Fillable Nyc 3360 Form in PDF

The NYC 3360 form is an important document for corporations operating in New York City, specifically designed to report changes in their tax base as determined by the Internal Revenue Service or the New York State Department of Taxation and Finance. This form must be filed within 90 days, or 120 days for combined groups, following a final determination that affects tax years beginning prior to January 1, 2015. It serves multiple purposes, including reporting changes in filing status, calculating the general corporation tax, and determining any additional tax or refund due. The form requires detailed information such as the corporation's name, employer identification number, and contact details. Additionally, it necessitates a breakdown of the original amounts, net changes, and corrected amounts across various tax components, including net income and capital allocated to New York City. Furthermore, the NYC 3360 form includes sections for claiming tax credits and calculating penalties or interest for late filings or payments. Completing this form accurately is crucial, as it ensures compliance with New York City tax regulations and prevents potential penalties.

Preview - Nyc 3360 Form

*30011591*

A.Payment

Department of Finance |

|

GENERAL CORPORATION TAX REPORT OF CHANGE IN |

|||||||||||||||||||||||||||||||||

|

TAXBASEMADEBYINTERNALREVENUESERVICEAND/OR |

||||||||||||||||||||||||||||||||||

|

|

|

|

|

NEWYORKSTATEDEPARTMENTOFTAXATIONANDFINANCE |

||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

|

|

|

|

|

TO BE FILED WITHIN 90 DAYS (120 DAYS FOR A COMBINED GROUP) AFTER A FINAL DETERMINATION |

||||||||||||||||||||||||||||||

|

|

|

|

|

FOR TAX YEARS BEGINNING PRIOR TO JANUARY 1, 2015 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

For CALENDAR YEAR __________ or FISCAL YEAR beginning ________________________ and ending _________________________ |

||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

ARE YOU REPORTING A CHANGE |

NEW FILING STATUS: |

|

|

|

|

|

ORIGINAL RETURN WAS FILED ON: |

|

|

|

|

|

|

|

||||||||||||||||||||

|

IN FILING STATUS? (SEE INSTR.) |

|

|

|

|

|

|

CHANGEIN |

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

SEPARATE |

|

|

COMBINED |

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

nYES nNO |

n |

n |

nCOMBINEDGROUP |

|

n |

n |

n |

n |

||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name |

|

Name |

|

Email Address |

|

|

|

|

|

|

|

EMPLOYER IDENTIFICATION NUMBER |

||||||||||||||||||||

|

t |

|

|

|

Change n |

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

Typeor |

|

In Care of |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Address (number and street) |

|

|

|

|

|

|

Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

Change n |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

Date of Final Determination: |

|

|

|

|

|

|

|

||||||||||||||||

|

t |

|

City and State |

|

|

|

Zip Code |

|

Country (if not US) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

n Federal |

|

|

|

||||||||||||||||

|

|

|

Business Telephone Number |

|

|

|

Person to contact |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

n New York State |

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Payment Amount |

|

|

|

|

|

|||||

Amountbeingpaidelectronicallywiththisreturn.............................................................................. A. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

