Fillable Nyc 3L Form in PDF

The NYC 3L form is a crucial document for S Corporations operating within New York City, specifically designed for the 2021 tax year. This form is essential for reporting the general corporation tax and is distinct from the forms required for C Corporations, which must file different versions like NYC-2 or NYC-2S. When completing the NYC 3L, businesses will need to provide detailed information such as their name, address, employer identification number, and business telephone number. It also requires the taxpayer to specify whether this is a final return or if they are applying for an extension. Additionally, the form includes various schedules that guide taxpayers through the computation of their tax liability, including the calculation of net income and allocation of capital. Important components such as prepayments, credits, and deductions are also covered in the form, ensuring that S Corporations can accurately report their financial activities and fulfill their tax obligations. Overall, understanding the NYC 3L form is vital for compliance and effective tax planning for businesses operating in the vibrant landscape of New York City.

Preview - Nyc 3L Form

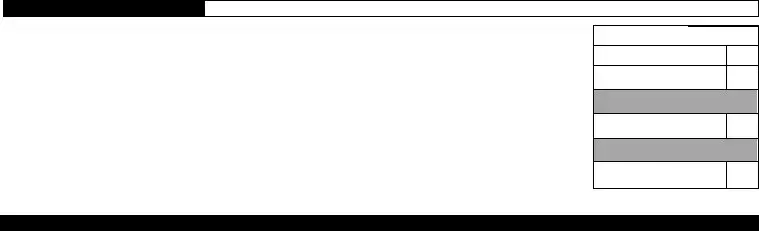

GENERAL CORPORATION TAX RETURN 2022

To be filed by S Corporations only. All C Corporations must file Form

For CALENDAR YEAR 2022 or FISCAL YEAR beginning _______________ 2022 and ending ___________________

Name |

|

Name |

n |

|

|

Change |

|

|

|

|

|

In Care Of |

|

|

|

|

|

|

|

Address (number and street) |

|

Address |

n |

|

|

Change |

|

City and State |

Zip Code |

Country (if not US) |

|

|

|

|

|

Business Telephone Number |

Date business began in NYC |

|

|

|

|

|

|

Taxpayer’s Email Address:

__________________________________________

EMPLOYER IDENTIFICATION NUMBER

BUSINESS CODE NUMBER AS PER FEDERAL RETURN

*30212291*

|

n Final return - Check this box if you have ceased operations in NYC |

n |

|

|

||

APPLY |

iinga |

eetaxabear |

||||

|

||||||

THAT |

n Special short period return (See Instr.) |

n |

prrfederareturnisattached |

|||

n aianatedfederataxbenefitseinst |

nn ter‑characterspeciacnditincdeifappicabeeinst |

|||||

ALL |

||||||

n ndedreturn |

|

nIRS change |

|

|||

CHECK |

If the purpose of the amended return is to report a |

Date of Final |

||||

federal or state change, check the appropriate box: |

nNYS change |

Determination |

||||

|

||||||

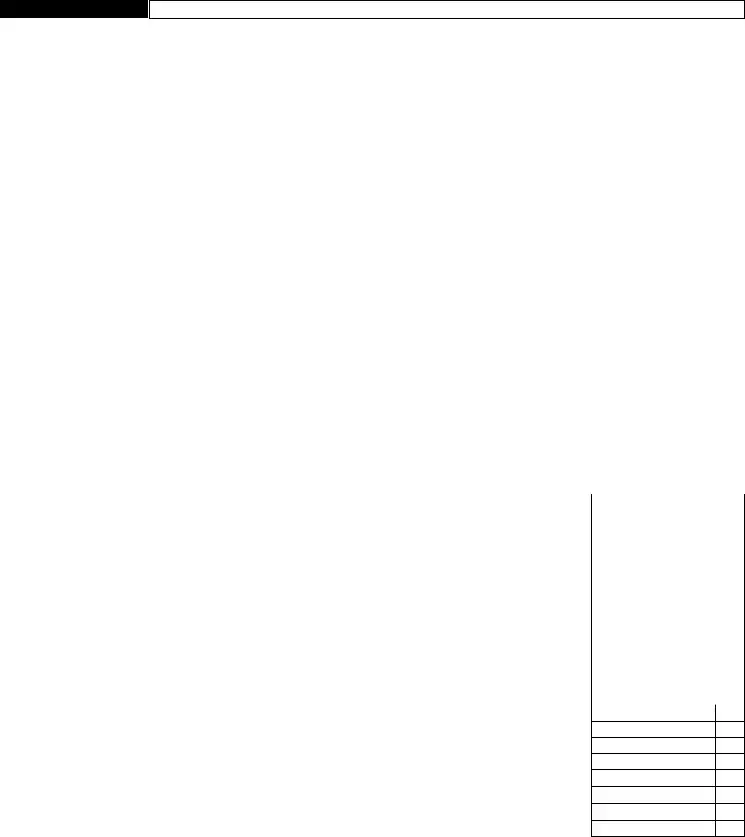

SCHEDULE A  Computation of Tax - BEGIN WITH SCHEDULE B ON PAGE 3. COMPLETE ALL OTHER SCHEDULES. TRANSFER APPLICABLE AMOUNTS TO SCHEDULE A.

