Fillable Nyc 202 Form in PDF

The NYC-202 form is essential for individuals and single-member LLCs engaged in unincorporated business activities within New York City. This form serves as the Unincorporated Business Tax Return for the calendar year 2021, requiring detailed information about the business's financial activities and tax obligations. Taxpayers must provide their name, business address, and contact information, along with crucial dates marking the beginning and end of their business operations in NYC. The form also includes sections for reporting income, deductions, and tax credits, ensuring that businesses comply with local tax regulations. Additionally, it requires taxpayers to indicate if they are submitting an amended return or if they have ceased operations. Completing the NYC-202 accurately is vital for avoiding penalties and ensuring proper tax assessment. Timely submission is crucial, as the due date for the 2021 return is April 18, 2022, with specific instructions for fiscal year filers. Understanding the requirements and deadlines associated with this form can significantly impact a business's financial standing and compliance status.

Preview - Nyc 202 Form

Estates and Trusts using an EIN as their primary identifier must use Form |

|

|

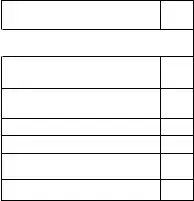

UNINCORPORATED BUSINESS TAX RETURN 2022

FOR INDIVIDUALS AND

For CALENDAR YEAR 2022 beginning ___________________________ and ending ____________________________

*60212291*

First name and initial |

|

Last name |

|

Name |

n |

|

|

|

|

|

|

Change |

|

|

|

|

|

|

|

|

In Care Of |

|

|

|

|

|

|

|

|

|

|

|

|

|

Business name |

|

|

|

|

|

|

|

|

|

|

|

|

|

Business address (number and street) |

|

Address |

n |

|||

|

|

|

|

|

Change |

|

|

|

|

|

|

|

|

City and State |

|

|

Zip Code |

|

Country (if not US) |

|

|

|

|

|

|

|

|

Business Telephone Number |

Date business began in NYC |

Date business ended in NYC |

||||

|

|

|

|

|

|

|

TAXPAYER’S EMAIL ADDRESS

SOCIAL SECURITY NUMBER

BUSINESS CODE NUMBER

FROM FEDERAL SCHEDULE C:

APPLY |

n ndedreturn |

If the purpose of the amended return is to report a |

n |

IRS change |

Date of Final |

|

||

|

|

|

Determination |

|

||||

|

federal or state change, check the appropriate box: |

nNYS change |

|

|||||

THAT |

n inalreturn |

Check this box if you have ceased operations in NYC. Attach copy of your entire federal Form 1040 and statement showing disposition of business property. |

||||||

ALL |

||||||||

n Engaged in a fully exempt unincorporated business activity |

|

n Engaged in a partially exempt unincorporated business activity |

|

|||||

CHECK |

|

|

||||||

n laianlatedfederaltaxbenefitseinstructin |

s |

nn ter‑characterspecialcnditincdeifapplicableeinstru |

ctins |

|||||

|

|

|

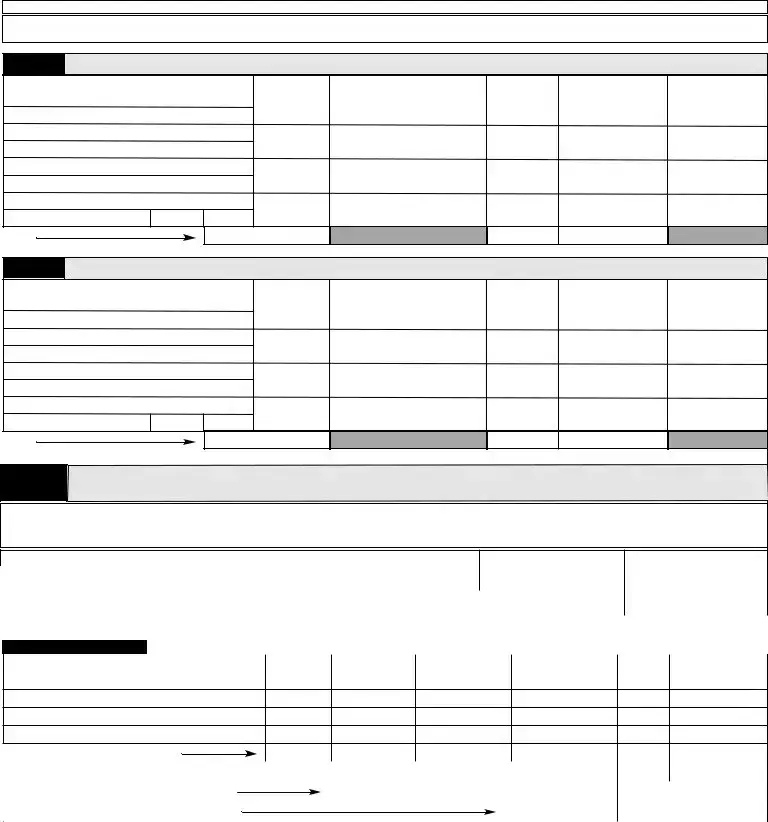

SCHEDULE A |

Computation of Tax |

BEGIN WITH SCHEDULE B ON PAGE 3. COMPLETE ALL OTHER SCHEDULES. TRANSFER APPLICABLE AMOUNTS TO SCHEDULE A. |

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Payment Amount |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Payment |