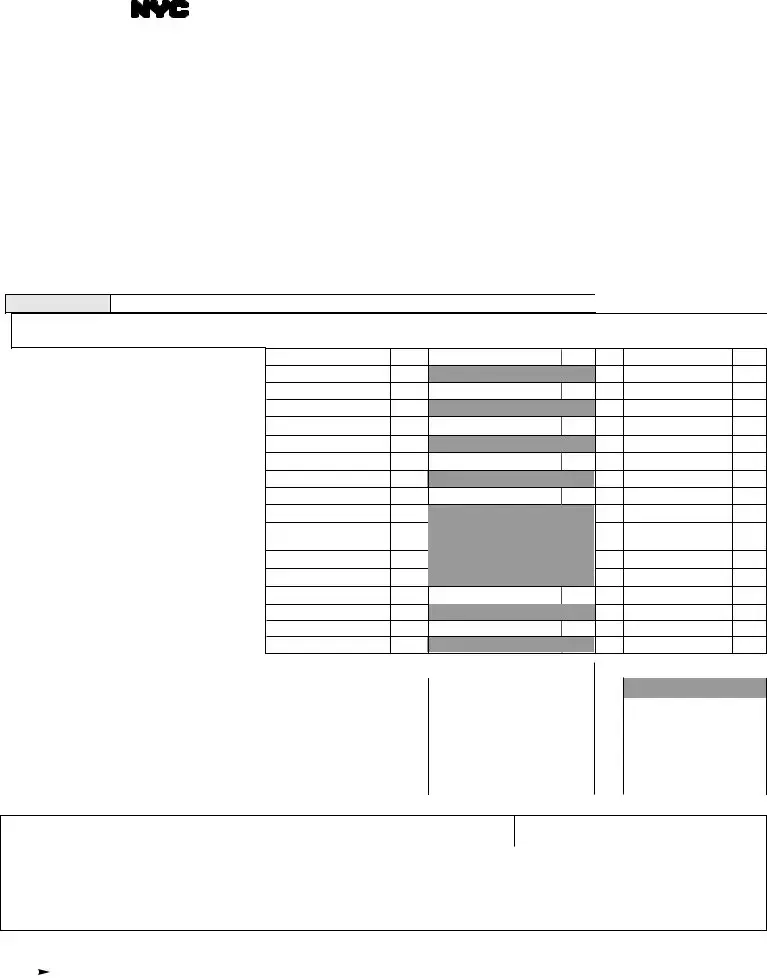

Calculation of General

Corporation Tax

COLUMN 1 |

COLUMN 2 |

COLUMN 3 |

Original Amount as last adjusted |

Net Change |

Correct Amount |

|

|

|

1. |

Net income allocated to New York City.... |

1. |

2. |

Tax at ______% (see instructions) |

2. |

3.Total capital allocated to New York City.. 3.

4. |

Tax at ______% (see instructions) |

4. |

5a. |

Alternative tax base (see instructions) |

5a. |

5b. |

Alternative tax (see instructions) |

5b. |

6. |

NYC Gross Receipts |

6. |

6a. |

Minimum tax (see instructions) |

6a. |

7. |

Subsidiary capital |

7. |

8. |

Tax at ______% (see instructions) |

8. |

9.Tax, (line 2, 4, 5b, or 6a, whichever

|

is largest, plus line 8) |

9. |

10. |

Minimum tax for subsidiaries |

10. |

11. |

Total tax (line 9 plus line 10) |

11. |

12. |

UBT Paid Credit (see instructions) |

12. |

13. |

TaxafterUBTPaidCredit(line11minusline12) |

13. |

14. |

Tax credits (see instructions) |

14. |

15. |

Net tax |

15. |

1.

2.

3.

4.

5a.

5b.

6.

6a.

7.

8.

9.

10.

11.

12.

13.

14.

15.

Additional Tax (or Refund) Due |

COLUMN A - Additional Tax Due |

COLUMN B - Refund Due |

16. |

If line 15 (col. 3) exceeds line 15 (col. 1), enter the difference in column A .......... 16. |

|

|||||

17. |

If line 15 (col. 3) is less than line 15 (col. 1), enter the difference in column B |

|

|

17. |

|

|

|

18. |

Interest (see instructions) |

18. |

|

|

|

|

|

19. |

Additional charges (see instructions) |

19. |

|

|

|

|

|

20. |

Total amount due (add lines 16 , 18, and 19) |

20. |

|

|

|

|

|

21. |

Refund due (enter amount from line 17 above) |

|

|

|

21. |

|

|

CERTIFICATION OF AN ELECTED OFFICER OF THE CORPORATION

Iherebycertifythatthisreturn,includinganyaccompanyingrider,is,tothebestofmyknowledgeandbelief,true,correctandcomplete. I authorize the Dept. of Finance to discuss this return with the preparer listed below. (see instructions) .....YES n

