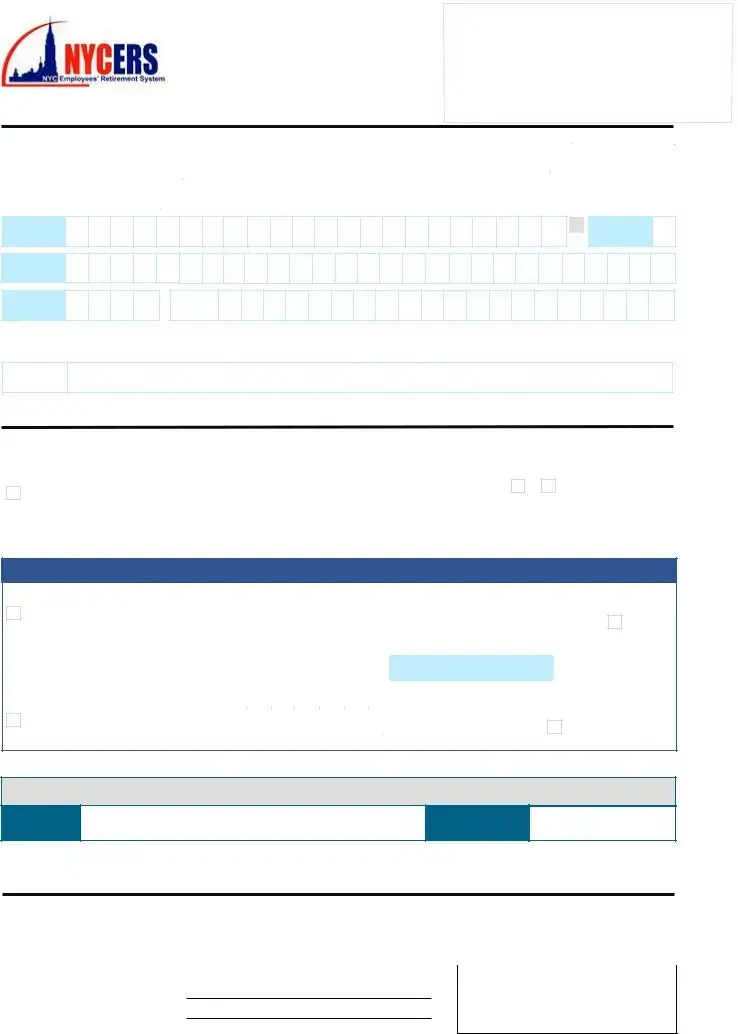

Fillable Nycers F349 Form in PDF

The NYCERS F349 form is an essential document for individuals receiving pension payments from the New York City Employees' Retirement System (NYCERS). This form allows pensioners to make important decisions regarding their federal income tax withholding. By filling out the F349, individuals can choose whether or not they want NYCERS to withhold taxes from their pension payments. The form includes options for those who prefer not to have any taxes withheld, as well as sections for specifying the number of allowances based on marital status. Additionally, pensioners can indicate if they wish to withhold an extra amount beyond the calculated allowances. Completing this form accurately is crucial, as it directly impacts the amount of tax withheld from monthly pension checks. To ensure its validity, the F349 must be acknowledged before a Notary Public or Commissioner of Deeds, adding an extra layer of importance to this seemingly straightforward document. Understanding the details of the F349 form can help retirees navigate their tax obligations with confidence.

Preview - Nycers F349 Form

NYCERS USE ONLY

Mail completed form to: |

or Visit Client Services |

340 Jay Street |

|

Long Island City, NY 11101 |

Brooklyn, NY |

www.nycers.org |

(347) |

Federal I ncome Tax Withholding Change - - W - 4P

[ Print clearly in CAPI TAL letters. See reverse for information and instructions. ]

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

M M |

|

D D |

|

|

|

Y Y Y Y |

|||||||

|

PENSION # |

|

|

|

|

|

|

- |

|

|

|

|

|

LAST 4 |

|

|

|

|

|

|

|

|

|

|

|

DATE OF |

|

|

|

- |

|

|

|

|

- |

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

SSN |

|

|

|

|

|

|

|

|

|

|

|

BIRTH |

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

FIRST NAME |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MIDDLE |

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

INITIAL |

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LAST NAME |

1 |

ADDRESS IS |

|

FOREIGN |

ADDRESS |

APT |

CITY |

STATE |

|

|

|

ZIP CODE |

|

|

|

|

|

|

DAYTIME |

|

( |

|

|

|

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PHONE # |

|

|

|

|

|

|

|

|

|

|

|

[ Choose your tax- w ithholding option below . Place an X or a number in the box( es) to indicate your choice( s) .]