Amount being paid electronically with this return |

...................................................................... |

|

A. |

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

1. |

sinessincrpageScheduleline |

|

|

|

|

|

1. |

________________________________ |

|

|

||||||

|

2. |

ntentinalltted |

|

|

|

|

|

|

2. |

________________________________ |

|

||||||

|

3. |

fbusinessallcatinpercentagefrSchedulePartine |

|

islessthan |

|

|

|

|

|

|

|

||||||

|

|

|

enterincrlssnNYrealprpert |

|

(see instructions) |

|

|

|

3. |

________________________________ |

|

|

|||||

|

4. |

lanceinelessline |

|

|

|

|

|

|

4. |

________________________________ |

|

|

|||||

|

5. |

MultiplinebthebusinessallcatinpercentagefrSched |

|

ulePartine |

|

5. |

________________________________ |

|

|

||||||||

|

6. |

untfrlineYrealprpertincandgainntsubject |

|

|

tallcatin |

(see instructions) |

6. |

________________________________ |

|

|

|||||||

|

7. |

nvestntincrpageScheduleline |

|

|

|

|

|

7. |

________________________________ |

|

|

||||||

|

8. |

ntentinalltted |

|

|

|

|

|

|

8. |

________________________________ |

|

||||||

|

9. |

MultiplinebtheinvestntallcatinpercentagefrSch |

|

eduleine |

(see instructions) |

9. |

________________________________ |

|

|

||||||||

|

10. |

talbefreNdeductinflinesand |

|

(see instructions) |

10. |

________________________________ |

|

|

|||||||||

|

11. |

eductNYnetperatinglssdeductinrrNY |

|

|

|

line |

(see instructions) |

11. |

________________________________ |

|

|

||||||

|

12. |

lancebefreallwancefrtaxpar’sservicesinelessline |

|

|

|

12. |

________________________________ |

|

|

||||||||

|

13. |

essallwancefrtaxpar’sservicesdntenterrethan |

|

fliner$ |

|

|

|

|

|

|

|

||||||

|

|

|

whicheverisless |

(see instructions) |

|

|

|

|

|

13. |

________________________________ |

|

|

||||

|

14. |

lancebefreexetininelessline |

|

|

|

|

|

14. |

________________________________ |

|

|

||||||

|

15. |

essexetin$axparperatingrethannebusin |

|

|

essrshrtperid |

|

|

|

|

|

|

|

|||||

|

|

|

taxpar |

see instructions) |

|

|

|

|

|

15. |

________________________________ |

|

|

||||

|

16. |

axableincinelessline |

(see instructions) |

|

|

|

16. |

________________________________ |

|

|

|||||||

|

17. |

axbefrebusinesstaxcreditfauntnline |

|

|

|

|

|

17. |

________________________________ |

|

|

||||||

|

18. |

essbusinesstaxcreditlecttheapplicablecreditcnditin |

|

frthesinessaxredit |

|

|

|

|

|

|

|||||||

|

|

|

utatinschedulenthebttfpageandentera |

|

|

unt |

(see instructions) |

|

18. |

________________________________ |

|

|

|||||

|

19. |

NNRPRSNinelessline |

|

|

(see instructions) |

|

19. |

________________________________ |

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

60212291 |

|

THIS RETURN MUST BE SIGNED. (SEE PAGE 5 FOR SIGNATURE BOX AND MAILING INSTRUCTIONS.) |

|

NY |

||||||||||||

Form

Name ___________________________________________________________________________ SSN _________________________________________

