Fillable Nyc 4S Form in PDF

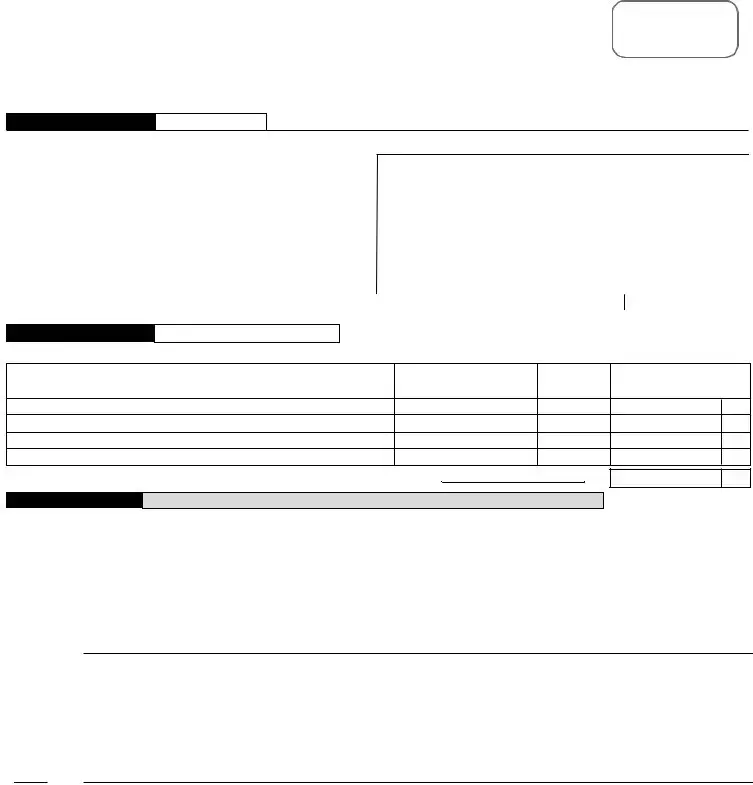

The NYC 4S form is an essential document for corporations operating in New York City, particularly for tax reporting purposes. This form is used to report various financial details, including net income, total capital, and compensation for stockholders. It also allows corporations to claim specific federal tax benefits related to events such as the September 11 attacks. Corporations must indicate whether they are filing an amended return, a final return, or a special short period return. Additionally, the form requires corporations to provide their Employer Identification Number (EIN) and business code, along with a detailed breakdown of their income and expenses. Completing the NYC 4S form accurately is crucial, as it impacts the corporation's tax obligations and potential refunds. Timely submission is necessary, with a due date typically set for March 15 following the tax year. Understanding the various sections of this form, from the computation of taxable income to the certification by an elected officer, ensures compliance with New York City's tax regulations.

Preview - Nyc 4S Form

*30410391*

|

NYC GENERAL CORPORATION |

|

|

|

|

|

|

|

|

|

|

||||||

F I N A N C E 4 S |

T A X R E T U R N |

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

NEW ● YORK |

|

|

|

|

|

|

|

▲ DO NOT WRITE IN THIS SPACE - FOR OFFICIAL USE ONLY ▲ |

|

||||||||

www.nyc.gov/ finance |

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

||||||||

For CALENDAR YEAR 2003 or FISCAL YEAR beginning ___________________2003 and ending ___________________ |

2003 |

|

|||||||||||||||

Check "yes" if you claim any |

|

|

|

|

|||||||||||||

● ■ Am ended return |

● ■ Final return .Check box if the corporation has ceased operations. |

|

● ■ Special short period return (see inst.) |

|

|||||||||||||

▼ |

Nam e |

|

|

|

|

|

|

|

|

|

|

EM PLOYER IDENTIFICATION NUM BER |

|

||||

here |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

label |

Address (num ber and street) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

mailing |

|

|

|

|

|

|

|

|

|

|

|

BUSINESS CODE NUM BER AS PER FEDERAL RETURN |

|

|

|||

Affix |

City and State |

|

|

|

|

Zip Code |

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Business Telephone Num ber |

|

|

|

Date business began in NYC |

|

|

|

|

|

|

|

|

|

||||

▼ |

|

|

|

|

|

|

IMPORTANT: Corporations licensed and/or regulated by the NYC Taxi and |

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

Limousine Commission use business code 999900 in lieu of federal code. |

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

S C H E D U LE A |

|

Com putation of Tax |

|

BEGIN WITH SCHEDULES B THROUGH E ON PAGE 2. TRANSFER APPLICABLE AM OUNTS TO SCHEDULE A. |

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Payment Enclosed |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