Computation of Tax - BEGIN WITH SCHEDULE B ON PAGE 3. COMPLETE ALL OTHER SCHEDULES. TRANSFER APPLICABLE AMOUNTS TO SCHEDULE A.

A. Payment |

|

Amount being paid electronically with this return |

|

|

|

|

|

|

|

|

|

A. |

|

Payment Amount |

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

1. |

catednetincrSchedueine |

|

|

1. |

|

|

|

|

|

|

|

|

X .0885 |

1. |

|

|

|

|

|

|||||

2a. catedcapitarSchedueine |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

2a. |

|

|

|

|

|

|

|

|

X .0015 |

2a. |

|

|

||||||||||

2b. taacatedcapitaperativeusingrps |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

2b. |

|

|

|

|

|

|

|

|

X .0004 |

2b. |

|

|

||||||||||

2c. perativesenter |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

BORO |

|

|

BLOCK |

|

|

|

LOT |

|

|

|

|

|

|

|||||||||

3. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ternativeaxrternativeaxScheduenpage |

...................................(see instructions) |

|

|

|

|

|

3. |

|

|

|

|

|

||||||||||||

4. |

nitax |

einstructinsNY rssReceipts |

|

|

|

|

|

|

|

|

|

|

4. |

|

|

|

|

|

||||||

5. |

catedsubsidiarcapita |

|

see instructions |

5. |

|

|

|

|

|

|

|

X .00075 |

5. |

|

|

|

|

|

||||||

6. axineabrwhicheveris |

|

|

largest, PLUS ine |

|

|

|

|

|

|

|

6. |

|

|

|

|

|

||||||||

7. |

Paidredit |

|

(attach Form |

|

|

|

|

|

|

|

|

|

|

7. |

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

8. |

axafterreditineessine |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

8. |

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

9a. |

Rredit |

(attach Form |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

9a. |

|

|

||||||||||||

9b. |

Lredit |

|

(attach Form |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

9b. |

|

|

|||||||||||

10a. |

ReaateaxatinntOpprtunitRecatinan |

|

|

|

|

dIreditsttachrNY |

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

10a. |

|

|

|||||||||||||

10b. |

Intentinaeftban |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10b. |

|

|

|||||||

10c. |

erPrductinredit |

|

(attach Form |

|

|

|

|

|

|

|

|

|

|

10c. |

|

|

||||||||

11. |

Nettaxaftercreditsineess |

ttafinesathrughc |

|

|

|

|

|

|

|

|

|

|

11. |

|

|

|

|

|

||||||

12. |

irstinstantfestitedtaxfrperidfwingthat |

cveredbthisreturn |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

(a) Ifappicatinfrextensinhasbeenfiedenteraunt |

frinefrNY |

|

|

|

|

|

............ |

|

12a. |

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

(b) Ifappicatinfrextensinhas |

notbeenfiedandineexceeds$enter%fi |

|

|

|

|

|

ne |

12b. |

|

|

|||||||||||||

13. tafinesaandb |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

13. |

|

|

|

|

|

|||

14. |

PrepantsrPrepantsScheduepageine |

...........................(see instructions) |

|

|

|

|

|

14. |

|

|

|

|

|

|||||||||||

15. |

ancedueine |

|

essine |

|

|

|

|

|

|

|

|

|

|

|

|

15. |

|

|

|

|

|

|||

16. |

Overpantine |

|

essine |

|

|

|

|

|

|

|

|

|

|

|

|

16. |

|

|

|

|

|

|||

17a. |

.................................................................Interest (see instructions) |