20a.RreditttachNY |

|

|

20a. |

|

|

|

|

|

|

|

||||||||||

20b.RealateaxlatinlntpprtunitRelcatin |

|

|

|

|

|

|

|

|

|

|

||||||||||

|

stsandreditsttachNY |

|

|

20b. |

|

|

|

|

|

|

|

|||||||||

20c.MRreditttachNY |

|

|

20c. |

|

|

|

|

|

|

|

||||||||||

20d.ntentinallleftblan |

|

|

20d. |

|

|

|

|

|

|

|

||||||||||

20e.erPrductinreditttachNY |

|

|

20e. |

|

|

|

|

|

|

|

||||||||||

21. |

Nettaxaftercreditsinelesssuflinesathrugh |

e |

21. |

|

|

|

||||||||||||||

22. |

Pantfestitednincrpratedsinessax |

|

|

includingcarrvercreditfr |

|

|

|

|

|

|||||||||||

|

precedingarandpantwithextensinNY |

(see instructions) |

22. |

|

|

|

||||||||||||||

23. |

flineislargerthanlineenterbalancedue |

|

|

|

23. |

|

|

|

||||||||||||

24. |

flineissllerthanlineenterverpant |

|

|

|

|

|

24. |

|

|

|

||||||||||

25a.nteresteinstructins |

|

|

25a. |

|

|

|

|

|

|

|

||||||||||

25b.ditinalchargeseinstructins |

|

|

25b. |

|

|

|

|

|

|

|

||||||||||

25c.Penaltfrunderpantfestitedtax |

|

ttachfrNY |

25c. |

|

|

|

|

|

|

|

||||||||||

26. |

talflinesabandc |

|

|

|

|

|

26. |

|

|

|

||||||||||

27. |

Netverpantinelessline |

(see instructions) |

|

|

|

27. |

|

|

|

|||||||||||

28. |

untflinetbeRefunded |

n irectdepsit |

fill out line 28c OR |

n Paperchec 28a. |

|

|

||||||||||||||

|

|

|

|

|

|

|

reditedtitedaxnrNY |

|

|

|

|

28b. |

|

|

|

|||||

28c. |

Routing |

|

|

|

|

|

|

|

|

|

Account |

|

|

|

|

ACCOUNT TYPE |

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

Number |

|

|

|

|

|

|

|

|

|

Number |

|

|

|

Checking n Savings n |

|

|

|||

29. |

Total remittance due (see instructions) |

|

|

|

29. |

|

|

|

||||||||||||

30. |

NYrentdeductednfederaltaxreturnrNYrentfrSchedule |

Part |

30. |

|

|

|

||||||||||||||

31. |

rssreceiptsrsalesfrfederalreturn |

|

|

|

|

|

31. |

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Business Tax Credit Computation

*60222291*

1. |

ftheauntnpagelineis$rlessur |

|

3. ftheauntnpagelineisver$butle |

|

ssthan |

||||

|

|

||||||||

|

creditnlineistheentireauntftaxnline |

|

$urcreditiscutedbthefllwingfrla |

|

|

|

|||

|

W |

|

|

auntnpgline |

X |

$nustaxnline |

|

_______ |

|

|

|

|

|

|

|

||||

2. |

ftheauntnpagelineis$rvern |

|

|

|

$ |

urcredit |

|

||

|

creditisallwedter“”nline |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Prepayments of Estimated Tax Computation |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

PREPAYMENTS CLAIMED ON SCHEDULE A, LINE 22 |

|

|

|

DATE |

AMOUNT |

|||

PantwithdeclaratinrNY

PantwithNticefitedaxue

PantwithNticefitedaxue

PantwithNticefitedaxue

PantwithextensinrNY

verpantcreditedfrprecedingar

G.TOTAL fnternScheduleline

60222291

|

Form |

|

Page 3 |

||

|

Name ___________________________________________________________________________ |

SSN _________________________________________ |

|||

|

|

|

|

|

|

|

SCHEDULE B |

Computation of Total Income |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Part |

