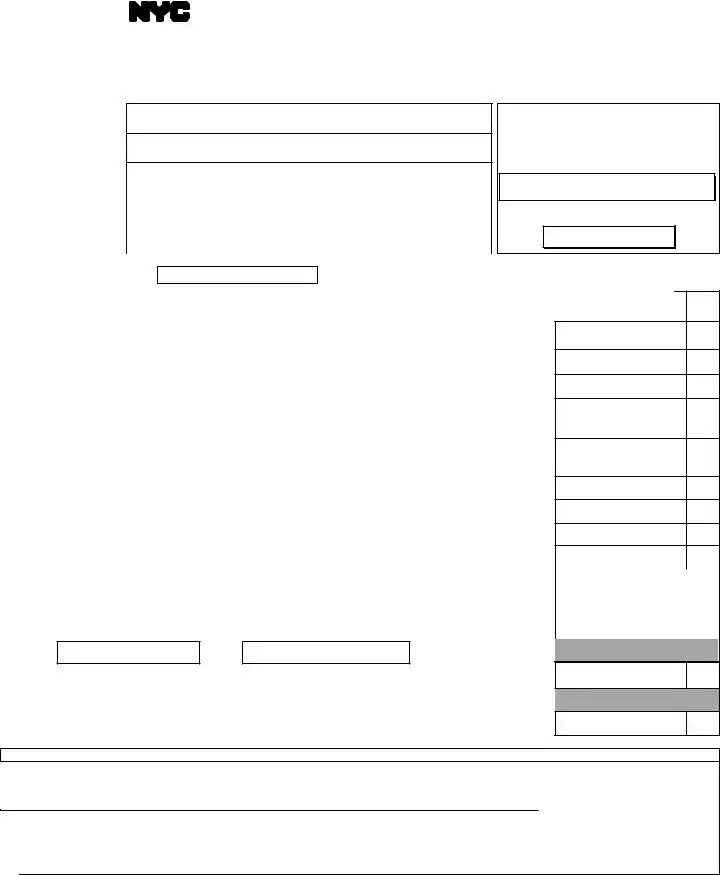

Fillable Nyc 4S Ez Form in PDF

The NYC 4S EZ form is a streamlined tax return designed for corporations operating within New York City. It caters specifically to businesses that meet certain eligibility criteria, allowing for a simplified reporting process. This form is intended for use by corporations filing for the calendar year 2012 or for a fiscal year that begins in 2012 and ends in 2013. It includes various options such as filing an amended return, a final return for corporations that have ceased operations, or a special short-period return. The form requires essential information such as the corporation's name, address, Employer Identification Number (EIN), and business code number. Corporations must also report their net income or minimum tax, determine their total tax liability, and indicate any payments or overpayments. The form includes schedules for calculating taxable income, with specific instructions for both C Corporations and S Corporations. Additionally, it necessitates the inclusion of the federal tax return or a pro forma version to ensure accurate reporting. Proper completion of the NYC 4S EZ form is crucial for compliance with New York City's General Corporation Tax requirements, and timely submission is essential to avoid penalties.

Preview - Nyc 4S Ez Form

*31111293*

NEWYORK CITYDEPARTMENT OF FINANCE

EZ

FINANCE

|

|

Check box if you are filing |

For CALENDAR YEAR 2012 or FISCAL YEAR beginning _______________ 2012 and ending ___________________ ● ■ a52- |

||

● ■ Amended return |

● ■ Final return - Check box if the corporation has ceased operations. |

● ■ Special |

Name

In Care Of

Address (number and street)

City and State |

Zip Code |

|

|

Business Telephone Number |

Date business began in NYC |

|

|

Taxpayer’s Email Address:

__________________________________________

EMPLOYER IDENTIFICATION NUMBER

BUSINESS CODE NUMBER AS PER FEDERAL RETURN

SCHEDULE A Computation of Tax

BEGIN WITH SCHEDULES B1 or B2 ON PAGE 2. TRANSFER APPLICABLE AMOUNT TO SCHEDULE A.