|

|

|

|

17a. |

|

|

|

|

|

|

|

|

|

|

|

|

||||||

17b. |

ditinacharges |

(see instructions) |

|

|

17b. |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

17c. |

Penatfrunderpantfestitedtax |

(attach Form |

17c. |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

18. tafinesabandc |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

18. |

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

19. |

Netverpantineessine |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

19. |

|

|

|

|

|

|||

20. |

untfinetbe |

|

|

|

(a)Refunded n irectdepsit |

fill out line 20c OR |

|

n Paperchec |

20a. |

|

|

|

||||||||||||

|

|

|

|

|

|

(b)reditedtestitedtax |

|

|

|

|

|

|

|

|

|

|

20b. |

|

|

|

||||

20c. Routing Number

Account

Number

ACCOUNT TYPE

Checking n Savings n

21. TOTAL REMITTANCE DUE (see instructions) |

|

21. |

|

|

30212291 |

SEE PAGE 7 FOR MAILING INSTRUCTIONS |

|

NYL |

|

Form

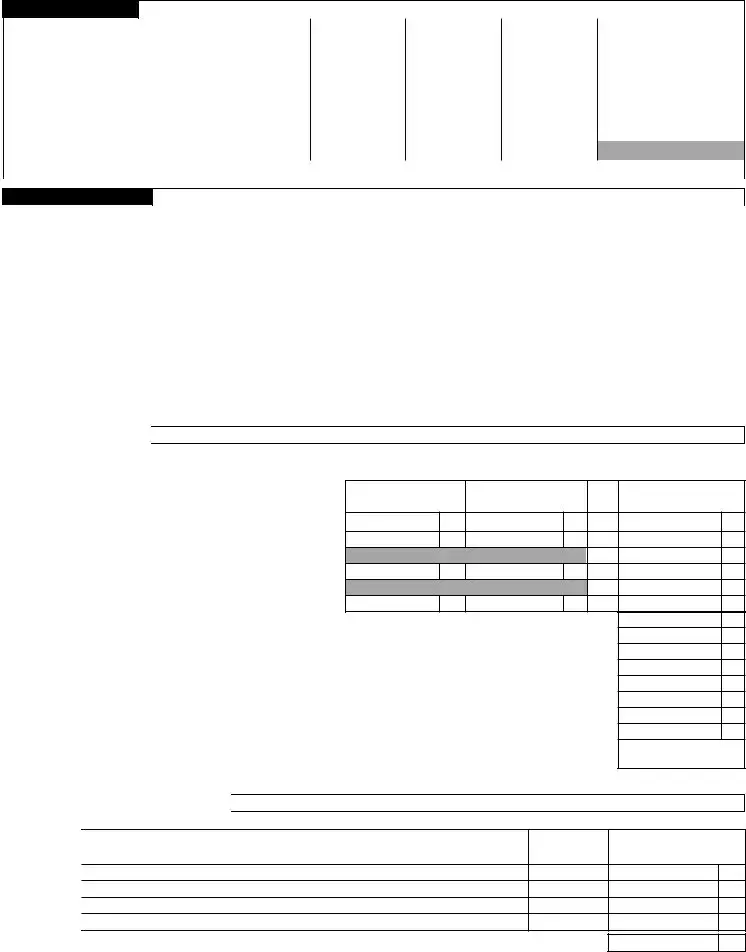

SCHEDULE A - Continued

Computation of Tax - BEGIN WITH SCHEDULE B ON PAGE 3. COMPLETE ALL OTHER SCHEDULES. TRANSFER APPLICABLE AMOUNTS TO SCHEDULE A.

Computation of Tax - BEGIN WITH SCHEDULE B ON PAGE 3. COMPLETE ALL OTHER SCHEDULES. TRANSFER APPLICABLE AMOUNTS TO SCHEDULE A.

22. |

IssuersacatinpercentagerSchedueine |

|

|

|

|

|

|

|

22. |

|||||

23. |

NYrentdeductednfederataxreturnrNYrentfrSchedue |

Part |

(See instructions) |

23. |

||||||||||

24. |

rssreceiptsrsaesfrfederareturn |

|

|

|

|

|

|

|

24. |

|||||

25. |

N fParentrpratin |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

26. |

taassetsfrfederareturn |

|

|

|

|

|

|

|

26. |

|||||

27. |

NfnParentrpratin |

|

|

|

|

|

|

|

|

|

|

|

|

28. |

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|||

28. |

ensatinfstcdersrSchedine |

|

|

|

|

|

|

|

||||||

%

COMPOSITION OF PREPAYMENTS SCHEDULE

|

PREPAYMENTS CLAIMED ON SCHEDULE A, LINE 14 |

|

DATE |

|

|

AMOUNT |

||||

ndatrfirstinstantpaidwithprecedingarstax |

|

|

|

|

|

|

|

|||

PantwithecaratinrNY |

|

|

|

|

|

|

|

|

||

PantwithNticefitedaxue |

|

|

|

|

|

|

|

|

||

PantwithNticefitedaxue |

|

|

|

|

|

|

|

|

||

PantwithextensinrNY |

|

|

|

|

|

|

|

|

||

Overpantfrprecedingarcreditedtthisar |

|

|

|

|

|

|

|

|||

G. TOTAL fthrughnternSchedueine |

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

ALTERNATIVE TAX SCHEDULE |

Refer to page 6 of instructions before computing the alternative tax |

|||||||||

|

|

|

|

|

|

|

|

|

||

Net income/loss einstructins |

|

|

|

|

1. |

$ |

__________________________ |

|||

Enter 100% of salaries and compensation for the taxable year paid to stockholders owning more than 5% of the taxpayer’s stock. (See instr.) |

2. |

$ |

__________________________ |

|||||||

Totalinepusine |

|

|

|

|

|

3. |

$ |

__________________________ |

||

Statutory exclusion - Enter $40,000. freturndesntcveranentirearexcusinstbeprrate |