Firm's Email Address

_____________________________________________

SIGN |

|

|

|

|

|

|

|

Preparer's Social Security Number or PTIN |

||||||||||||||||||||||||

HERE ’ |

Signature of officer |

|

Title |

|

|

Date |

||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Preparer's |

Preparer’s |

Check if self- |

n |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

PREPARER'S |

signature |

printed name |

employed 4 |

Date |

|

Firm's Employer Identification Number |

||||||||||||||||||||||||||

|

|

|

||||||||||||||||||||||||||||||

USE ’ |

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

ONLY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

s Firm's name (or yours, if

|

|

ALLRETURNSEXCEPTREFUNDRETURNS |

REMITTANCES |

RETURNSCLAIMINGREFUNDS |

Attach copies of federal and/or New York State |

To receive proper cred- |

|

|

MAILING |

|

changes and explanation of items. Make remittance |

it, you must enter your |

|||

INSTRUCTIONS NYC DEPARTMENT OF FINANCE |

ATNYC.GOV/ESERVICES |

NYC DEPARTMENT OF FINANCE |

|||||

payabletotheorderof: |

correct Employer |

||||||

|

|

GENERAL CORPORATION TAX |

GENERAL CORPORATION TAX |

||||

|

|

Identification Number |

|||||

|

|

P.O. BOX 5564 |

NYC DEPARTMENT OF FINANCE |

P.O. BOX 5563 |

|

||

|

|

|

on your form and remit- |

||||

|

|

BINGHAMTON, NY |

P.O. BOX 3646 |

BINGHAMTON, NY |

NYCDEPARTMENT OF FINANCE |

||

30011591 |

NEW YORK, NY |

|

PaymentmustbemadeinU.S.dollars,drawnonaU.S.bank. |

tance. |

|||

|

|

|

|||||

NYC - 3360 - 2015

Form |

Page 2 |

Payments may be made on the NYC Department of Finance website at nyc.gov/eservices, or via check or money order. If paying with check or money order, do not include these payments with your New York City return. Checks and money orders must be accompanied by payment voucher form

(Pursuant to Title 11, Chapter 6 of the Administrative Code of the City of New York)

For taxable years beginning prior to January 1, 2015, you must file Form

If you are filing this form to report a change in filing on a separate basis on a Form

For information regarding differences between Federal and City depreciation deductions, see Finance Memorandum

SPECIFIC INSTRUCTIONS

CALCULATION OF TAX

In Column 1, lines 1, 3, 5a, 6, 7, 12 and 14, enter amounts from the latest NewYorkCityreportreflectinganyclaimforcreditorrefundorNewYork City Department of Finance adjustment prior to the filing of this return. If youfiledanamendedreturnoriftheamountsshownonyouroriginalreturn were changed pursuant to a final Department of Finance adjustment, attach documentation reflecting the New York City changes and a schedule show- ing your calculations. In Column 2 enter net reportable changes resulting from changes made by the Internal Revenue Service or the New York State Department of Taxation and Finance and submit a schedule showing calcu- lations. In Column 3, lines 1, 3, 5a 6, 7, 12 and 14, enter the difference between,orsumof,columns1and2,asappropriate.

Submit schedule of allocation percentages (if any) utilized in mak- ing entries in column 2 of this report.

LINES 2, 4, 5b and 8

Use the tax rate schedule to determine the applicable rates for the taxable year covered by this report.

TAX RATE SCHEDULE

Taxable |

|

Allocated Net |

Allocated |

Allocated |

Years |

...and |

Income/ |

Businessand |

Subsidiary |

Beginning |

Before |

Alternative |

Investment |

Capital |

on or After... |

|

Tax |

Capital |

|

|

|

|

|

|

8.85% |

0.15% |

.075% |

||

|

|

|

|

|

NOTE: The rate of tax on capital for cooperative housing corpora- tions is 4/10 mill (.0004). For all other corporations subject to tax on capital (other than cooperative housing corporations) the rate of tax on capital is 1 1/2 mills (.0015).

LINE 5a, Column 3 - ALTERNATIVE TAX BASE

Submit schedule showing computation of alternative tax base. To compute the alternative tax base:

a)add to the amount of corrected allocated net income (loss), column 3 all salaries and compensation paid to every stock- holder owning more than five percent of the issued capital stock.

b)deduct from such total the statutory exemption amount, which is $40,000 for taxable years beginning on or after July 1, 1999 (a pro- portionate part is deducted in the case of a return for less than a year);

c)For tax years beginning on or after January 1, 2010, multiply the resulting total by 15%. See Ad Code §

The alternative tax base is computed based on revised entire net income (entire net income per original return plus or minus change in taxable income).

LINE 5b - ALTERNATIVE TAX

Todeterminethealternativetax,applytheappropriatetaxrateshownin thescheduleabovetothetaxbasedeterminedinline5a.