A. Payment |

Amount included with form - Make payable to: NYC Department of Finance |

● |

|

|

|

|

|

Payment Enclosed

1. |

Netincome(fromScheduleB1,line3orB2,line6)● 1. |

|

|

|

|

X .0885 |

.. ● 1. |

|

|

2. |

|

|

|

|

............... |

● 2. |

|

|

|

|

|

|

|

|

|

|

|||

3. |

Tax (line 1 or 2, whichever is larger) |

|

|

|

● 3. |

|

|

||

4. |

First installment of 2013 estimated tax: |

|

|

|

|

|

|

|

|

|

(a) If application for extension has been filed, enter amount from line 2 of Form |

● 4a. |

|

|

|||||

|

(b) If application for extension has not been filed and line 3 exceeds $1,000, |

|

|

|

|||||

|

enter 25% of line 3 (see instructions) |

|

|

|

● 4b. |

|

|

||

5. |

Total before prepayments (add lines 3 and 4a or 4b) |

|

|

|

● 5. |

|

|

||

6. |

Prepayments (see instructions) |

|

|

|

● 6. |

|

|

||

7. |

Balance due (line 5 less line 6) |

|

|

|

● 7. |

|

|

||

8. |

Overpayment (line 6 less line 5) |

|

|

|

● 8. |

|

|

||

9. |

Interest (see instructions) |

9. |

|

|

|

|

|

|

|

10. |

Amount of line 8 to be: (a) Refunded - ■ Direct deposit - fill out line 10c |

...OR ■ Paper check |

● 10a. |

|

|

||||

|

.........................................................(b) Credited to 2013 estimated tax |

|

|

|

● 10b. |

|

|

||

10c. Routing

Number

Account Number

ACCOUNT TYPE

Checking ■ Savings ■ ●

11. TOTAL REMITTANCE DUE (see instructions) Enter payment amount on lineAabove |

............... ● 11. |

|

12. |

Federal return filed: ● ■ 1120 ● ■1120C ● ■ 1120S ● ■ 1120H |

● ■ 1120F |

13. |

Gross income |

● 13. |

SIGN HERE USE ONLY

PREPARER'S

CERTIFICATION OF AN ELECTED OFFICER OF THE CORPORATION

Iherebycertifythatthisreturn,includinganyaccompanyingrider,is,tothebestofmyknowledgeandbelief,true,correctandcomplete. |

Firm'sEmailAddress: |

|||||||||

I authorize the Dept. of Finance to discuss this return with the preparer listed below. (see instructions)...YES ■ |

● |

|||||||||

Officerʼs |

|

|

|

|

|

____________________________________ |

||||

|

|

|

|

|

|

● Preparer'sSocialSecurityNumberorPTIN |

||||

signature: |

|

Title: |

|

|

Date: |

|

||||

|

Checkifself- |

■ |

|

|

|

|

|

|||

Preparer's |

Preparerʼs |

|

|

|

|

|

|

|||

signature: |

printed name: |

employed: |

Date: |

|

● Firm's Employer Identification Number |

|||||

|

|

|

||||||||

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

▲ Firm's name (or yours, if |

▲ Address |

|

|

▲ Zip Code |

||||||

|

|

|

|

|

|

|

|

|

|

|

Make remittance payable to the order of: NYC DEPARTMENT OF FINANCE. Payment must be made in U.S.dollars, drawn on a U.S. bank.

Attach copy of all pages of your federal tax return or pro forma federal tax return.

To receive proper credit, you must enter your correct Employer Identification Number on your tax return and remittance.