dbasedntheperidcveredbthereturn |

4. |

$ |

__________________________ |

||||||

Net amount inenusine |

|

|

|

|

|

5. |

$ |

__________________________ |

||

15% of net amount inex% |

|

|

|

|

6. |

$ |

__________________________ |

|||

Investment income to be allocated untnSchedueinebx%ntenterreth |

antheauntnineabve |

|

|

|

|

|||||

ter |

ifntappicabe |

|

|

|

|

|

7. |

$ |

__________________________ |

|

Business income to be allocated inenusine |

|

|

|

8. |

$ |

__________________________ |

||||

Allocated investment income inexinvestntacatin%frSchedueine |

|

|

9. |

$ |

__________________________ |

|||||

Allocated business income inexbusinessacatin%frSchedueine |

|

|

10. |

$ |

__________________________ |

|||||

Taxable net incomeinepusine |

|

|

|

|

11. |

$ |

__________________________ |

|||

Tax rate |

|

|

|

|

|

12. |

|

% |

|

|

|

|

|

|

|

|

__________________________ |

||||

Alternative tax ine |

xine |

ransferaunttpage |

Schedueine |

|

|

13. |

$ |

__________________________ |

||

|

|

|

|

|

|

|

|

|

|

|

*30222291* 30222291

Form |

NAME: ______________________________________ EIN: __________________________________ |

Page 3 |

SCHEDULE B

Computation and Allocation of Entire Net Income

1. |

ederataxabeincbefrenetperatingssdeductina |

|

ndspeciadeductins |

(see instructions) |

1. |

|

|

||||||

2. |

Interestnfederastatenicipaandtherbigatin |

|

sntincudedinineabve |

(see instructions) |

2. |

|

|

||||||

3. |

eductinsdirectattributabetsubsidiarcapita |

(attach list) (see instructions) |

3. |

|

|

||||||||

4. |

eductinsindirectattributabetsubsidiarcapita |

|

(attach list) (see instructions) |

4. |

|

|

|||||||

5a. |

NYSranchiseaxincudingtaxesandtherbusinesstaxesded |

|

uctednthefederareturn |

ttachridereinstr |

5a. |

|

|

||||||

5b. |

NYenerarpratinaxdeductednfederareturn |

|

(see instructions) |

5b. |

|

|

|||||||

5c. |

NYSPasshrughtitaxandsiartaxesfrtherurisdicti |

|

|

nsdeductedfrederaaxabeInceinstr |

.. 5c. |

|

|

||||||

5d. |

NYPasshrughtitaxdeductedfrederaaxabeInc |

|

|

einstructins |

5d. |

|

|

||||||

6. |

NewYritadustntsreatingt |

|

(see instructions) |

|

|

|

|

|

|

|

|||

|

(antpprtunitrecatincstscreditandIcredit |

|

|

|

|

|

|

6a. |

|

|

|||

|

(b)Reaestatetaxescaatincredit |

|

|

|

|

|

|

|

6b. |

|

|

||

|

(c) RSdepreciatinandradustnt |

(attach Form |

6c. |

|

|

||||||||

7. |

ditins |

|

|

|

|

|

|

|

|

|

|

|

|

|

(a) Pantfrusefintangibes |

............................................................................................................. |

|

|

|

|

|

|

7a. |

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|||

|

(b) IntentinaOtted |

|

|

|

|

|

|

|

|

|

|

|

|

|

(c) Other (see instructions) (attach rider) |

|

|

|

|

|

|

7c. |

|

|

|||

8. |

tafinesthrughc |

|

|

|

|

|

|

|

|

8. |

|

|

|

9a. |

ividendsfrsubsidiarcapita |

(itemize on rider) (see instr.) |

9a. |

|

|

|

|

|

|||||

9b. |

Interestfrsubsidiarcapita |

..............................(itemize on rider) (see instructions) |

9b. |

|

|

|

|

|

|||||

9c. |

ainsfrsubsidiarcapita |

|

|

|

|

9c. |

|

|

|

|

|

||

10. |

%fdividendsfrnnsubsidiarcrpratins |

(see instructions) |

10. |

|

|

|

|

|

|

||||

11. |

NewYritnetperatingssdeductin |

|

11. |

|

|

|

|

|

|

||||

12. |

ainnsaefcertainprpertacquiredprirt |

|

(see instructions) |

12. |

|

|

|

|

|

|

|||

13. |

NYandNYStaxrefundsincudedinSchine |

(see instructions) |

13. |

|

|

|

|

|

|

||||

14. |

WagesandsaariessubecttIR§deductindisawa |

|

nce (see instr.) |

14. |

|

|

|

|

|

|

|||

15. |

epreciatinandradustntcacuatedunderpreRSrpre |

|

rues |

|

|

|

|

|

|

|

|||

|

(attach Form |

.............................................. |

15. |

|

|

|

|

|

|

||||

16a. ntributinsfcapitabgvernntaentitiesrcivicgrup |

|

s (seeinstructions). |

16a. |

|

|

|

|

|

|||||

..........................................16b. Otherdeductins (see instructions) (attach rider) |