A. |

Payment |

Pay amount shown on line 15 - Make check payable to: NYC Department of Finance |

|

● |

|

|

|

|

|

|||||||||||||||||||

|

|

|

|

|

||||||||||||||||||||||||

1. |

Net income (from Schedule B, line 8) |

|

|

|

|

● 1. |

|

|

|

|

|

|

|

|

|

X .0885 |

|

● 1. |

|

|

|

|

|

|||||

|

|

........................................ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

2a. |

Total capital (from Schedule C, line 7) (see instructions) |

● 2a. |

|

|

|

|

|

|

|

|

|

X .0015 |

|

● 2a. |

|

|

|

|

|||||||||

|

2b. |

Total capital - Cooperative Housing Corps. (see instructions) .... |

● 2b. |

|

|

|

|

|

|

|

|

|

X .0004 |

|

● 2b. |

|

|

|

|

|||||||||

|

2c. |

Cooperatives - enter: |

● BORO |

|

|

|

● BLOCK |

|

|

|

|

|

|

● LOT |

|

|

|

|

|

|

|

|||||||

|

3a. |

Compensation of stockholders |

(from Schedule D, line 1) |

● |

3a. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

3b. |

Alternative tax (applies to corporations including professional corporations) |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

(see instructions for worksheet) |

......................................................................................................... |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

● 3b. |

|

|

|

|

||||

4. |

Minimum tax - No reduction is permitted for a period of less than 12 months |

...................................... |

|

|

|

|

4. |

|

300 |

00 |

||||||||||||||||||

5. |

Tax (line 1, 2a, 2b, 3b or 4, whichever is largest) |

|

|

|

|

|

|

|

|

|

|

|

|

|

● 5. |

|

|

|

|

|||||||||

6. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

First installment of estimated tax for period following that covered by this return: |

|

|

|

|

|

|

|

|||||||||||||||||||||

|

|

( a) If application for extension has been filed, enter amount from line 4 of Form |

....... |

● 6a. |

|

|

|

|

||||||||||||||||||||

|

|

|

|

|

|

|

||||||||||||||||||||||

|

|

( b) If application for extension has not been filed and line 5 exceeds $1,000, |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

7. |

enter 25% of line 5 (see instructions) |

|

|

|

|

|

|

|

|

|

|

|

|

|

● 6b. |

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

Total before prepayments (add lines 5 and 6a or 6b) |

......................................................................... |

|

|

|

|

|

|

|

|

|

|

|

|

|

● 7. |

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

8. |

Prepayments (from Prepayments Schedule, line E) (see instructions) |

|

|

|

|

|

● 8. |

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

9. |

Balance due (line 7 less line 8) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

● 9. |

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

10. |

Overpayment (line 8 less line 7) |

|

|

|

|

|

|

|

|

|

|

|

|

|

● 10. |

|

|

|

|

|||||||||

|

11a. |

...................................................................Interest (see instructions) |

|

|

|

|

|

|

11a. |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

11b. |

...................................................Additional charges (see instructions) |

|

|

|

11b. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

11c. |

Penalty for underpayment of estimated tax (attach Form |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

12. |

Total of lines 11a, 11b and 11c |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

● 12. |

|

|

|

|

|

|||||

13. |

Net overpayment (line 10 less line 12) |

|

|

|

|

|

|

|

|

|

|

|

|

|

● 13. |

|

|

|

|

|||||||||

14. |

...........................................................................................Amount of line 13 to be: ( a) Refunded |

|

|

|

|

|

|

|

|

|

|

|

|

● 14a. |

|

|

|

|

||||||||||

|

|

|

|

|

( b) Credited to 2004 estimated tax |

......................................................... |

|

|

|

|

|

|

|

|

|

● 14b. |

|

|

|

|

||||||||

15. |

..................TOTAL REMITTANCE DUE (see instructions) Enter payment amount on line A above |

● 15. |

|

|

|

|

||||||||||||||||||||||

16. |

NYC rent deducted on federal return (see instr. ) THIS LINE M UST BE COM PLETED. |

... ● 16. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

17. |

Federal return filed: |

● ■ 1120 |

|

● ■ |

|

|

● ■ 1120S |

|

|

|

● ■ 1120F |

|

|

|

|

|

|

|

|

||||||||

|

18. |

Gross receipts or sales from federal return |

|

|

|

|

|

|

|

|

|

|

|

|

|

● 18. |

|

|

|

|

|

|||||||

|

19. |

Total assets from federal return |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

● 19. |

|

|

|

|

|

||||

CERTIFICATION OF AN ELECTED OFFICER OF THE CORPORATION

SIGN →

HERE

PREPARER'S USE →

ONLY

I hereby certify that this return, including any accompanying rider, is, to the best of my knowledge and belief, true, correct and complete.