31111293 |

ATTACH REMITTANCE TO THIS PAGE ONLY |

Form |

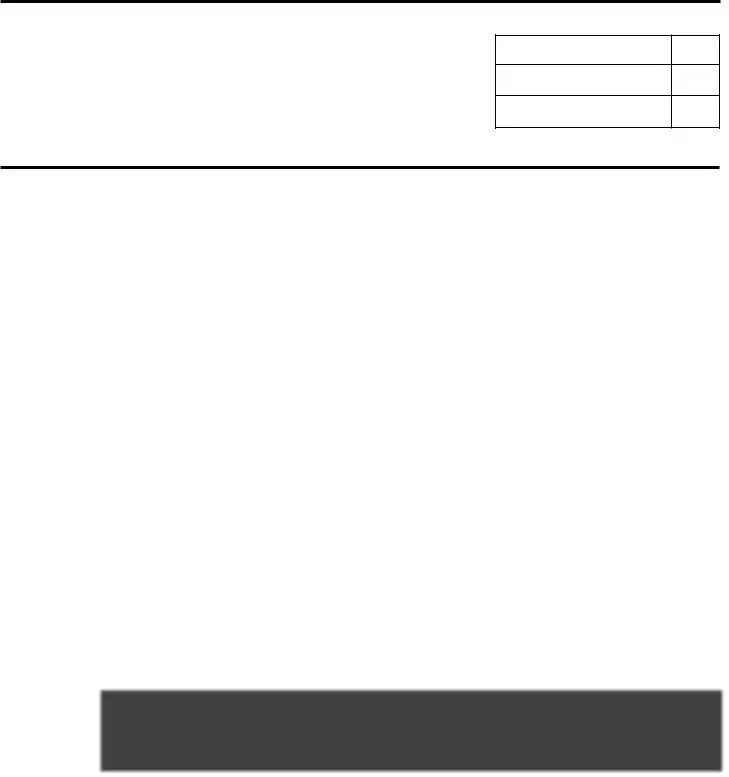

Page 2 |

NAME _______________________________________________________________________ |

EIN _______________________________________ |

SCHEDULE B1

To be used by New York State C Corporations that elect to use NYS entire net income. See instructions.

1. |

New York State Entire Net Income |

1. |

2. |

General Corporation Tax deducted in computing amount on line 1 |

2. |

3. |

Total of lines 1 and 2 (Enter on page 1, ScheduleA, Line 1) |

3. |

SCHEDULE B2

To be used by New York State S Corporations and C Corporations that do not elect to use Schedule B1. See instructions.

1. |

Federal Taxable Income before net operating loss deduction and |

|

|

|

|

|

special deductions |

1. |

|

|

|

2. |

State and local income and MTAtaxes deducted on federal return |

|

|

|

|

|

(see instructions) |

2. |

|

|

|

3. |

Total of lines 1 and 2 |

3. |

|

|

|

4. |

New York City net operating loss deduction (see instructions) |

4. |

|

|

|

5. |

New York City and New York State income tax refunds included in |

|

|

|

|

|

Schedule B2, line1 |

5. |

|

|

|

6. |

Taxable net income. Line 3 less the sum of lines 4 and 5. |

|

|

|

|

|

(Enter on page 1, ScheduleA, Line 1) |

6. |

|

|

|

|

|

|

|

||

|

ADDITIONAL REQUIRED INFORMATION - See Instructions |

|

|

|

|

|

|

|

|

|

|

1. |

Is this taxpayer subject to the Commercial Rent Tax? |

● |

■ YES |

■ NO |

|

2. |

If "YES", were all required Commercial Rent Tax Returns filed? |

● |

■ YES |

■ NO |

|

*31121293*

|

RETURNS WITH REMITTANCES |

|

RETURNS CLAIMING REFUNDS |

|

ALL OTHER RETURNS |

|

|

|

|||

MAILING |

NYC DEPARTMENT OF FINANCE |

|

NYC DEPARTMENT OF FINANCE |

|

NYC DEPARTMENT OF FINANCE |

INSTRUCTIONS: |

GENERAL CORPORATION TAX |

|

GENERAL CORPORATION TAX |

|

GENERAL CORPORATION TAX |

|

PO BOX 5040 |

|

PO BOX 5050 |

|

PO BOX 5060 |

|

KINGSTON, NY |

|

KINGSTON, NY |

|

KINGSTON, NY |

|

|

|

|

|

|

|

|

|

|

|

|

The due date for the calendar year 2012 return is on or before March 15, 2013.

For fiscal years beginning in 2012, file on or before the 15th day of the third month after the close of the fiscal year.

31121293

Form Characteristics

| Fact Name | Details |

|---|---|

| Form Purpose | The NYC 4S EZ form is used for filing the General Corporation Tax Return for corporations operating in New York City. |

| Filing Period | This form is applicable for the calendar year 2012 or fiscal years starting in 2012. |

| Tax Rate | The tax rate for net income is set at 8.85% as indicated in the form. |

| Minimum Tax | Corporations must pay a minimum tax based on New York City gross receipts, as detailed in the instructions. |

| Estimated Tax Payments | Corporations may need to make estimated tax payments if the tax owed exceeds $1,000. |

| Remittance Instructions | Payments must be made in U.S. dollars and drawn on a U.S. bank, payable to the NYC Department of Finance. |

| Filing Deadline | The due date for the 2012 return is on or before March 15, 2013, or the 15th day of the third month after the fiscal year ends. |

| Required Attachments | Corporations must attach a copy of all pages of their federal tax return or pro forma federal tax return. |

| Governing Law | This form is governed by New York City’s General Corporation Tax regulations. |

More PDF Templates

Nycha Careers - Decision outcomes, including whether an accommodation has been granted, recommended, or denied, are clearly documented on the form, ensuring transparency.

New York State Inheritance Tax - The ET-133 offers a pathway for resolving estate tax liens, critical for clear and undisputed asset transfer.