|

16b. |

|

|

|

|

|

||||||

17. |

tadeductinsddinesathrughb |

|

|

|

|

|

|

|

|

17. |

|

|

|

18. |

tirenetincineessine |

|

(see instructions) |

|

|

|

|

|

18. |

|

|

||

19. |

Iftheauntnineisntcrrectentercrrectaunth |

|

ereandexpaininrider |

(see instr.) |

19. |

|

|

||||||

20. |

Investntinceteinesathrughhbew |

|

|

(see instructions) |

|

|

|

|

|

|

|

||

|

(a) |

ividendsfrnnsubsidiarstchedfrinvestnteinstructin |

|

s |

|

|

|

|

20a. |

|

|

||

|

(b) Interestfrinvestntcapitancudefederastateandn |

|

icipabigatins |

(itemize in rider) |

20b. |

|

|

||||||

|

(c)Netcapitagainssfrsaesrexchangesfnnsubsidiarsecu |

ritieshedfrinvestnt |

|

|

|

||||||||

|

tezenriderrattachederaSchedue |

|

|

|

|

|

|

|

20c. |

|

|

||

|

(d) |

IncfrassetsincudedninefSchedue |

|

|

|

|

|

|

|

20d. |

|

|

|

|

(e) |

dinesathrughdincusive |

|

|

|

|

|

|

|

|

20e. |

|

|

|

(f) |

eductinsdirectrindirectattributabetinvestntinc |

|

ttachisteinstructins |

|

20f. |

|

|

|||||

|

(g) |

anceineeessinef |

|

|

|

|

|

|

|

|

20g. |

|

|

|

(h) |

Interestnbanaccuntsincudedinincreprtednine |

|

d |

20h. |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

||||||

21. |

NewYritnetperatingssdeductinapprtinedti |

nvestntinc |

(attach rider)(see instr.) |

21. |

|||

22a. Investntincinegessine |

|

|

|

|

|

22a. |

|

22b. Investntinctbeacated |

(see instructions) |

|

|

|

|

22b. |

|

23. |

sinessinctbeacatedinerineessine |

b |

|

|

|

23. |

|

24. |

catedinvestntinc |

tipinebbtheinvestntacatinpercentagen |

SchedueLine |

(see instr.)... |

24. |

||

25a. catedbusinessinctipinebthebusinessaca |

tinpercentagenSchedueLine |

|

25a. |

||||

25b. Iftheauntnineaisntcrrectentercrrectaunt |

hereandexpaininrider |

(see instructions) |

25b. |

||||

26. |

taacatednetincinepusinearine |

bnteratSchedueine |

|

|

|

26. |

|

*30232291* 30232291

ATTACH ALL PAGES OF FEDERAL RETURN

Form |

NAME: ____________________________________ EIN: ___________________________________ |

Page 4 |

SCHEDULE C

Subsidiary Capital and Allocation

|

|

|

A |

|

|

B |

|

|

C |

|

D |

|

E |

|

F |

|

G |

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

RIPIONOSIY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

%fVting |

|

|

verage |

|

LiabiitiesirectrIn |

|

NetverageVaue |

|

Issuer |

|

|

|

Vauecated |

|

|||

|

|

LISI |

|

|

OYIIIION |

|

|

Stc |

|

|

Vaue |

|

directtributabet |

|

unus |

|

catin |

|

|

|

tNY |

|

||

|

SRIINY |

|

|

N |

|

|

Owned |

|

|

|

|

Subsidiarapita |

|

cu |

|

Percentage |

|

|

u |

xcu |

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

% |

|

|

|

|

|

|

|

|

% |

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1. |

tasandncudingitenrider |

1. |

|

|

|

|

|

|

|

|

|

2. |

taucatedsubsidiarcapitaransferthistt |

|

atSchedueine |

2. |

|

|

|

|

|

|

|

SCHEDULE D

Investment Capital and Allocation

|

|

|

|

A |

|

|

|

B |

|

|

C |

D |

|

|

|

E |

|

|

F |

|

G |

|

|

H |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

RIPIONOINV |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

rssInc |

|

|

|

|

|

|

|

|

NfShares |

|

|

verage |

|

Liabiitiesirectr |

|

|

|

NetverageVaue |

|

|

Issuer |

|

|

|

Vauecated |

|

|

|

||||

|

|

|

LISSOSRIY |

|

|

|

runtf |

|

|

Vaue |

|

Indirecttributabe |

|

|

|

unuscu |

|

|

catin |

|

|

|

tNY |

|

|

fr |

|

||

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

|

|

|

|

|

|

Securities |

|

|

|

tInvestntapita |

|

|

|

|

|

|

Percentage |

|

|

u |

xcu |

|

|

Investnt |

|

||||

|

|

|

|

SRIINY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

1. |

tasncudingitenrider |

1. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

2. |

Investntacatinpercentage |

inedividedbinerundedtthenearestnehun |

dredthfapercentagepint |

2. |

% |

|

|

|

|

|

|

|

|||||||||||||||||

3. |

ash |

(To treat cash as investment capital, |

3. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

you must include it on this line.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