I authorize the Dept. of Finance to discuss this return with the preparer listed below. (see instructions) .................YES ■ |

|

|

|

||||||

Signature of officer |

|

Title |

|

Date |

Preparer's Social Security Number or PTIN |

||||

|

|

||||||||

|

|

|

Check if self- |

■ |

|

● |

|

|

|

Preparer's signature |

|

Date |

|

|

|

||||

|

employed ✔ |

Firm's Employer Identification Number |

|||||||

|

|

|

|

|

|

● |

|||

|

|

|

|

|

|

|

|

|

|

▲ Firm's name (or yours, if |

▲ Address |

|

▲ Zip Code |

|

|

|

|||

|

|

|

|

||||||

Attach copy of all pages of your federal tax |

M ake remittance payable to the order of: |

return or pro forma federal tax return. |

NYC DEPARTM ENT OF FINANCE. |

|

Payment must be made in U. S. dollars, drawn on a U. S. bank. |

To receive proper credit, you must enter your correct Employer Identification Number on your tax return and remittance.

30410391 |

AT TA C H R E M I T TA N C E T O T H I S PA G E O N LY |

|

Form |

NAME _____________________________________________________________ EIN __________________________ |

Page 2 |

||||||||

|

|

|

|

|

|

|

||||

S C H E D U LE B |

Com putation of N YC Taxable N et Incom e |

|

|

|

|

|

||||

|

|

|

|

|

1. |

|

|

|

||

1. |

Federal taxable income before net operating loss deduction and special deductions (see instructions) .. |

|

|

|

||||||

2. |

.................................Interest on federal, state, municipal and other obligations not included in line 1 |

|

|

|

||||||

|

|

|

||||||||

3a. |

NYS Franchise Tax and other income taxes, including MTA surcharge, deducted on federal return (see instr.) |

3a. |

|

|

|

|||||

|

|

|

||||||||

3b. |

NYC General Corporation Tax deducted on federal return (see instructions) |

3b. |

|

|

|

|||||

|

|

|

||||||||

4. |

ACRS depreciation and/or adjustment (attach Form |

4. |

|

|

|

|||||

|

|

|

||||||||

5. |

Total (sum of lines 1 through 4) |

|

|

5. |

|

|

|

|||

6a. |

..........New York City net operating loss deduction (see instructions) |

6a. |

|

|

|

|

|

|

||

6b. |

Depreciation and/or adjustment calculated under |

|

|

|

|

S CORPORATIONS |

||||

|

|

|

|

|||||||

|

pre - 9/11/01 rules (attach Form |

6b. |

|

|

|

see instructions |

||||

6c. |

NYC and NYS tax refunds included in Schedule B, |

|

|

|

|

for line 1 |

||||

|

|

|

|

|

|

|

||||

|

line 1 (see instructions) |

6c. |

|

|

|

|

|

|

||

7. |

.........................................................................................................Total (sum of lines 6a through 6c) |

|

|

7. |

|

|

|

|||

|

|

|

|

|

|

|||||

8. |

Taxable net income (line 5 less line 7) (enter on page 1, Schedule A, line 1) (see instructions) |

8. |

|

|

|

|||||

S C H E D U LE C

Total Capital

Basis used to determine average value in column C. CHECK ONE. (ATTACH DETAILED SCHEDULE)

■ - Annually |

■ - |

■ - Quarterly |

|

COLUMN A |

|

COLUMN B |

|

COLUMN C |

|||||

|

|

|

|

|

|

Beginning of Year |

|

End of Year |

|

Average Value |

|||

■ |

- Monthly |

■ - Weekly |

■ - Daily |

||||||||||

|

|

|

|

|

|

|

|

||||||

1. |

Total assets from federal return |

1. |

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|||||||

2. |

Real property and marketable securities included in line 1 |

2. |

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|||||||

3. |

Subtract line 2 from line 1 |

3. |

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|||||||

4. |

Real property and marketable securities at fair market value |

4. |

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|||||||

5. |

Adjusted total assets (add lines 3 and 4) |

5. |

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|||||||

6. |

Total liabilities (see instructions) |

6. |

|

|

|

|

|

|

|

||||

7. |

Total capital (column C, line 5 less column C, line 6) (enter on page 1, Schedule A, line 2a or 2b) |

.......................... |

7. |

|

|

||||||||

|

|

|

|||||||||||

S C H E D U LE D

Cer tain Stockhold ers

Include all stockholders owning in excess of 5% of taxpayer's issued capital stock who received any compensation, including commissions.

