filing process, individuals are encouraged to contact the New York State Office of Real Property Services or the New York City ACRIS Help Desk.

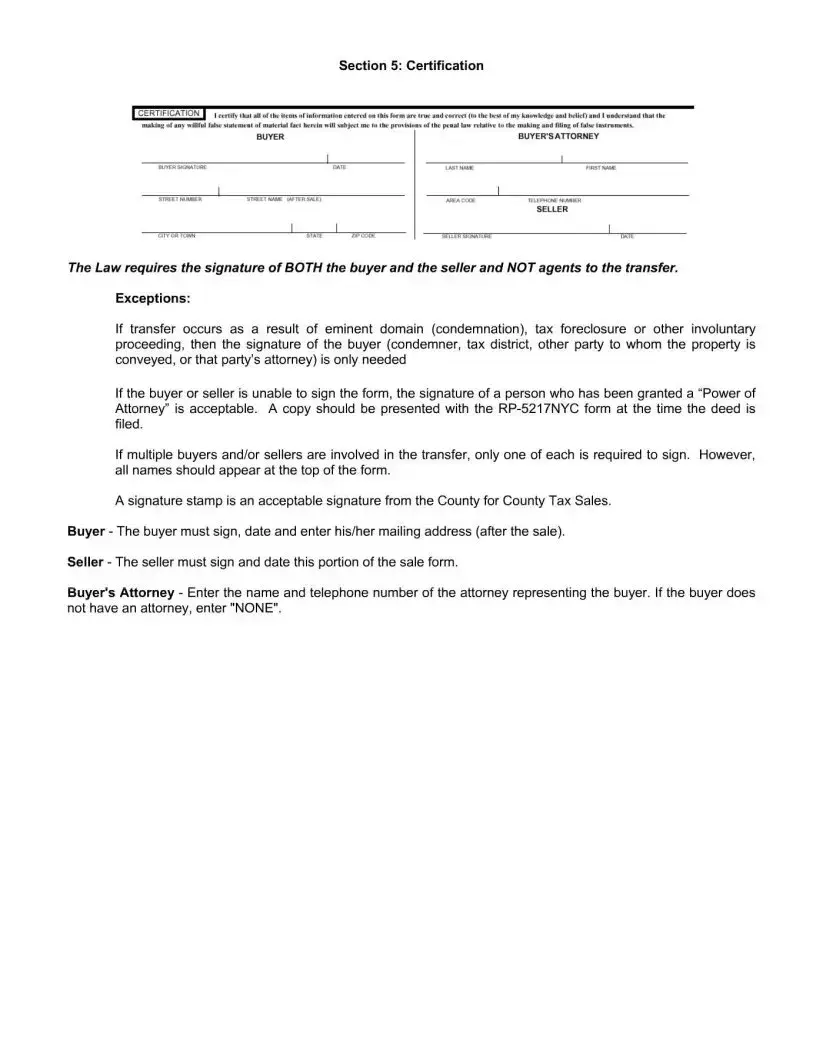

Preview - Rp 5217Nyc Form

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose | The RP-5217NYC form is used to document information related to real property transfers in New York City. |

| Filing Requirement | Since January 1, 2003, an original RP-5217 form must accompany all deeds when filed with the City Register or Richmond County Clerk. |

| Filing Fees | A filing fee of $125 is required for qualifying residential properties, while a fee of $250 applies to all other properties. |

| Exemptions | According to Section 8017 of the Civil Practice Law and Rules, state and county agencies are exempt from filing fees. |

| Contact Information | For questions regarding the form, individuals can contact the NYS Office of Real Property Services at (518) 473-7222. |

More PDF Templates

Gas Stove Installation Rules Nyc - Ensures compliance with the NYC Noise Code by requiring a complete and accurate Construction Mitigation Plan at the work site.

Resale Certificate Nyc - A critical step for non-profits in NYC to continue enjoying the advantages of being tax-exempt.