4. |

InvestntcapitatafinesandenternSchedu |

|

|

eine |

|

4. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SCHEDULE E |

Computation and Allocation of Capital |

|

|||||

sisusedtdeterneaveragevaueincu |

Checkone.(Attachdetailedschedule.) |

|

|

||||

n - Annually |

n - |

n - Quarterly |

COLUMN A |

COLUMN B |

|||

|

|

|

|

|

|||

n - Monthly |

n - Weekly |

n - Daily |

|||||

Beginning of Year |

End of Year |

||||||

|

|

||||||

1.taassetsfrfederareturn

2.Reaprpertandrtabesecuritiesincudedinine

3. |

Subtractinefrine |

|

|

4. |

Reaprpertandrtabesecuritiesat |

fair market value |

|

5. |

ustedttaassetsddinesand |

|

|

6. |

taiabiities |

(seeinstructions) |

................................................... |

7.tacapitauineesscuine

8. Subsidiarcapitaeduecuine

|

9. |

sinessandinvestntcapitaineessine |

(seeinstructions) |

|

|||

|

10. |

Investntcapitaedueine |

|

(seeinstructions) |

|

|

|

*30242291* |

11. |

sinesscapitaineessine |

|

|

|

|

|

12. |

catedinvestntcapita |

tipinebtheinvestntacatinpercentagen |

|

SchedueLine |

|||

|

|

||||||

|

13. |

catedbusinesscapita |

tipinebthebusinessacatinpercentagenSche |

dueLine |

|||

|

14. |

taacatedbusinessandinvestntcapita |

inepusinenteratSchedueinearb |

|

|||

|

15. |

IssuersacatinpercentagefSchineandSch |

|

|

cine |

÷Schine |

|

|

|

rundedtthenearesthundredthfapercentnternpag |

e |

line22. SeeInstr. |

|||

|

|

Certain Stockholders |

|

|

|||

|

SCHEDULE F |

|

|

||||

|

Incudeastcderswninginexcessf |

5%ftaxparsissuedcapitastcwhreceivedancensatini |

ncudingcssins |

||||

|

|

Name, Country and US Zip Code (Attach rider if necessary) |

|

SciaSecuritNuer |

Officiaite |

||

|

|

|

|||||

|

|

|

|

|

|

|

|

COLUMN C

Average Value

1.

2.

3.

4.

5.

6.

7.

8.

9.

10.

11.

12.

13.

14.

15.%

SaarOtherensatin

Receivedfrrpratin

fnneenter

1. taincudinganauntnriderternSchedueine1.

30242291 |

ATTACH ALL PAGES OF FEDERAL RETURN |

|

Form |

NAME: ______________________________________ EIN: ____________________________________ |

Page 5 |

SCHEDULE G

Locations of Places of Business Inside and Outside New York City

taxparsstceteScheduePartsand

Part 1 - List location for each place of business INSIDE New York City (see instructions; attach rider if necessary)

|

etedress |

|

Rent |

Naturefivities |

Nfes |

WagesSaariesc |

uties |

||

|

|

|

|

|

|

|

|

|

|

N |

SR |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

IY |

|

S |

ZIP |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

N |

SR |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

IY |

|

S |

ZIP |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

N |

SR |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

IY |

|

S |

ZIP |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

N |

SR |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

IY |

|

S |

ZIP |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ta |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Part 2 - List location for each place of business OUTSIDE New York City (see instructions; attach rider if necessary) |

|

|

|||||||

|

etedress |

|

Rent |

Naturefivities |

Nfes |

WagesSaariesc |

uties |

||

|

|

|

|

|

|

|

|

|

|

N |

SR |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

IY |

|

S |

ZIP |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

N |

SR |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

IY |

|

S |

ZIP |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

N |

SR |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

IY |

|

S |

ZIP |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

N |

SR |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

IY |

|

S |

ZIP |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ta |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SCHEDULE H

Business Allocation - see instructions before completing this schedule

Taxpayers must report their Business Allocation Percentage in this schedule for this return to be accepted

axparswhdntacatebusinessincutsideNewYr |

itstenter%nSchedueine |

|

|

|

|

||

axparswhacatebusinessincbthinsideandutside |

NewYritstceteSchedueandenterpercentagen |

|

Schedueine |

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

COLUMN A - NEW YORK CITY |

COLUMN B - EVERYWHERE |

|

||

|

Receipts in the regular course of business from: |

|

|

|

|

|

|

1. |

Saesftangibepersnaprpert |

1. |

|

1. |

|

|

|

2. |

Servicesperfrd |

2. |

|

2. |

|

|

|

______________________________________________________________________ |

|

||||||

3. |

Rentasfprpert |

3. |

|

3. |

|

|

|

______________________________________________________________________ |

|

||||||

4. |

Rties |

4. |

|

4. |

|

|

|

5. |

Otherbusinessreceipts |

5. |

|

5. |

|

|

|

6. |

ta |

6. |

|

6. |

|

|

|

7. |

sinesscatinPercentageinecudividedbine |

curundedtthenearesthundredthfapercent |

|

|

|

|

|

|

IfusingSchedueIenterpercentagefrPartinerPa |

rtineSeeinstructins |

|

7. |

|

|

% |

*30252291* |

30252291 |

ATTACH ALL PAGES OF FEDERAL RETURN |

Form |

NAME: ______________________________________ EIN: ___________________________________ |

Page 6 |

SCHEDULE I

Business Allocation for Aviation Corporations and Corporations Operating Vessels

Part 1 |

sinessacatinfraviatincrpratins |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

AVERAGE FOR THE YEAR |

|

|

|

||

|

|

|

|

|

COLUMN A - NEW YORK CITY |

|

COLUMN B - EVERYWHERE |

|

||

1. |

rcraftarrivasanddepartures |

|

1. |

|

|

|

|

|

|

|

2. |

NewYritpercentageudividedbcu |

|

2. |

|

|

|

|

|

% |

|

|

|

|

|

|

|

|||||

3. |

Revenuetnshanded |

|

3. |

|

|

|

|

|

|

|

4. |

NewYritpercentageudividedbcu |

|

4. |

|

|

|

|

|

% |

|

5. |

Originatingrevenue |

|

5. |

|

|

|

|

|

|

|

6. |

NewYritpercentageudividedbcu |

|

6. |

|

|

|

|

|

% |

|

|

|

|

|

|

|

|||||

7. |

tafinesand |

|

7. |

|

|

|

|

|

% |

|

8. |

catinpercentageinedividedbthreerundedtth |

enearestnehundredthfapercentagepintnternSche |

dueine |

8. |

|

% |

||||

|

|

|

|

|

|

|

|

|

||

Part 2 |

sinessacatinfrcrpratinsperatingvessesinfreignc |

|

rce |

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

1. |

gregatenuerfwrngda |

1. |

|

2. |

catinpercentage |

udividedbcurundedtthenearestnehundre |

|

COLUMN A - |

NEW YORK CITY |

COLUMN B |

EVERYWHERE |

|

TERRITORIAL WATERS |

|

|

|

|

|

|

dthfapercentagepintnternSchedueine |

2. |

% |

|

SCHEDULE J

The following information must be entered for this return to be complete. (REFER TO INSTRUCTIONS BEFORE COMPLETING THIS SECTION.)

