Fillable Nyc Rpt Form in PDF

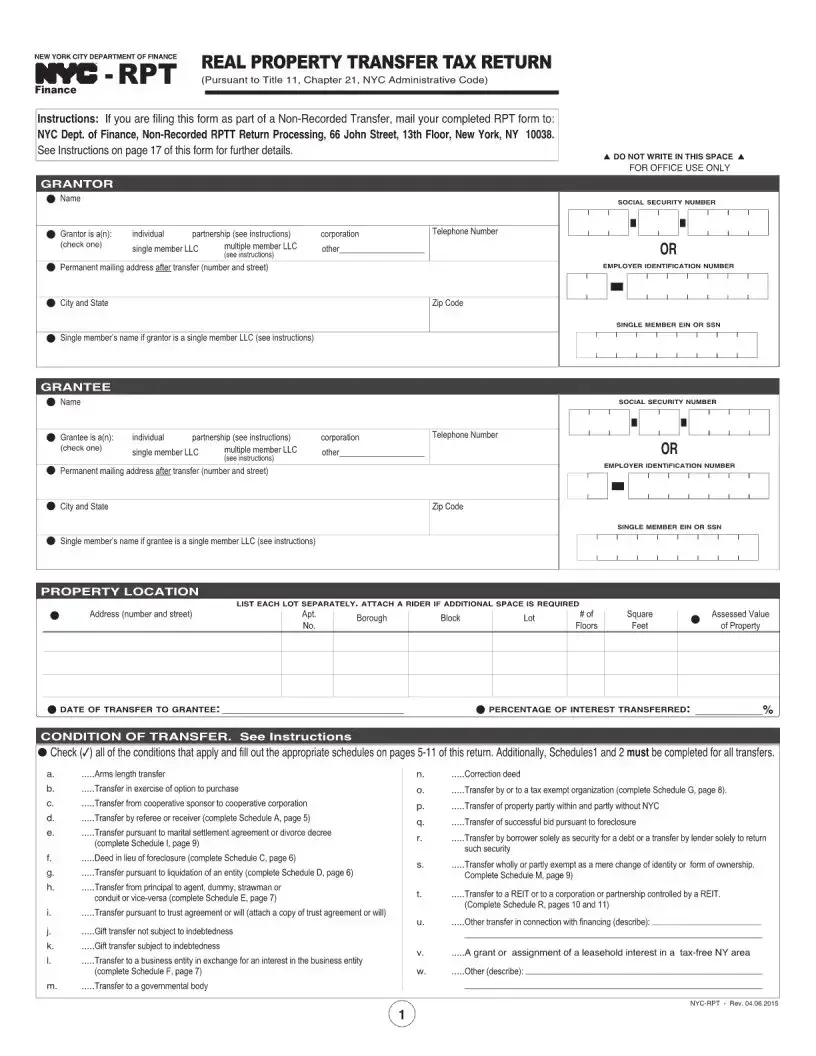

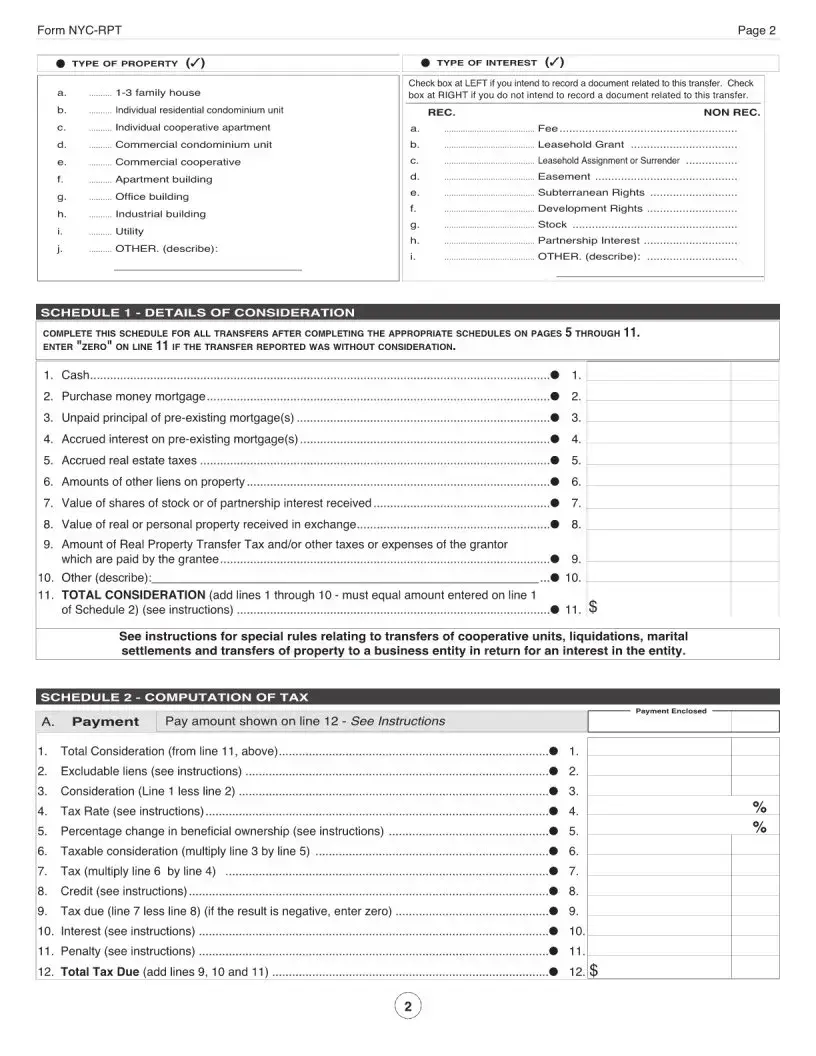

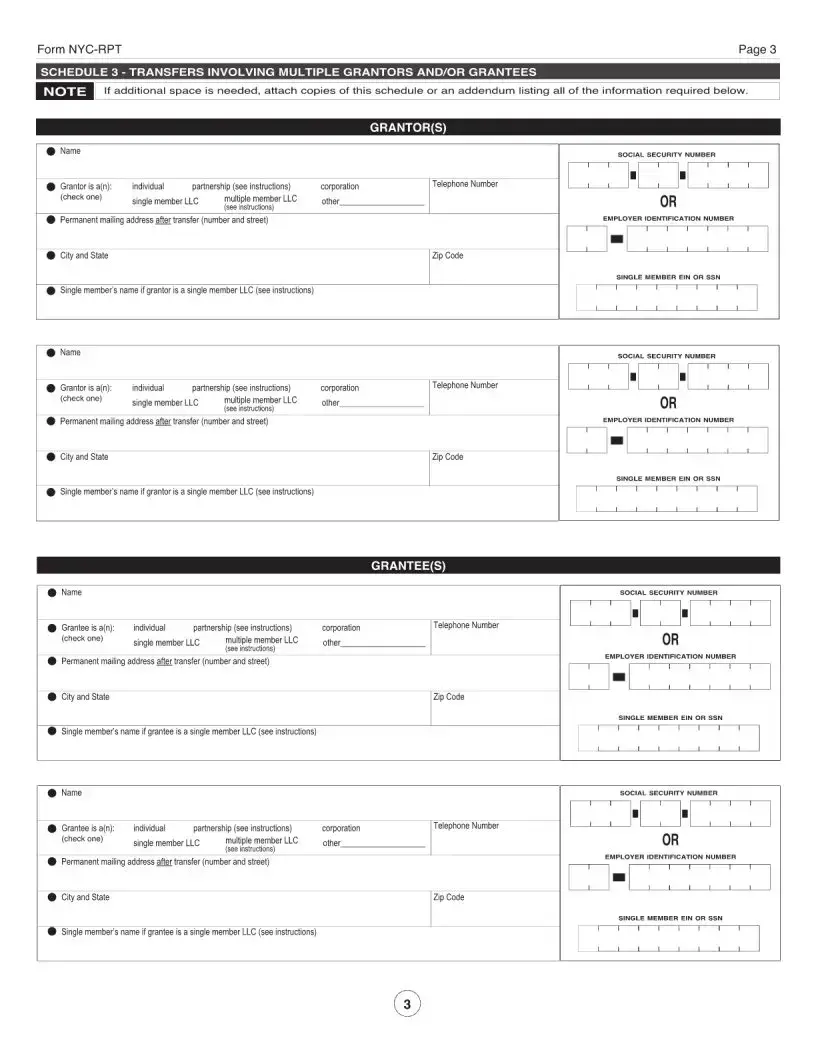

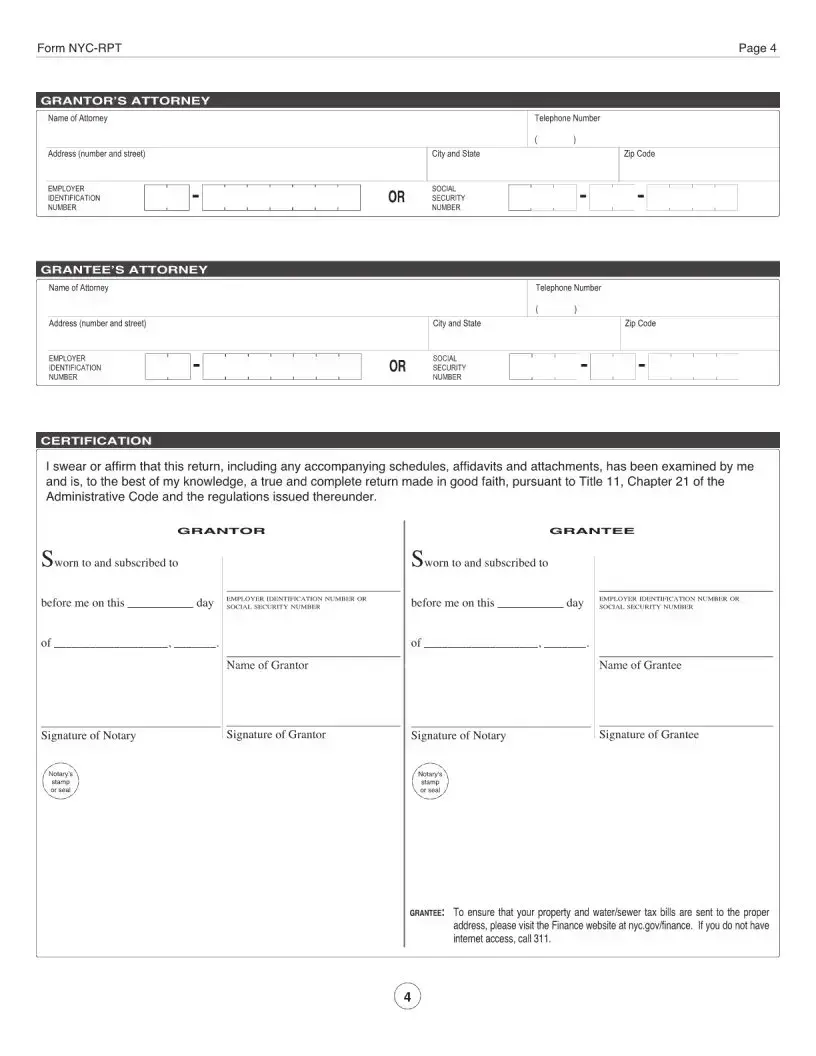

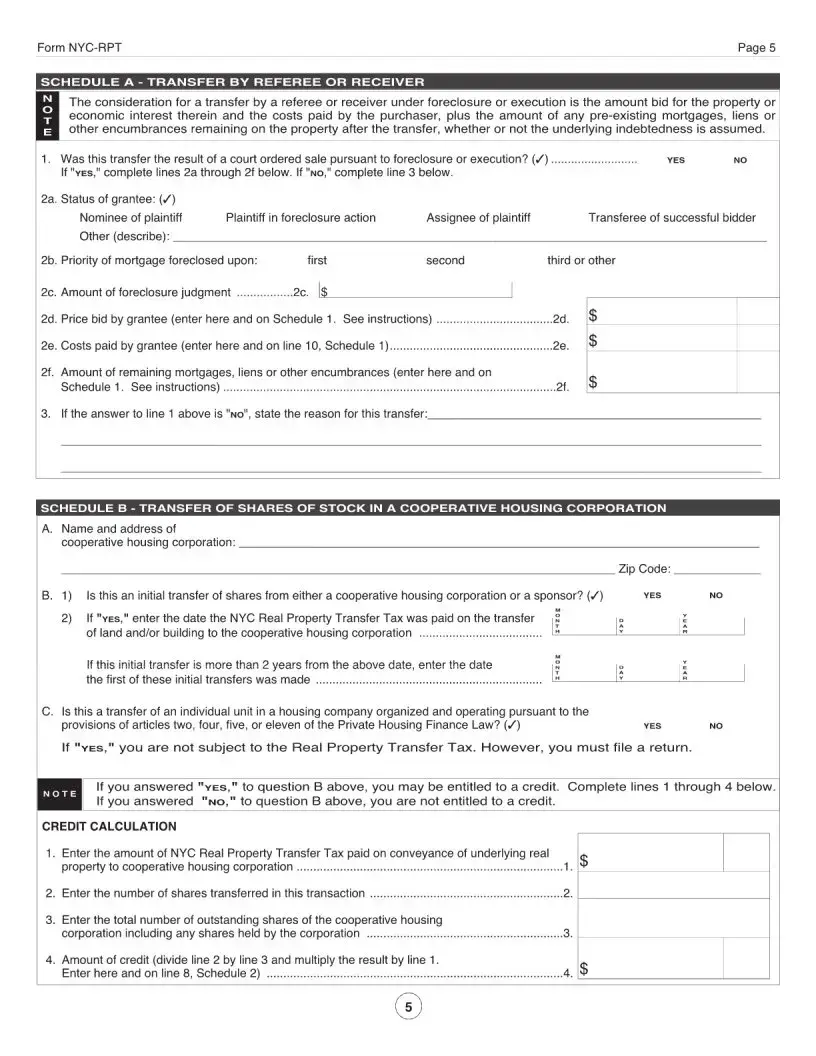

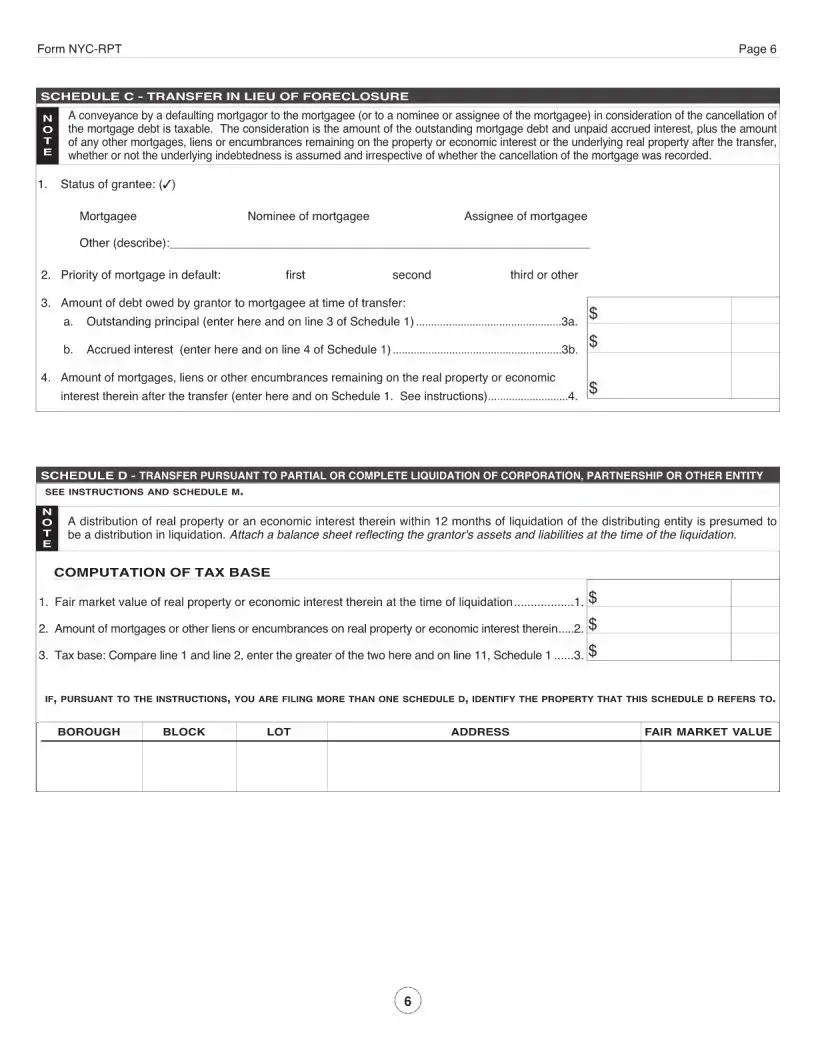

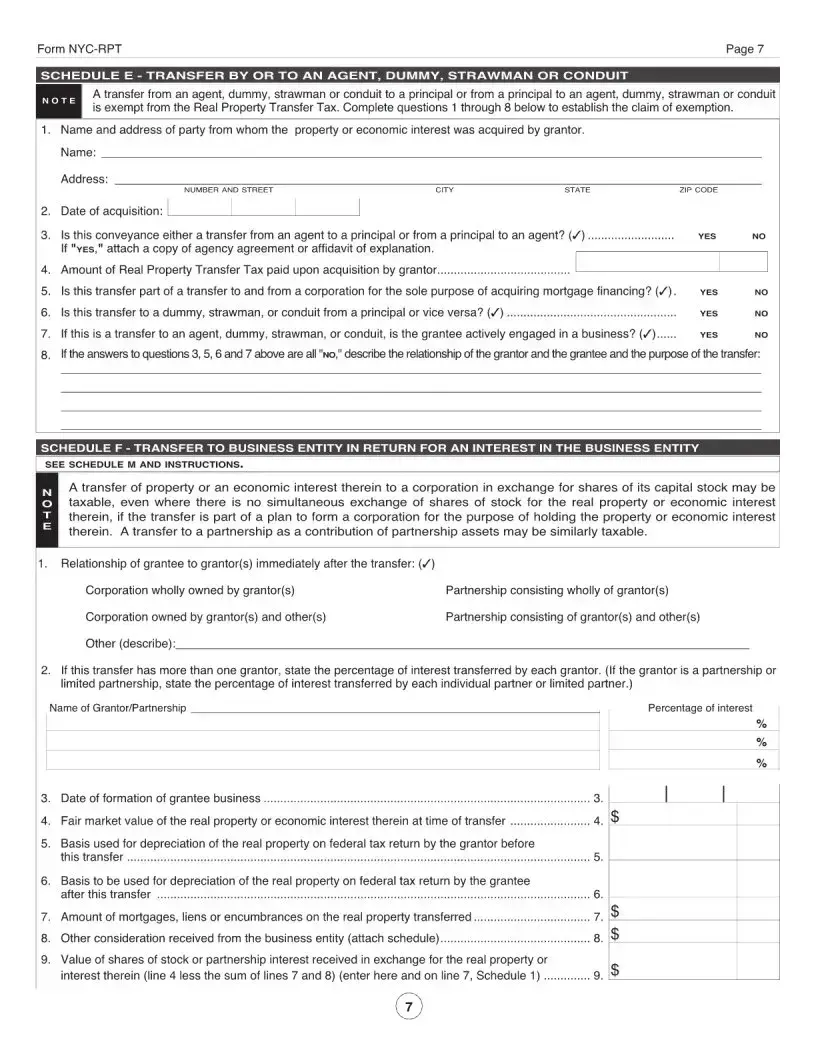

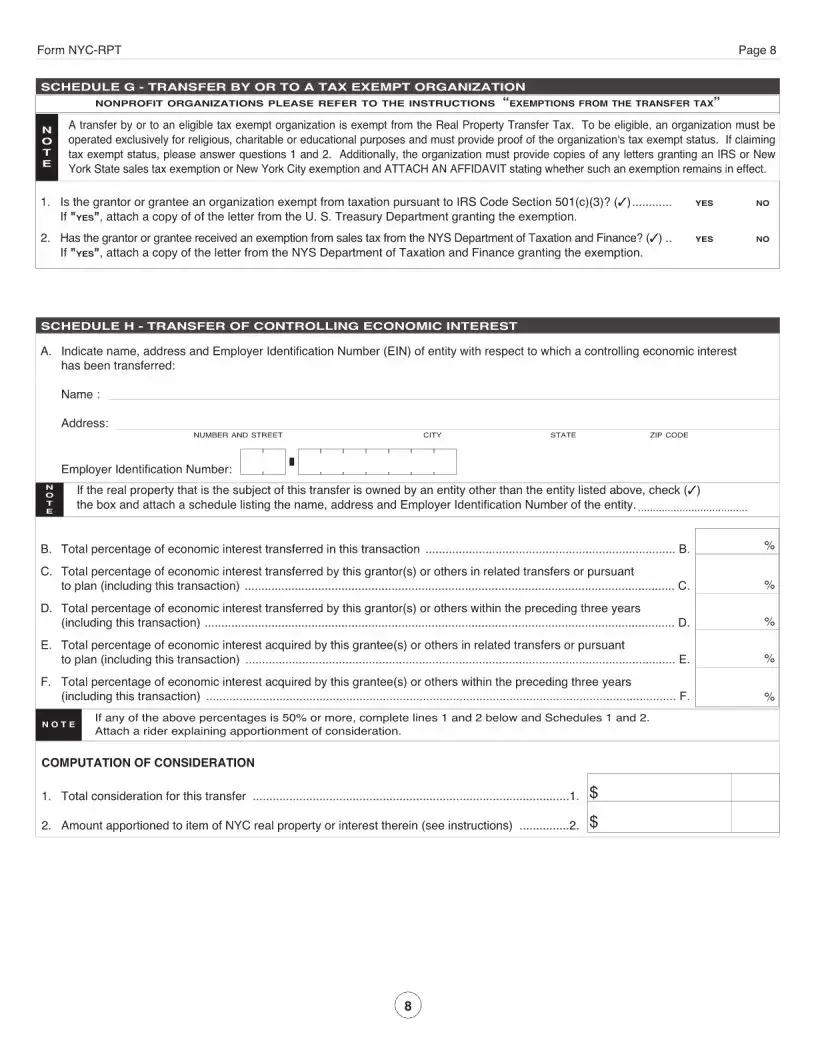

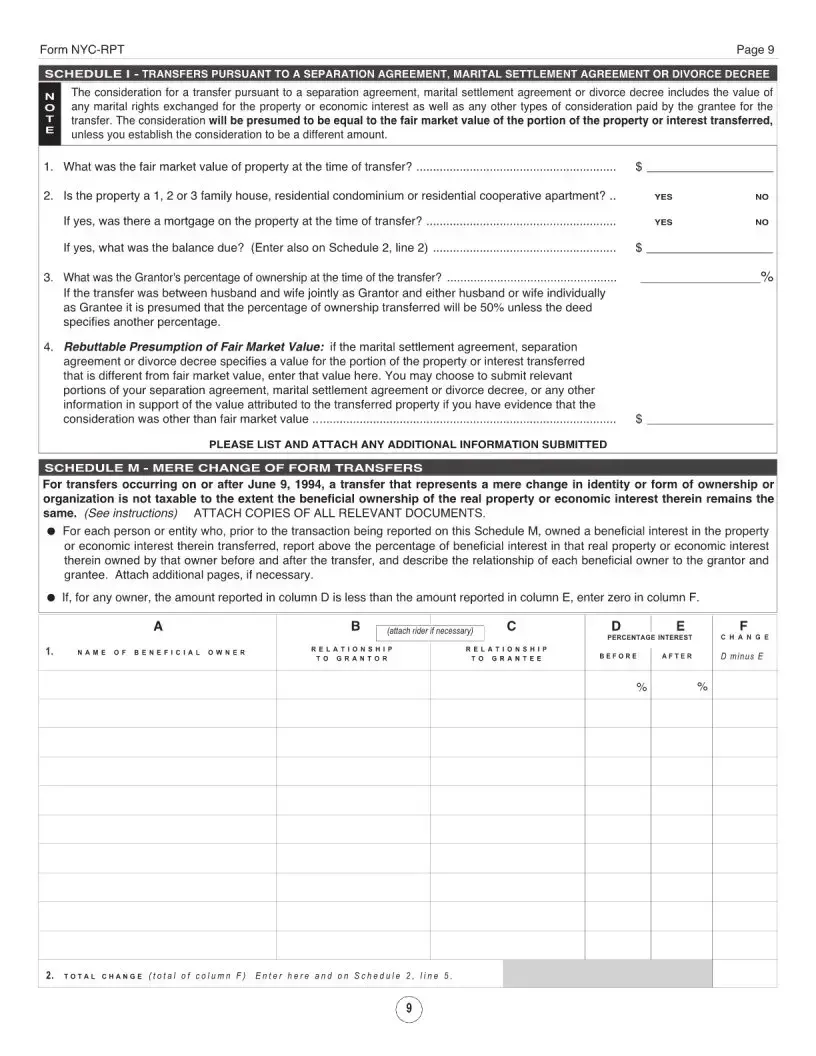