LINES 6, 6a and 10 – MINIMUM TAX

For tax years before 2009, the minimum tax is $300. If this form is being filed with respect to a corporation filing a combined report, enter $300 on line 6a for the reporting corporation, and enter on line 10 the total minimum tax of each corporation included in the combined report other than the reporting corporation, with the exception of any corpora- tionnototherwisesubjecttotax.

For tax years beginning in or after 2009, use the following table to deter- mine the minimum tax. Enter on line 6 NYC Gross Receipts. Enter on line 6a the minimum tax for the reporting corporation. Enter on line 10 the sum of the minimum tax for each corporation included in the com- bined group other than the reporting corporation. Attach a schedule showingeachsuchcorporationandtheamountofminimumtaxforeach. The amount of New York City receipts for the purpose of calculating the minimum tax for tax years beginning in or after 2009 is the total amount of all receipts the taxpayer has received in the regular course

Form |

Page 3 |

of business from such sources as sales of personal property, services |

of the General Corporation Tax Return (without regard to any |

||

performed, rentals of property and royalties. For taxpayers which have |

extension of time for payment) to the date of payment. (Section 11- |

||

filed an NYC 3L, this receipts amount would be the same as the |

675 of the Administrative Code). The applicable prescribed inter- |

||

amount that would have to be shown on Form |

est rate or rates are available from the interest rate table set forth on |

||

Column A, Line 2g. For taxpayers which are part of a combined |

the Finance website at nyc.gov/finance. |

||

group in tax years beginning in 2014 or 2013, this amount would be: |

Effective September 1, 1983, interest is compounded on a daily |

||

(i) for the reporting corporation, the amount on Form |

|||

ule H, Column A, Line 2g(A); and (ii) for corporations other than the |

basis at the applicable rate. |

||

reporting corporation (“subsidiaries”), the amount on Form NYC- |

For the rate of interest on overpayments, for a rate of interest not |

||

3A/B, Schedule H, Line 2g(A) in the column for that subsidiary, |

shown on the website and for interest calculations, call 311. If call- |

||

except if there is only one subsidiary, in which case the amount |

ing from outside of the five NYC boroughs, please call |

||

entered on form |

YORK |

||

|

|

||

TABLE - FIXED DOLLAR MINIMUM TAX |

|

LINE 19 - ADDITIONAL CHARGES |

|

For a corporation with New York City receipts of: |

|

||

|

a) A late filing penalty is assessed if you fail to file this form |

||

Not more than $100,000: |

$ 25 |

||

More than $100,000 but not over $250,000: |

$ 75 |

when due, unless the failure is due to reasonable cause. For |

|

every month or partial month that this form is late, add to the |

|||

More than $250,000 but not over $500,000: |

$ 175 |

||

tax (less any payments made on or before the due date) 5%, up |

|||

More than $500,000 but not over $1,000,000: |

$ 500 |

||

to a total of 25%. |

|||

More than $1,000,000 but not over $5,000,000: |

$1,500 |

||

|

|||

More than $5,000,000 but not over $25,000,000: |

$3,500 |

b) If this form is filed more than 60 days late, the above late filing |

|

Over $25,000,000: |

$5,000 |

penalty cannot be less than the lesser of (1) $100 or (2)100% of the |

|

|

|

||

Short periods - fixed dollar minimum tax. Compute the New York |

amount required to be shown on the form (less any payments made |

||

by the due date or credits claimed on the return). |

|||

City receipts for short periods (tax periods of less than 12 months) |

|||

|

|||

by dividing the amount of New York receipts by the number of |

c) A late payment penalty is assessed if you fail to pay the tax |

||

months in the short period and multiplying the result by 12. The |

shown on this form by the prescribed filing date, unless the fail- |

||

fixed dollar minimum tax may be reduced for short periods: |

ure is due to reasonable cause. For every month or partial |

||

|

|

month that your payment is late, add to the tax (less any pay- |

|

Period Reduction |

|

ments made) 1/2%, up to a total of 25%. |

|

|

|

||

l Not more than 6 months |

50% |

d) The total of the additional charges in a and c may not exceed |

|

l More than 6 months but not more than 9 months |

25% |

||

5% for any one month except as provided for in b. |

|||

l More than 9 months |

None |

||

|

|||

If this form is being filed with respect to a corporation filing a com- |

If you claim not to be liable for these additional charges, attach a state- |

||

ment to your return explaining the delay in filing, payment or both. |

|||

bined report, enter on line 10 the sum of the fixed dollar minimum |

