Fillable Nyc Ext 1 Form in PDF

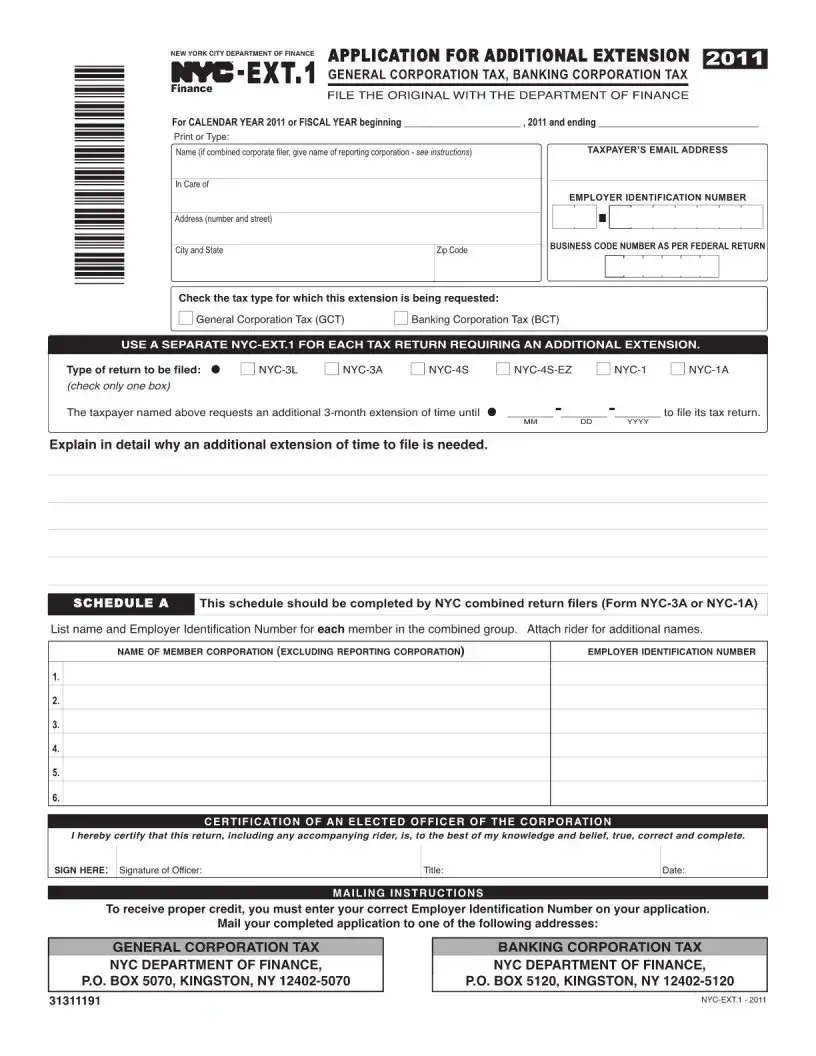

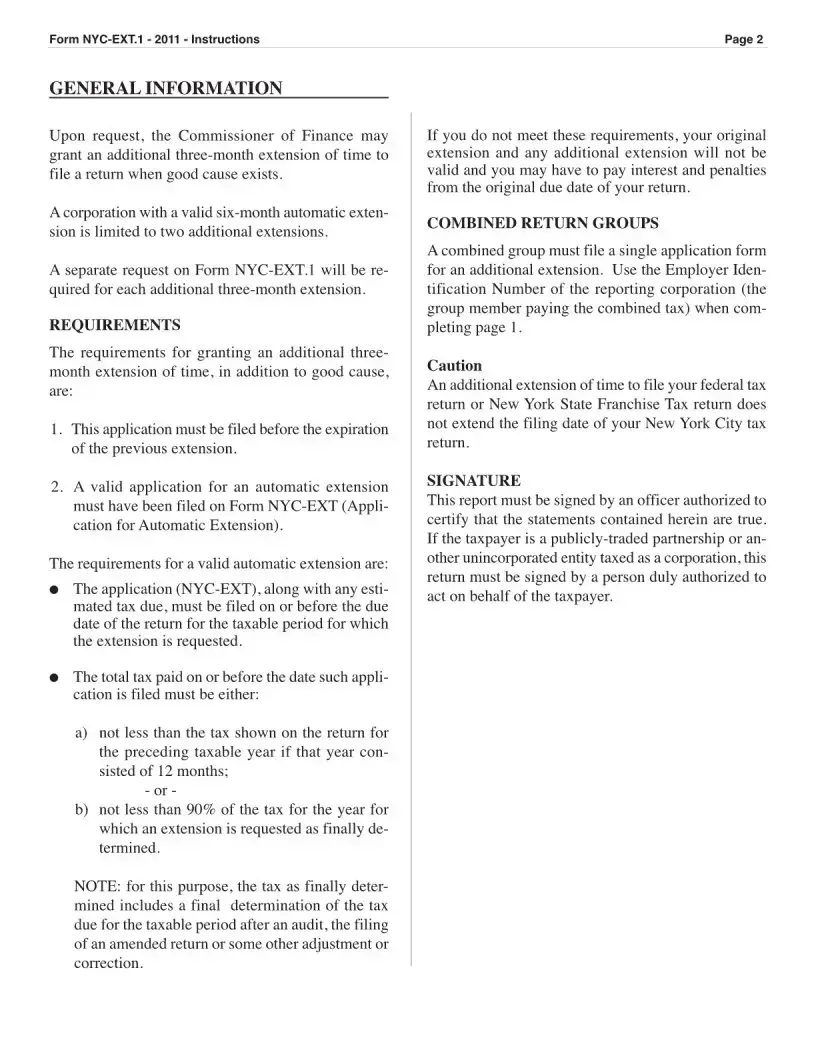

The NYC Ext 1 form is an essential document for corporations seeking an additional extension to file their tax returns in New York City. Specifically designed for general and banking corporation taxes, this form allows taxpayers to request an extra three months beyond their original filing deadline. To qualify for this extension, corporations must demonstrate good cause and ensure that a valid application for an automatic extension has already been submitted. It’s important to note that each tax type requires a separate NYC Ext 1 form. The form includes sections for identifying the type of tax return being filed, as well as details about the corporation and its members. Additionally, it mandates the signature of an authorized officer, affirming the accuracy of the information provided. For those filing combined returns, a single application for the entire group is necessary. Proper completion and timely submission of this form can help avoid penalties and interest, making it a crucial step in managing corporate tax obligations.

Preview - Nyc Ext 1 Form

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose | The NYC EXT 1 form is used to request an additional three-month extension for filing the General Corporation Tax or Banking Corporation Tax returns. |

| Filing Requirement | This application must be submitted before the expiration of any previous extension to be considered valid. |

| Automatic Extension | A valid automatic extension must have been filed on Form NYC-EXT before applying for this additional extension. |

| Tax Types | Taxpayers can request extensions for either General Corporation Tax (GCT) or Banking Corporation Tax (BCT). |

| Combined Groups | A combined group must file a single NYC EXT 1 application using the Employer Identification Number of the reporting corporation. |

| Certification Requirement | An authorized officer of the corporation must sign the form, certifying that all information is true and complete. |

| Mailing Instructions | Completed applications must be mailed to the appropriate NYC Department of Finance address for either GCT or BCT. |

| Tax Payment Requirement | To qualify for an extension, the total tax paid must meet specific criteria, such as being at least 90% of the current year's tax liability. |

| Governing Law | This form is governed by New York City tax regulations as outlined by the NYC Department of Finance. |

More PDF Templates

How to Close a Corporation in Ny - Framework for legal petitions against child support subpoenas, outlining modifications or quashings desired.

Shed Size Without Permit - Submission of the PW1 form initiates the formal review process by the Department of Buildings, setting the stage for project approval and permitting.