The NYC RPT form, officially known as the Real Property Transfer Tax Return, is a crucial document for anyone involved in the transfer of real estate in New York City. This form spans multiple pages, including important sections such as the Smoke Detector Affidavit for one- and two-family dwellings. It outlines the necessary tax rates, exemptions, and filing fees, ensuring that all parties understand their obligations. For those specifically dealing with property transfers in Staten Island, this form is essential, while transfers in other boroughs must be filed through ACRIS. The form requires detailed information about both the grantor and grantee, including names, addresses, and social security numbers. Additionally, it asks for specifics about the property being transferred, such as its location, assessed value, and the date of transfer. Various conditions of the transfer must be checked off, and appropriate schedules must be completed based on the nature of the transaction. The form also includes guidance on what to do if the transfer involves multiple grantors or grantees, ensuring that all necessary details are captured. Understanding this form is vital for compliance and to avoid potential penalties.

Preview - Nyc Rpt Form

Form Characteristics

| Fact Name | Description |

|---|---|

| Form Purpose | The NYC-RPT form is used to report the transfer of real property and calculate the associated transfer tax. |

| Governing Law | This form is governed by Title 11, Chapter 21 of the NYC Administrative Code. |

| Filing Borough | Use this form only for property transfers in Staten Island; other boroughs require filing via ACRIS. |

| Smoke Detector Affidavit | Included in the form is an affidavit for smoke detectors, specifically for one- and two-family dwellings. |

| Tax Rate Information | The form provides details on the current tax rates applicable to property transfers. |

| Exemptions | It outlines who may be exempt from the transfer tax, detailing specific conditions for exemption. |

| Filing Fee | Information about the required filing fee is included, ensuring filers are aware of any costs involved. |

| Submission Instructions | Instructions for submitting the completed form are provided, including mailing addresses and deadlines. |

More PDF Templates

Nyc Ubt Tax Rate - The alternative tax schedule section provides an avenue for corporations to potentially lower their tax liabilities through a different computation mechanism, stressing the importance of understanding all available tax calculation methods.

Dob Forms - The NYC PA1 form includes a warning against the unlawful exchange of benefits between city employees and applicants, ensuring the process's integrity.