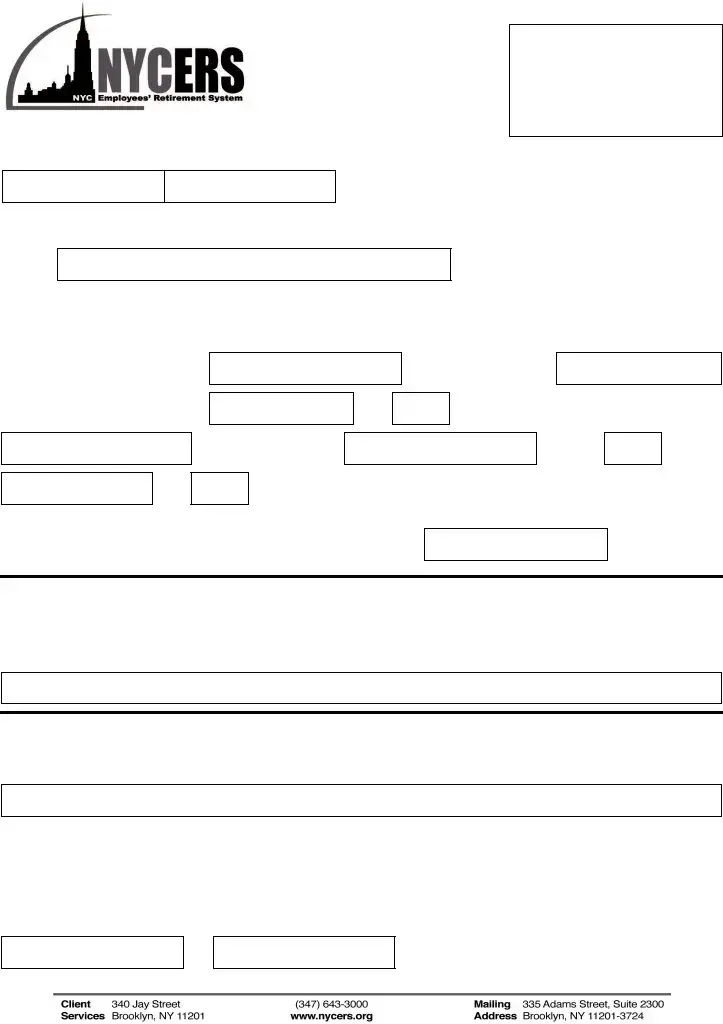

Fillable Nycers F321 Form in PDF

The NYCERS F321 form plays a crucial role for members of the New York City Employees' Retirement System who wish to transfer their accumulated salary deductions to another retirement system within New York State. This application not only allows members to move their funds, including accrued interest, but also requires them to formally release NYCERS from any liability related to this transfer. Members must provide essential information such as their member number and the last four digits of their Social Security number. Additionally, the form captures details about the member's previous and current employment, ensuring that the transfer aligns with their new retirement system. For those who participated in specific programs under Chapter 96 of the laws of 1995, the F321 form also offers the option to request a refund of additional member contributions. Completing this form involves signing and notarizing it, adding an extra layer of security and authenticity to the process. Understanding the F321 form is vital for ensuring a smooth transition of retirement benefits, making it an important document for NYCERS members navigating their retirement options.

Preview - Nycers F321 Form

NYCERS USE ONLY |

F321 |

|

*321*

Application for Transfer of Member’s Accumulated Salary

Deductions to Another Retirement System Within New York State

Member Number Last 4 Digits of SSN

I, the undersigned, do hereby make application to have the accumulated salary deductions, and accrued interest on the same, standing to my credit in the New York City Employees' Retirement System (NYCERS) transferred to my membership

in the

Retirement System.

In consideration of the transfer of such amount, and upon the transmittal of such funds to the retirement system to which I am transferring, I do hereby release and discharge from any and all liability the New York City Employees' Retirement System in connection therewith.

My City service in the position of

ceased on the |

|

day of |

|

|

|

with the Department of

, 20

.

, 20

with the Department of

.I have accepted a position as a(n)

on the

day of

I hereby authorize NYCERS to draw a check made payable to the retirement system of which I am now a member, to be credited to my account in that retirement system under Membership Number

.

For Tier 2 and Tier 4 members who participated in a special program enacted by Chapter 96 of the laws of 1995 only.

If eligible, I hereby elect to receive a refund of my share of the ADDITIONAL MEMBER CONTRIBUTIONS required to have been contributed by me due to my participation in one of the programs enacted by Chapter 96 of the Laws of 1995 and which are now to my credit in NYCERS in my Retirement Reserve Fund account.

Signature of Member

First Name |

M.I. |

Last Name |

|

|

|

In Care of (if applicable)

Address |

|

|

Apt. Number |

|

|

|

|

|

|

City |

State |

|

Zip Code |

|

|

|

|

|

|

Home Phone Number

()

Work Phone Number

()

Sign this form and have it notarized, Page 2

R07/26/11 |

Page 1 of 2 |

NYCERS USE ONLY |

F321 |

|

Member Number |

Last 4 Digits of SSN |

|

|

Signature of Member |

Date |

|

|

|

|

This form must be acknowledged before a Notary Public or Commissioner of Deeds

State of |

|

County of |

|

|

On this |

|

day of |

|

|

2 0 |

|

, personally appeared |

before me the above named, |

|

|

|

|

|

|

, to me known, and known to |

|||||

me to be the individual described in and who executed the foregoing instrument, and he or she acknowledged to me that he or she

executed the same, and that the statements contained therein are true. |

If you have an official seal, affix it |

||||

Signature of Notary Public or |

|

||||

|

|||||

Commissioner of Deeds |

|

||||

|

|

|

|

|

|

Official Title |

|

||||

|

|

|

|

|

|

Expiration Date of Commission |

|

||||

|

|

|

|

|

|

Sign this form and have it notarized, THIS PAGE

R07/26/11 |

Page 2 of 2 |

Form Characteristics

| Fact Name | Details |

|---|---|

| Form Purpose | The NYCERS F321 form is used to apply for the transfer of a member's accumulated salary deductions to another retirement system within New York State. |

| Member Information | Applicants must provide their member number and the last four digits of their Social Security Number (SSN) on the form. |

| Transfer Authorization | By signing the form, members authorize NYCERS to transfer their accumulated salary deductions and accrued interest to the new retirement system. |

| Release of Liability | Members release NYCERS from any liability related to the transfer upon completion of the transaction. |

| Notarization Requirement | The form must be signed in the presence of a Notary Public or Commissioner of Deeds to be valid. |

| Eligibility Criteria | This form is specifically for Tier 2 and Tier 4 members who participated in a special program under Chapter 96 of the Laws of 1995. |

More PDF Templates

Is Health and Welfare Pay Taxable - Guidance on making payments in U.S. dollars from a U.S. bank account reflects the regulatory requirements specific to New York City's financial operations.

When Is Property Tax Due for 2023 - The RP-602C form is a pivotal document for property owners seeking to navigate the tax relief options available for condos and co-ops in New York City.

Trsnyc Db28 - Form DB28 serves as a vital tool in the beneficiary claim process, balancing user needs with legal requirements.