Fillable Nyc Payroll Form in PDF

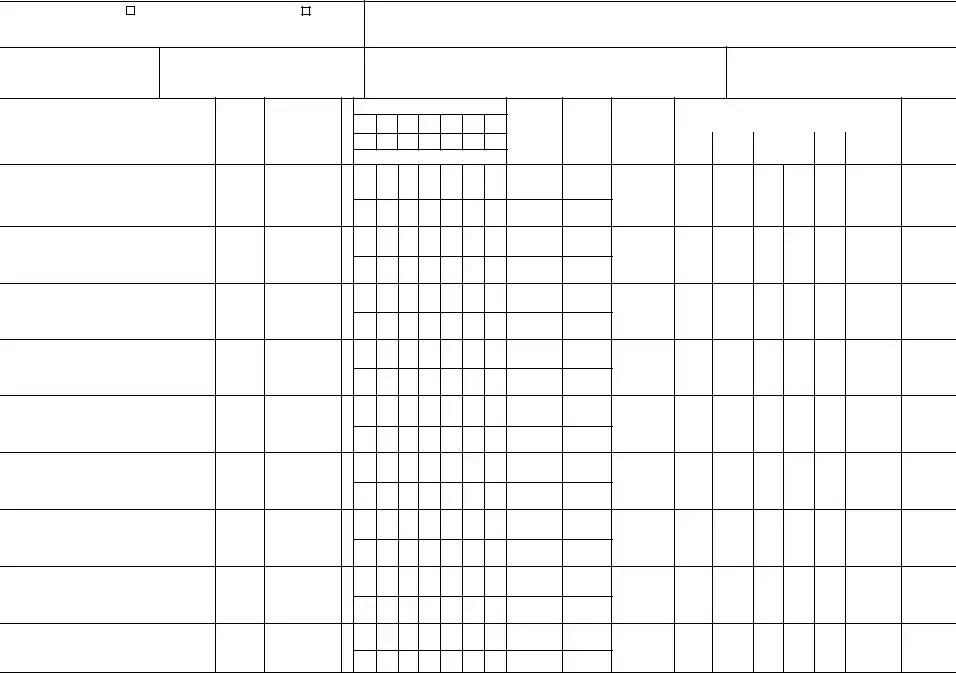

The NYC Payroll form serves as a crucial tool for contractors and subcontractors operating within the city, ensuring compliance with labor laws and regulations. Designed for weekly reporting, this form captures essential information such as the contractor's name, address, and Federal Employer Identification Number (FEIN). It also requires details about the project, including its location and contractor number, which helps in tracking labor practices across various sites. Each employee's information is meticulously documented, including their name, address, and the last four digits of their Social Security number. The form outlines the number of withholdings, work classifications, and hours worked each day, culminating in a total hours calculation. Additionally, it details the rate of pay and gross earnings, while also accounting for deductions such as FICA tax and other specified deductions. Importantly, the form includes a certification section, where the signatory affirms that all employees have been paid their full wages without unauthorized deductions. This section emphasizes the legal obligations regarding wage rates and the necessity for compliance with apprenticeship program regulations. The NYC Payroll form not only fulfills payroll notification requirements but also serves as a safeguard against potential violations, reinforcing the importance of accurate and honest reporting in the construction industry.

Preview - Nyc Payroll Form

Department of Labor Bureau of Public Work

WEEKLY PAYROLL

For Contractor's Optional Use. The use of this form meets payroll notification requirements; as stated on the Payroll Records Notification.

NAME OF CONTRACTOR

SUBCONTRACTOR

ADDRESS

FEIN

FOR WEEK ENDING

PROJECT AND LOCATION

PROJECT OR CONTRACTOR NO.

(1)

NAME, ADDRESS, AND

LAST 4 DIGITS OF SOCIAL SECURITY NUMBER

OF EMPLOYEE

(2)

NO. OF

WITH-

HOLDINGS

(3)

WORK

CLASSIFICATION

ST

or

OT

4) DAY AND DATE

HOURS WORKED EACH DAY

(5)

TOTAL

HOURS

(6)

RATE

OF

PAY

(7) GROSS

AMOUNT

EARNED

(a)

|

|

DEDUCTIONS |

|

|

|

|

|

|

WITH- |

|

TOTAL |

|

HOLDING |

|

|

|

|

|

|

FICA |

Tax |

|

OTHER DEDUCTIONS |

|

|

||

(9)