1a. |

NewYritprincipabusinessactivit____________________ |

_____________________________________________________________________ |

|

1b. |

Othersignificantbusinessactivities (attach schedule, see instructions__________________________________________________ _______________ |

||

2. |

radenafreprtingcrpratinifdifferentfrnaen |

terednpage___________________________________ |

|

3. |

Isthiscrpratinincudedinacnsidatedfederareturn |

n YES |

n NO |

|

Ifgiveparentsna |

______________________________________________ |

N |

___________________________ |

||||

|

|

|

|

|

|

|

enterhereandnpageine |

|

4. |

Isthiscrpratinaerfacntredgrupfcrpratin |

sasdefinedinIRsectin |

|

|

n YES |

|||

|

disregardinganexcusinbreasnfparagraphfthatsect |

in |

|

|

|

|||

|

If |

givecnparentcrpratin’snaifan ________________ |

|

_______________ |

N |

_______________________________ |

||

|

|

|

|

|

|

|

enterhereandnpageine |

|

5. |

astheInternaRevenueServicertheNewYrStateepartn |

tfaxatinandinance |

|

|

n YES |

|||

|

crrectedantaxabeincrthertaxbasereprtedinaprir |

arrareucurrentunderaudit |

|

|

||||

|

Ifbwh |

|

n Internal Revenue Service |

|

Stateperid |

|

g________________ |

d________________ |

|

|

|

|

|

|

|

YY |

YY |

|

|

|

n New York State Department of Taxation and Finance |

Stateperid |

|

g________________ |

d________________ |

|

|

|

|

|

|

|

|

YY |

YY |

6.If“Ytquestin

|

6a.rarsprirthasrNYeprtfedera |

|

|

Statehangeinaxsebeenfied |

|

|

n YES |

||||||

|

6b. rarsbeginningnrafterhasanandedreturn |

|

beenfied |

|

|

|

|

n YES |

|||||

7. |

idthiscrpratinanpantstreatedasinterestinthe |

cutatinfentirenetinctsharehders |

|

wningdirectr |

|

||||||||

|

indirectindividuarintheaggregaterethan% |

fthecrpratin’sissuedandutstandingcapitastcIf |

|

“Y |

n YES |

||||||||

|

cetethefwingfrethanneattachseparatesh |

eet |

|

|

|

|

|

||||||

|

Sharehder’sna___________________________________ |

______SSNN________________________________ |

__ |

||||||||||

|

InterestpaidtSharehder |

|

_______________ |

taIndebtednesstsharehderdescribedabve |

________________ |

tainterestpaid |

_______________ |

||||||

8. |

Wasthiscrpratinaerfapartnershiprintventured |

uringthetaxar |

|

|

|

n YES |

|||||||

|

IfattachschedueistingnaandrIdentificatin |

|

Nuer |

|

|

|

|

|

|||||

|

|

9. |

antiduringthetaxabeardidthecrpratinhave |

aninterestinreaprpert |

ncudingaeasehdinterest |

n YES |

|||||||

|

|

|

catedinNYracntringinterestinanentitwnin |

gsuchreaprpert |

|

|

|

||||||

*30262291* |

10. |

a) |

If |

t |

attachascheduefsuchprpertindicatingthenaturef |

theinterestandincudingthestreet |

|

||||||

|

addressbrughbcandtnuer |

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

b) WasanNYreaprpertncudingaeasehdinterestrcnt |

|

ringinterestinanentitwningNYrea |

|

n YES |

||||||

|

|

|

prpertacquiredrtransferredwithrwithutcnsiderati |

|

n |

|

|

|

|||||

|

|

|

c) |

Wasthereapartiarceteiquidatinfthecrprati |

n |

|

|

|

|

n YES |

|||

|

|

|

d) Was%rrefthecrpratin’swnershiptransferredduring |

thetaxarverathreearperidraccrdingtapa |

n |

n YES |

|||||||

|

|

11. |

IftbcrdwasaReaPrpertransferaxReturn |

|

rNYPfied |

|

|

|

n YES |

||||

|

|

12. |

IfOtexpain______________________________ |

____________________________________________ |

|||||||||

|

|

13. |

esthecrpratinhavenerrequaifiedsubchapterSsub |

|

sidiaries |

|

|

|

n YES |

||||

|

|

|

If“YtachaschedueshwingthenaaddressandNif |

|

anfeachQSSSandindicatewhether |

|

|

||||||

|

|

|

theQSSSfiedrwasrequiredtfieaitbusinessincta |

|

xreturn (see instructions) |

|

|

|

|||||

|

|

14. |

terthenuerfedreturnsattached________________ |

|

______________________ |

|

|

||||||

|

|

15. |

esthistaxparparentgreaterthan$franprese |

|

sinNYinthebrughfnhattansuth |

|

n YES |

||||||

|

|

|

fthStreetfrthepurpsefcarrngnantradebusine |

|

ssprfessinvcatinrcrciaactivit |

|

|||||||

|

|

16. |

IfwerearequiredrciaRentaxReturnsfied |

|

|

|

|

|

n YES |

||||

30262291 |

|

PeaseenterrIdentificatinNuerwhichwasusednth |

|

erciaRentaxReturn ____________________________ |

|||||||||

nNO

nNO

nNO

nNO

nNO

nNO

nNO

nNO

nNO

nNO

nNO

nNO

nNO

nNO

__

Form |

NAME: ______________________________________ EIN: ___________________________________ |

Page 7 |

SCHEDULE K

Federal Return Information

The following information must be entered for this return to be complete.