|

||

tax amounts for each corporation (other than the reporting corpora- |

SIGNATURE |

||

tion) included in the combined report, except for any corporation |

This report must be signed by an officer authorized to certify that |

||

not otherwise subject to tax. To determine the fixed dollar mini- |

the statements contained herein are true. If the taxpayer is a pub- |

||

mum tax for each such corporation, use the above table. |

|

||

|

|

||

LINE 12 - UBT PAID CREDIT |

|

corporation, this return must be signed by a person duly authorized |

|

|

to act on behalf of the taxpayer. |

||

Enter on line 12, column 1 the total amounts from Form |

|||

|

|||

Preparer Authorization: If you want to allow the Department of |

|||

allchangestothisamountandenterthecorrectedamountincolumn3. |

Finance to discuss your return with the paid preparer who signed it, |

||

|

|

you must check the "yes" box in the signature area of the return. |

|

LINE 14 - |

|

This authorization applies only to the individual whose signature |

|

All applicable credits should be taken into account when computing |

appears in the "Preparer's Use Only" section of your return. It does |

||

the tax. Attach schedule of credits claimed. Attach Forms NYC- |

not apply to the firm, if any, shown in that section. By checking the |

||

9.5, |

"Yes" box, you are authorizing the Department of Finance to call |

||

Enter in column 2 all changes to these amounts and enter the cor- |

the preparer to answer any questions that may arise during the pro- |

||

rected amount in column 3. |

|

cessing of your return. Also, you are authorizing the preparer to: |

|

LINE 17 - CLAIM FOR REFUND |

|

l Give the Department any information missing from your return, |

|

|

l Call the Department for information about the processing of |

||

Where the federal or New York State change would result in a |

|||

refund, Form |

your return or the status of your refund or payment(s), and |

||

l Respond to certain notices that you have shared with the |

|||

it is accompanied by a complete copy of the federal and/or New |

preparer about math errors, offsets, and return preparation. |

||

York State Audit Report or Statement of Adjustment. |

|

||

|

The notices will not be sent to the preparer. |

||

|

|

||

Effective for taxable years beginning on or after January 1, 1989, if |

You are not authorizing the preparer to receive any refund check, |

||

this report is not filed within 90 days after the notice of the final |

bind you to anything (including any additional tax liability), or oth- |

||

federal (or New York State) determination, no interest on the |

erwise represent you before the Department. The authorization |

||

resulting refund will be paid. |

|

cannot be revoked, however, the authorization will automatically |

|

|

|

||

LINE 18 - INTEREST |

|

expire no later than the due date (without regard to any extensions) |

|

|

for filing next year's return. Failure to check the box will be |

||

Enter at Line 18, Column A, interest owed on the additional tax due |

|||

deemed a denial of authority. |

|||

at the applicable prescribed interest rate or rates from the due date |

|

||

Form Characteristics

| Fact Name | Description |

|---|---|

| Form Purpose | The NYC 3360 form is used to report changes in the tax base for corporations following adjustments made by the IRS or New York State Department of Taxation and Finance. |

| Filing Deadline | This form must be filed within 90 days of a final determination, or 120 days for a combined group, for tax years beginning before January 1, 2015. |

| Governing Law | The form is governed by Title 11, Chapter 6 of the Administrative Code of the City of New York. |

| Payment Methods | Payments can be made online through the NYC Department of Finance website or via check or money order, accompanied by form NYC-200V. |

| Tax Calculation | The form includes calculations for general corporation tax based on net income, capital, and alternative tax bases. |

| Minimum Tax | For tax years beginning in or after 2009, the minimum tax is based on NYC gross receipts, with specific amounts outlined for different revenue thresholds. |

| Certification Requirement | The form must be certified by an elected officer of the corporation, affirming that the information provided is true and complete. |

More PDF Templates

Poa Affidavit - Promotes transparency and accountability in the delegation of financial decisions on behalf of pensioners.

Acp5 Form - The link provided for voter registration at the end of the form highlights the city’s commitment to encouraging civic participation among its residents.

Forms Construction - Critical for ensuring the electrical code reflects current technologies, practices, and safety protocols relevant to NYC's landscape.