NET WAGES

PAID

FOR WEEK

S

0

S

0

S

0

S

0

S

0

S

0

S

0

S

0

S

0

PW

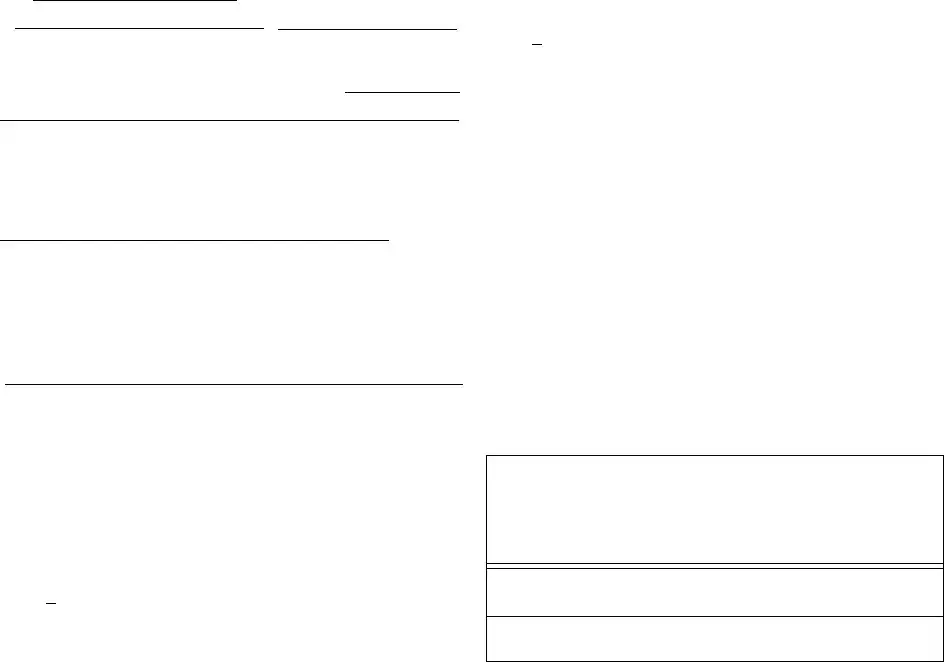

THIS CERTIFICATION MUST BE COMPLETED ON EACH WEEKLY PAYROLL FORM USED BY THE CONTRACTOR OR SUBCONTRACTOR

Date

I

(Name of signatory party) |

(Title) |

do hereby state:

(1) That I pay or supervise the payment of the persons employed by

|

|

|

(Contractor or Subcontractor) |

|

|

|

|

|

|

|

|

, that during the payroll period commencing on the |

|

||||

day of |

|

, 20 , and ending the |

|

day of |

|

|

20 |

|

all persons employed on said project have been paid the full weekly wages earned, that no rebates have been or will be made either directly or indirectly to or on behalf of said

from the full

(Contractor or Subcontractor)

weekly wages earned by any person and that no deductions have been made either directly or indirectly from the full wages earned by any person, other than permissible deductions as defined in Articles 8 and 9 and described below:

(2)That any payrolls submitted for the above period are correct and complete; that the wage rates for laborers, workers, or mechanics contained therein are not less than the applicable wage rates contained in any wage determination incorporated into the contract; that the classifications set forth therein for each laborer, worker or mechanic conform with the work he/she performed.

(3)That any apprentices employed in the above period are duly registered in a bona fide apprenticeship program registered with a State apprenticeship agency recognized by the Bureau of Apprenticeship and Training, United States Department of Labor, or if no such recognized agency exists in a State, are registered with the Bureau of Apprenticeship and Training, United States Department of Labor.

(4)That:

(a) WHERE FRINGE BENEFITS ARE PAID TO APPROVED PLANS, FUNDS, OR PROGRAMS

- In addition to the basic hourly wage rates paid to each laborer, worker or mechanic listed in the above referenced payroll, payments of fringe benefits as listed in the contract have been or will be made to appropriate programs for the

- In addition to the basic hourly wage rates paid to each laborer, worker or mechanic listed in the above referenced payroll, payments of fringe benefits as listed in the contract have been or will be made to appropriate programs for the

benefit of such employees, except as noted in Section 4(c).

(b) WHERE FRINGE BENEFITS ARE PAID IN CASH

- Each laborer, worker, or mechanic listed in the

- Each laborer, worker, or mechanic listed in the

(c) EXCEPTIONS

EXCEPTION (CRAFT) |

EXPLANATION |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

REMARKS:

SIGNATURE

THE WILLFUL FALSIFICATION OF ANY Of THE ABOVE STATEMENTS MAY SUBJECT THE CONTRACTOR OR SUBCONTRACTOR

TO CIVIL OR CRIMINAL PROSECUTION. SEE ARTICLES 8 AND 9.

Form Characteristics

| Fact Name | Description |

|---|---|

| Form Purpose | This form is used for weekly payroll reporting by contractors and subcontractors in New York City. |

| Governing Law | The form complies with New York State Labor Law, specifically Articles 8 and 9, which regulate wage payments. |

| Employee Information | It requires the name, address, and last four digits of the Social Security number of each employee. |

| Hours Worked | Employers must report the total hours worked by each employee, broken down by day. |

| Wage Details | The form captures the rate of pay and the gross amount earned by each employee for the week. |

| Deductions | Employers must list all deductions, including FICA tax and other withholdings, taken from employees' wages. |

| Certification Requirement | A certification by the contractor or subcontractor must be completed, affirming compliance with wage laws. |

| Consequences of Falsification | Willful falsification of information on this form can lead to civil or criminal prosecution. |

More PDF Templates

Ged Form Filling - For candidates under 18, parental or guardian permission is required, including consent for score release.

Nyc Ubt Estimated Tax - Filing this form helps avoid penalties associated with underpayment of estimated taxes.

Returning Plates to Dmv Ny - A transcript deposit of $50 is required if you request a full review of the hearing's proceedings for your appeal.