Enter on lines 1 through 10 in the Federal Amount column the amounts reported on your federal Form 1120S. (See instructions)

Federal 1120S |

|

t Federal Amount t |

||

|

|

|

____________________________________________ |

|

1. |

ividends |

1. |

____________________________________ |

|

2. |

Interestinc |

2. |

____________________________________ |

|

3. |

apitagainnetinc |

3. |

____________________________________ |

|

4. |

Otherinc |

4. |

____________________________________ |

|

5. |

tainc |

5. |

____________________________________ |

|

6. |

ddebts |

6. |

____________________________________ |

|

7. |

Interestexpense |

7. |

____________________________________ |

|

8. |

Otherdeductins |

8. |

____________________________________ |

|

9. |

tadeductins |

9. |

____________________________________ |

|

10. |

Netperatingssdeductin |

10. |

____________________________________ |

|

CERTIFICATION OF AN ELECTED OFFICER OF THE CORPORATION

I hereby certify that this return, including any accompanying rider, is, to the best of my knowledge and belief, true, correct and complete. I authorize the Dept. of Finance to discuss this return with the preparer listed below. (See instructions) ......YES n

irsidress

_______________________________________

|

SIGN |

|

|

Signatureffficer |

|

|

|

|

ite |

|

ate |

PreparersSciaSecuritNuerrPIN |

|

|

|

|

|

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||

|

HERE: |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

PREPARER'S |

|

PreparersPreparer’s |

|

|

|

|

hecifsef |

|

n |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

USE |

’ |

|

|

signatureprinted |

na |

ate |

|

✔ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

ONLY |

|

|

|

ed |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

irrIdentificatinNuer |

|

|

|

|

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

s irsna |

rursifsefd |

s dress |

|

|

|

|

|

s Zipde |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

MAILING INSTRUCTIONS

ATTACH COPY OF ALL PAGES OF YOUR FEDERAL TAX RETURN 1120S.

Make remittance payable to the order of NYC DEPARTMENT OF FINANCE. Payment must be made in U.S. dollars and drawn on a U.S. bank.

To receive proper credit, you must enter your correct Employer Identification Number on your tax return and remittance.

The due date for the calendar year 2022 return is on or before March 15, 2023.

For fiscal years beginning in 2022, file on or before the 15th day of the 3rd month following the close of the fiscal year.

ALLRETURNSEXCEPTREFUNDRETURNS

NYOIN

ORPORION

POX

NONNY

REMITTANCES

PAY ONLINE WITH FORM

AT NYC.GOV/ESERVICES

OR

Mail Payment and Form

NYOIN

POX

NYORNY

RETURNS CLAIMING REFUNDS

NYOIN

ORPORION

POX

NONNY

*30272291*

30272291

Form Characteristics

| Fact Name | Fact Description |

|---|---|

| Form Purpose | The NYC 3L form is specifically designed for S Corporations to report their general corporation tax return for the year 2021. |

| Filing Requirement | Only S Corporations must file this form. C Corporations are required to use Form NYC-2, NYC-2S, or NYC-2A instead. |

| Tax Year | The form is applicable for the calendar year 2021 or for a fiscal year beginning in 2021. |

| Identification Information | Taxpayers must provide their name, Employer Identification Number (EIN), and business address on the form. |

| Payment Methods | Taxpayers can make electronic payments when filing the NYC 3L form. |

| Amended Returns | If there are changes to the federal or state tax returns, taxpayers can check the appropriate box on the form to indicate an amended return. |

| Credits and Deductions | The form allows for various credits and deductions, including those related to subsidiary capital and investment income. |

| Alternative Tax Schedule | Taxpayers may need to complete an alternative tax schedule if applicable, based on their net income and other factors. |

| Business Allocation | Taxpayers must report their business allocation percentage, especially if conducting business both inside and outside New York City. |

| Governing Law | The NYC 3L form is governed by New York City Administrative Code, Title 11, Chapter 1, which outlines the general corporation tax regulations. |

More PDF Templates

Nyc Ubt Estimated Tax - An amended declaration section allows for adjustments if estimated taxes increase or decrease due to changes in income.

It-201 Resident Income Tax Return - The form's requirements contribute to a more streamlined, organized approach to handling traffic accidents.