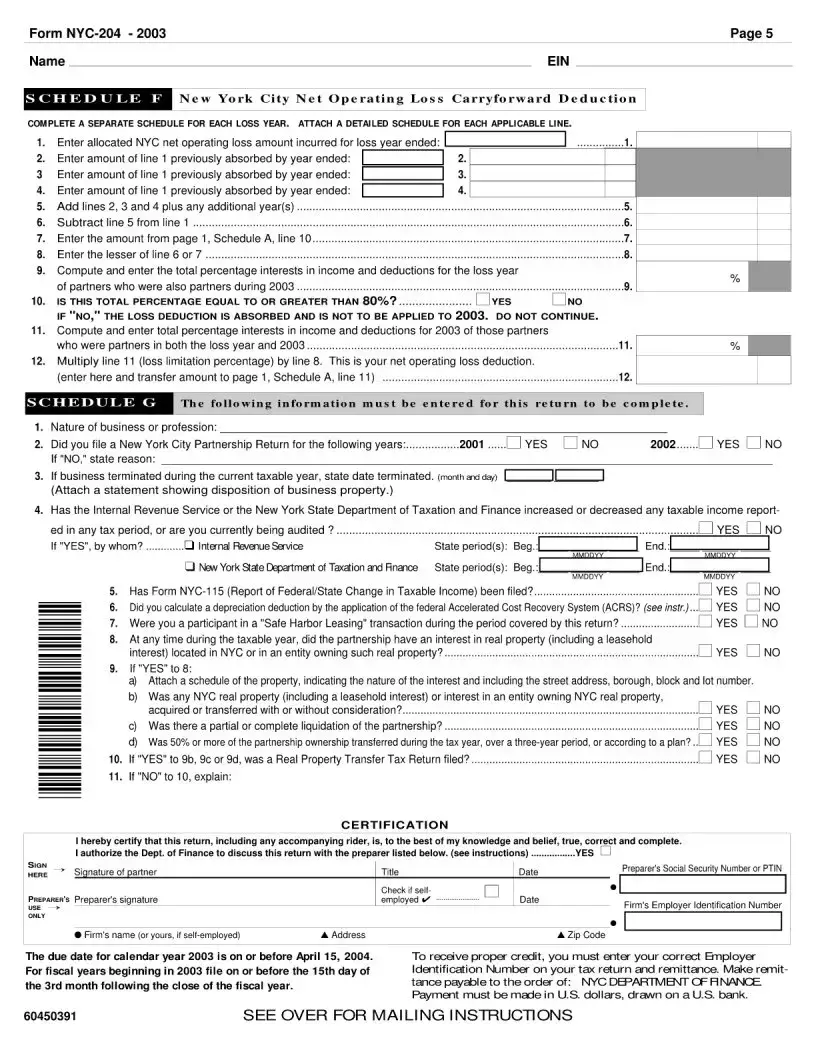

Fillable Nyc 204 Form in PDF

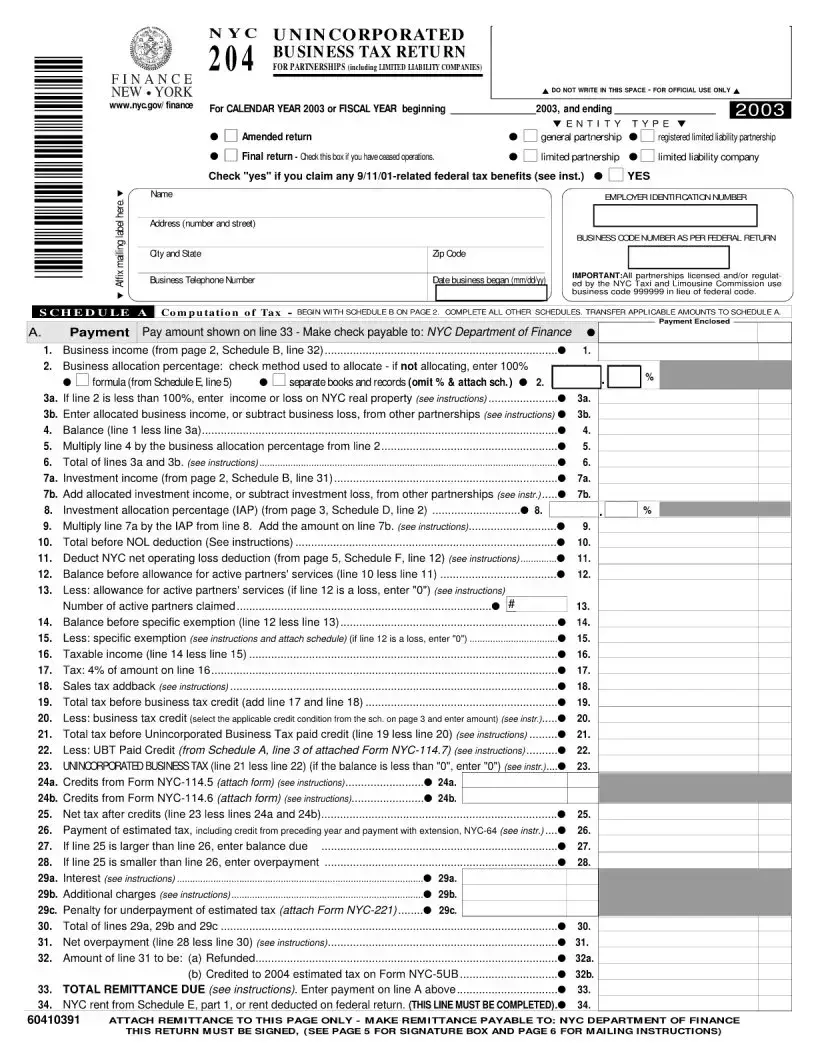

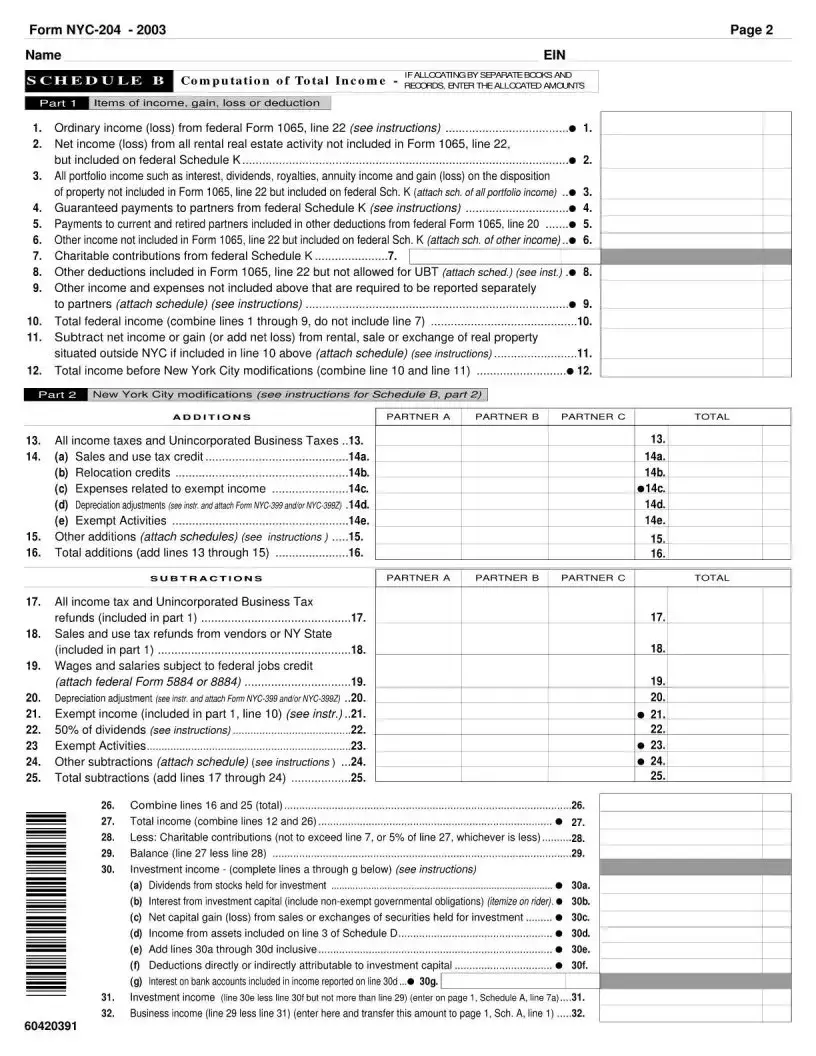

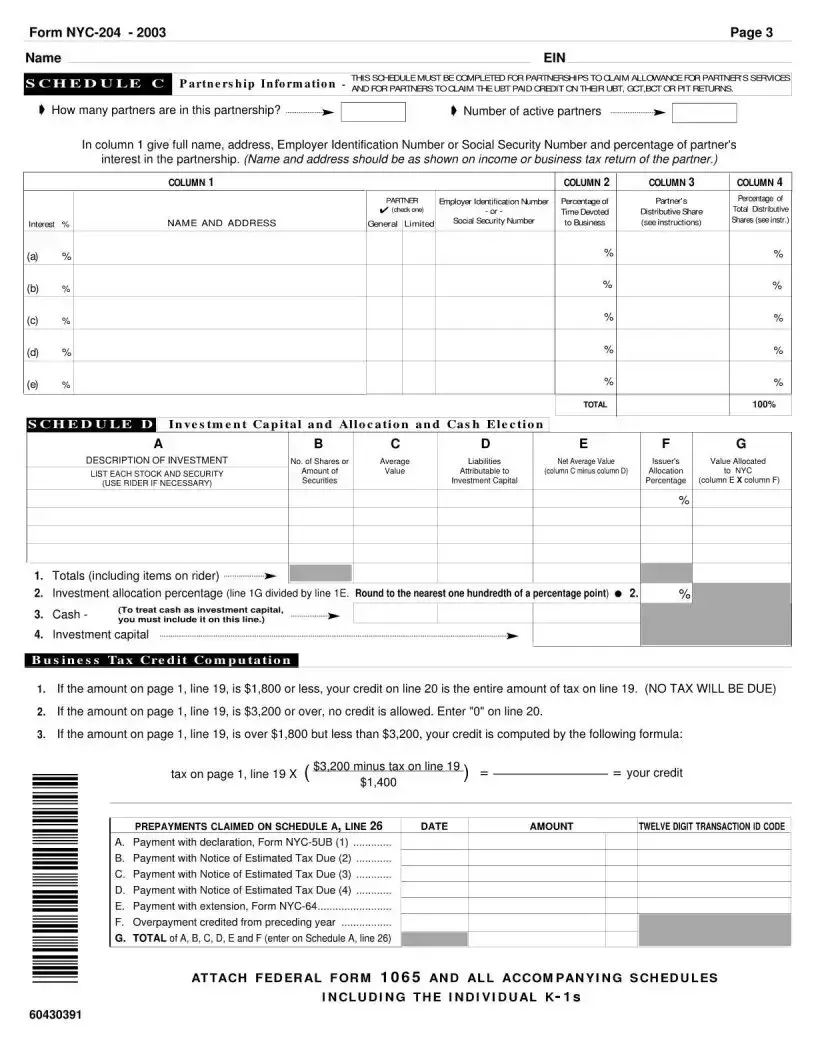

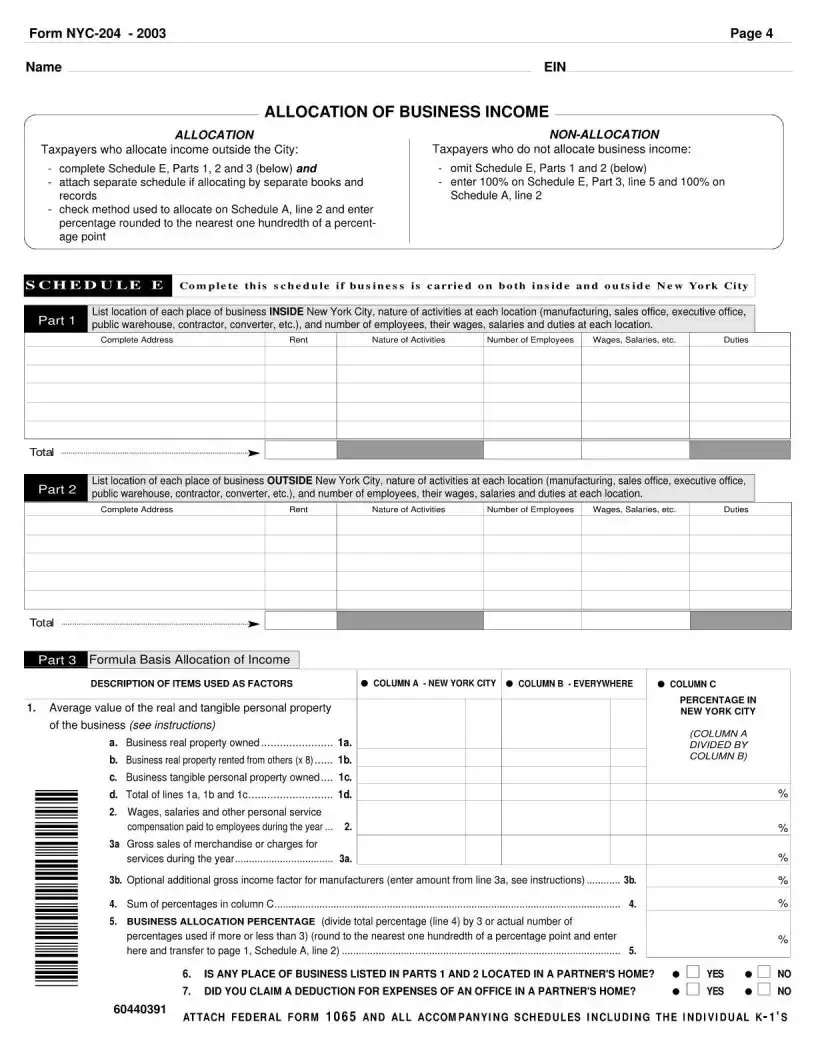

The NYC 204 form is a crucial document for partnerships and limited liability companies operating in New York City. Designed for the Unincorporated Business Tax (UBT) return, it provides a structured way for businesses to report their income, deductions, and tax liabilities. This form requires information such as the entity type, business