Name and Address - Give actual residence (Attach rider if necessary)

Social Security Number

Official Title

Salary & All Other Compensation

Received from Corporation

(If none, enter "0")

1. Total, including any amount on rider (enter on page 1, Schedule A, line 3a) |

1. |

S C H E D U LE E

The following infor m ation m us t be entered for this retur n to be com plete .

1.

2.

3.

*30420391*

New York City principal business activity |

|

|

|

|

|

||

|

|

|

|

|

|

|

|

Does the corporation have an interest in real property located in New York City? (see instructions) |

YES |

■ |

NO |

■ |

|||

If "YES": (a) |

Attach a schedule of such property, including street address, borough, block and lot number. |

|

■ |

|

■ |

||

(b) Was a controlling economic interest in this corporation (i.e., 50% or more of stock ownership) transferred during the tax year?.... |

YES |

NO |

|||||

4. |

Does the corporation have one or more qualified subchapter s subsidiaries (QSSS)? |

YES |

■ |

NO |

■ |

||

If "YES" Attach a schedule showing the name, address and EIN, if any, of each QSSS and indicate whether the QSSS filed or was required to file a City business income tax return. See instructions.

|

PREPAYMENTS CLAIMED ON SCHEDULE A, LINE 8 |

|

DATE |

|

AMOUNT |

|

TWELVE DIGIT TRANSACTION ID CODE |

|||

|

....A. Mandatory first installment paid with preceding year's tax |

|

|

|

|

|

|

|

|

|

|

.............Payment with declaration, Form |

|

|

|

|

|

|

|

|

|

|

B. Payment with Notice of Estimated Tax Due, (2) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

Payment with Estimated Tax Due (3) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

C.Payment with extension, Form |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

D.Overpayment credited from preceding year |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

E. TOTAL of A, B, C and D (enter on Schedule A, line 8) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

M A I L I N G |

RETURNS WITH REMITTANCES |

RETURNS CLAIMING REFUNDS |

ALL OTHER RETURNS |

2003 |

|||||

|

NYC DEPARTMENT OF FINANCE |

NYC DEPARTMENT OF FINANCE |

NYC DEPARTMENT OF FINANCE |

|||||||

|

INSTRUCTIONS |

PO BOX 5040 |

PO BOX 5050 |

|

|

|

|

- |

||

|

|

PO BOX 5060 |

||||||||

|

|

KINGSTON, NY |

KINGSTON, NY |

KINGSTON, NY |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

30420391 The due date for the calendar year 2003 return is on or before March 15, 2004. For fiscal years beginning in 2003, File within 2 1/2 months after the close of fiscal year. |

|||||||||

|

|

|||||||||

Form Characteristics

| Fact Name | Details |

|---|---|

| Form Purpose | The NYC 4S form is used by corporations to report their financial information and calculate taxes owed to New York City. |

| Filing Requirement | Corporations must file the NYC 4S form by March 15, 2004, for calendar year 2003 returns, or within 2.5 months after the close of their fiscal year. |

| Tax Rate | The tax rate for net income is 8.85%, while the capital tax rate is 0.15% for most corporations and 0.04% for cooperative housing corporations. |

| Employer Identification Number (EIN) | Corporations must include their correct EIN on the form to ensure proper credit for payments and filings. |

| Special Considerations | Corporations licensed by the NYC Taxi and Limousine Commission must use business code 999900 instead of the federal code. |

| Governing Law | The NYC 4S form is governed by New York City Administrative Code Title 11, Chapter 6, which outlines the General Corporation Tax regulations. |

More PDF Templates

Who Has to File Income Tax - An official form targeted at streamlining the process of making payments for tax obligations in New York City.

Prevailing Wage Reporting - Its use aids contractors in adhering to federal and state labor regulations, protecting against legal repercussions.

Nyc Annual Notices to Tenants - Tenants are urged to immediately report peeling paint to their landlord and can contact 311 if the landlord does not take action, highlighting the resources available for tenant protection.