DO NOT WI THHOLD TAX |

[ Complete this section if you do not want NYCERS to withhold any |

|||||||||

|

|

|

|

|

|

Federal income tax from your pension payments. If you check this |

||||

|

|

|

|

|

|

box, DO NOT COMPLETE Section |

|

or |

|

below. ] |

|

|

|

|

|

|

3 |

4 |

|||

|

2 |

|

DO NOT WITHHOLD FEDERAL TAX |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

OR

WI THHOLD TAX BASED ON EXEMPTI ONS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

[Enter total number of allowances (exemptions) and |

||||||||||||||

|

|

NUMBER OF |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

3 |

|

ALLOWANCES |

|

|

|

NUMBER OF ALLOWANCES YOU ARE |

|

|

|

|

|

|

|

|

your marital status. If you would like to withhold an |

|||||||||||||||||||||||||||

|

|

(REQUIRED) |

|

|

|

CLAIMING |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

additional amount, enter the amount in Section |

4 |

. ] |

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MARITAL |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

STATUS |

|

|

|

|

SINGLE |

|

|

OR |

|

MARRIED |

|

|

OR |

MARRIED, BUT WITHHOLD AT HIGHER |

|

|

|

|

|

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||

|

|

|

(REQUIRED) |

|

|

|

|

|

|

|

|

SINGLE RATE |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

[ If you enter an amount |

||||||||||||

|

|

ADDITIONAL |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

DOLLARS |

|

|

|

|

CENTS |

|

|

|||||||||||||||||

|

4 |

AMOUNT |

|

|

|

ADDITIONAL AMOUNT TO |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

. |

|

|

|

|

|

here, you must also complete |

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Section |

3 |

above.] |

|||||||||||||||||

|

|

(OPTIONAL) |

|

|

WITHHOLD PER MONTH |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

I have completed this form and represent that all information is true and accurate.

DATE

(MM/DD/YYYY)

This form must be acknow ledged before a Notary Public or Commissioner of Deeds

State of |

|

County of |

|

|

On this |

|

day of 20 |

|

, personally appeared before me the above |

|

named, |

|

|

|

|

, to me known, and known to me to be the individual described in and who |

|||||

executed the foregoing instrument and he or she acknowledged to me that he or she executed the same, and that the statements contained therein are true.

Signature of Notary Public or |

|

|

If you have an official seal, affix it |

|

|

|

|

Commissioner of Deeds |

|

|

|

|

|

|

Official Title

RExpiration Date of Commission

08/06/15

F3 4 9

*349*

R 08/06/15

Information and Instructions

This form is for NYCERS pensioners and beneficiaries who wish to change the amount of Federal income tax withheld from their monthly pension payments.

Print clearly in CAPITAL letters. Use black or blue ink only. Leave blank spaces between words and numbers.

1

2

2  3

3 4

4

5

5 6

6 7

7 8

8 9

9

0

0

A

A  B

B C

C D

D E

E F

F G

G

H

H I

I  J

J  K

K L

L  M

M N

N O

O  P

P Q

Q

R

R  S

S T

T  U

U

V

V  W

W X

X  Y

Y  Z

Z

1If your address is foreign:

Put an ‘X’ in the box labeled "Address is Foreign" and enter the address as follows:

Enter your street address or post office box number, City or Town, other principal subdivision (e.g., province, state, county) and postal code, if

Address Field: |

known. (The postal code may precede the city or town.). |

|

2

3

4

City: |

Enter the entire country name in the City field. |

State/Zip Code Fields: |

Leave these fields blank. |

Select this option if you do not want NYCERS to withhold any Federal income tax from your pension payments. If you check this box, DO NOT COMPLETE Section 3 or 4.

Enter total number of allowances (exemptions) and your marital status.

If you would like to withhold additional monies, enter the amount in Section 4.

If you enter an amount here, you must also complete Section 3.

Sign this form before a Notary and return it to NYCERS at the address shown. Keep a copy for your records.

Use this form to indicate to NYCERS the amount of Federal income tax to withhold. You may also use this form to choose:

(a) not to have any Federal income tax withheld from the payment, or (b) to have an additional amount of Federal income tax withheld.

Pensioners with a MyNYCERS account and a registered Personal Identification Number (PIN) may log in at www.nycers.org and change their tax withholding online instead of filing this paper form.

NYCERS cannot counsel you on tax matters. If you need assistance in determining which tax withholding selections to make, please consult with a professional tax preparer or the Internal Revenue Service (IRS).

NOTE: If the address you provide on this form is different from your address in our system, the new address will become your official address in our records.

Form Characteristics

| Fact Name | Description |

|---|---|

| Form Purpose | The NYCERS F349 form is used to change federal income tax withholding for pension payments. |

| Filing Location | Completed forms should be mailed to either Long Island City or Brooklyn, NY, or submitted in person at Client Services. |

| Contact Information | For assistance, individuals can contact NYCERS at (347) 643-3000 or visit their website at www.nycers.org. |

| Withholding Options | Participants can choose to either withhold tax, specify allowances, or opt not to withhold any tax at all. |

| Exemptions | Individuals must enter the number of allowances they wish to claim, which affects the amount of tax withheld. |

| Notary Requirement | The form must be acknowledged before a Notary Public or Commissioner of Deeds to be considered valid. |

| State Law | This form is governed by New York State laws regarding tax withholding and pension payments. |

| Additional Amount | Participants can specify an additional withholding amount, but must also complete the allowance section if they do. |

More PDF Templates

Nycera - NYCERS members can opt to redirect their monthly payments to a new address using this comprehensive form.

Certificate of Good Standing New York Sample - Directs towards the provision of a physical address to which the state can mail any legal process notifications.

Resale Certificate Nyc - Facilitates the continuation of tax benefits for non-profit organizations based in NYC.