income, and allocation percentages, ensuring that businesses accurately calculate their taxable income. It also includes sections for investment income and various deductions, like the allowance for active partners’ services. Additionally, the form addresses potential tax credits and estimated tax payments, making it essential for compliance with local tax regulations. Understanding the NYC 204 form is vital for any partnership or LLC to navigate the complexities of business taxation in New York City effectively.

Preview - Nyc 204 Form

Form Characteristics

| Fact Name | Details |

|---|---|

| Form Title | NYC 204 Unincorporated Business Tax Return for Partnerships |

| Applicable Entities | General partnerships, limited partnerships, limited liability partnerships, and limited liability companies |

| Filing Period | For calendar year 2003 or fiscal year beginning in 2003 |

| Governing Law | New York City Administrative Code, Title 11, Chapter 1 |

| Tax Rate | 4% of taxable income reported on the return |

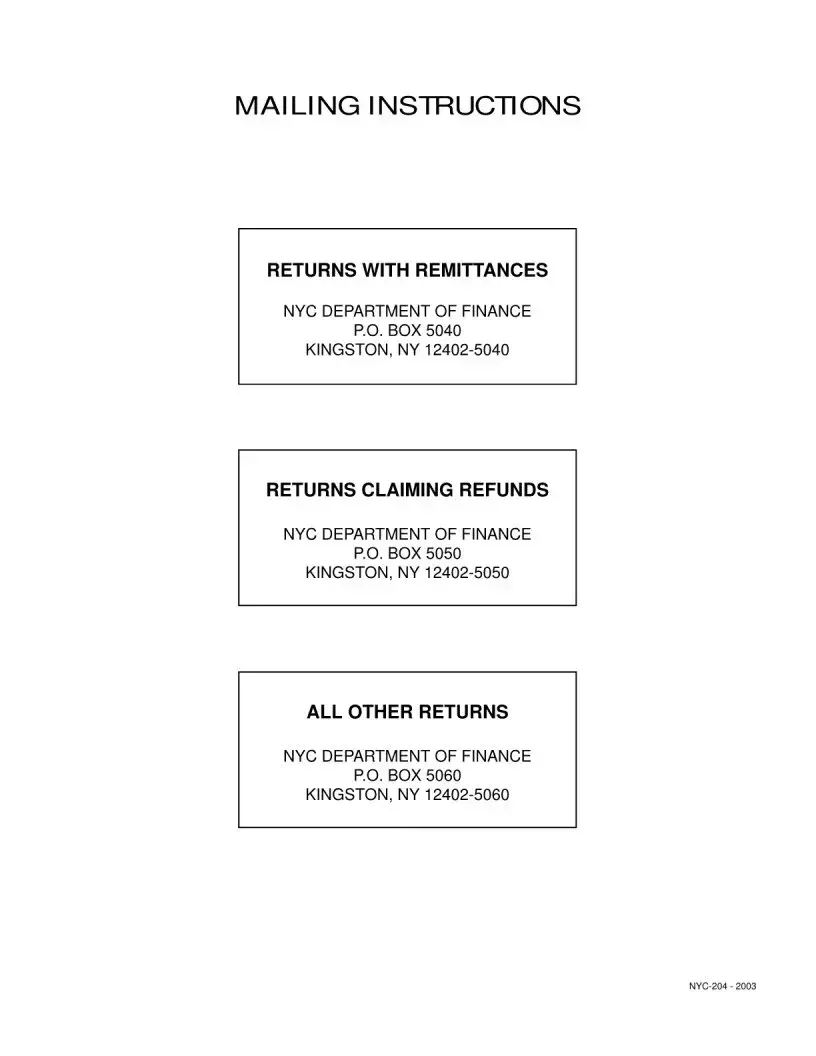

| Payment Instructions | Make checks payable to NYC Department of Finance |

| Amended Returns | Check the box if submitting an amended return |

| Signature Requirement | The return must be signed before submission |

More PDF Templates

Local Law 31 Nyc - Provides a platform for immediate action to update or cancel banking information for direct deposit purposes.

Seaportal - The form plays a key role in supporting the state's objective of reducing unemployment and enhancing workforce development.

Gen 215b - Overview of the necessary procedures for the approval, installation, and annual inspection of backflow prevention devices by the NYC DEP.