tefbusinessincgainlssrdeductin |

|

|

|

1. |

Netprfitrlssfrbusinessfarngrprfessinsasreprtedf |

rfederaltaxpurpsesfr |

|

||||

|

federalSchedulerr |

|

(see instructions) |

|

|

1. |

|

2. |

fenteringincfrrethannefederalSchedule |

|

rrchecthisbx |

|

2. |

||

|

terthenuerfSchedulesrattached |

|

➧ |

|

|

|

|

|

|

|

|

|

|||

3. |

ainrlssfrsalefbusinesspersnalprpertrbusinessreal |

prpert |

(attach federal |

|

|||

|

Schedule D or Form 4797) (see instructions) |

|

|

3. |

|||

4. |

Netauntfrentalrrltincfrbusinesspersnalprpe |

|

rtrbusinessrealprpert |

|

|||

|

(attach federal Schedule E) (see instructions) |

|

|

4. |

|||

5. |

therbusinessincrlss |

(attach schedule) (see instructions) |

|

5. |

|||

6. |

talfederalincrlssinelinesthrugh |

|

|

|

|

6. |

|

7. |

Subtractnetincrgainraddnetlssfrrentalsaler |

|

exchangefrealprpert |

|

|||

|

situatedutsideNewYritifincludedinliner |

abve |

(attach schedule) (see instructions) |

7. |

|||

8. |

talincbefreNewYritdificatinsinelines |

|

and |

|

8. |

||

|

|

|

|

|

|

||

Part |

|

NewYritdificatinseinstructinsfrSchedulepart |

|

|

|

||

n

ADDITIONS |

|

|

|

|

|

|

|

|

|

|

|

|||

9. |

linctaxesandnincrpratedsinessaxes |

|

|

|

|

|

9. |

|

|

|||||

10a.Relcatincredits |

|

|

|

|

|

|

|

|

10a. |

|

|

|||

10b.ensesrelatedtexetinc |

|

|

|

|

|

|

|

10b. |

|

|

||||

10c.epreciatinadjustnts |

|

(attach Form |

10c. |

|

|

|||||||||

10d.Realestateadditins |

(see instructions) |

|

|

|

|

10d. |

|

|

||||||

11. |

theradditins |

(attach schedule) (see instructions) |

|

|

|

11. |

|

|

||||||

12. |

taladditinsddlinesthrugh |

|

|

|

|

|

|

12. |

|

|

||||

SUBTRACTIONS |

|

|

|

|

|

|

|

|

|

|

||||

13. |

linctaxandnincrpratedsinessaxrefundsncludedin |

|

|

part |

13. |

|

|

|||||||

14. |

Wagesandsalariessubjecttfederaljbscredit |

(see instructions |

|

|

14. |

|

|

|||||||

15. |

epreciatinadjustnt |

|

(attach Form |

|

|

15. |

|

|

||||||

16. |

tincincludedinpart |

|

(attach schedule) |

|

|

|

16. |

|

|

|||||

17. |

fdividends |

(see instructions) |

....................................................................................................... |

|

|

|

17. |

|

|

|||||

|

|

|

|

|

|

|

||||||||

18. |

Realestatesubtractins |

|

(see instructions) |

|

|

|

18. |

|

|

|||||

19. |

thersubtractins |

(attach schedule) (see instructions) |

|

|

|

19. |

|

|

||||||

20. |

talsubtractinsddlinesthrugh |

|

|

|

|

|

20. |

|

|

|||||

21. |

NYdificatinsinelinesand |

|

|

|

|

|

|

21. |

|

|

||||

22. |

talincinelinesand |

|

|

|

|

|

|

|

22. |

|

|

|||

23. |

essharitablecntributinsttexceedfline |

|

|

(see instructions) |

23. |

|

|

|||||||

24. |

lance |

inelessline |

|

|

|

|

|

|

|

24. |

|

|

||

25. |

nvestntincletelinesathrughgbelw |

|

|

(see instructions) |

|

|

|

|||||||

|

(a) |

ividendsfrstcheldfrinvestnt |

|

|

|

|

|

25a. |

|

|

||||

|

(b) |

nterestfrinvestntcapitalncludennxetgvernntal |

|

|

bligatins |

|

|

|

||||||

|

|

(itemize on rider) |

|

|

|

|

|

25b. |

|

|

||||

|

(c) |

Netcapitalgainssfrsalesrexchangesfsecuritiesheldf |

|

rinvestnt |

25c. |

|

|

|||||||

|

(d) |

ncfrassetsincludednlinefSchedule |

|

|

|

|

25d. |

|

|

|||||

|

(e) |

dlinesathrughdinclusive |

|

|

|

|

|

25e. |

|

|

||||

|

(f) |

eductinsdirectlrindirectlattributabletinvestntinc |

|

|

|

25f. |

|

|

||||||

|

(g) |

nterestnbanaccuntsincludedinincreprtednline |

|

d |

25g. |

|

|

|

|

|||||

26. |

nvestntinc |

ineelesslinef |

nternpageSchline |

|

|

|

26. |

|

|

|||||

27. |

BUSINESS INCOME inelessline |

nterhereandtransferaunttpgSchline |

|

..................................... |

27. |

|

|

|||||||

|

|

|

|

|||||||||||

*60232291* 60232291

Form |

Page 4 |

Name ___________________________________________________________________________ |

SSN _________________________________________ |

SCHEDULE C

Locations of Places of Business Inside and Outside New York City

Locations of Places of Business Inside and Outside New York City

All taxpayers must complete Schedule C, Parts 1 and 2.

Part

catinfreachplacefbusinessNSNewYriteinstructinsattachriderifnecessar

|

letedress |

|

Rent |

Naturefivities |

Nfles |

WagesSalariesc |

uties |

|

|

|

|

|

|

|

|

|

|

NM |

SR |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Y |

|

S |

ZP |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NM |

SR |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Y |

|

S |

ZP |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NM |

SR |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Y |

|

S |

ZP |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NM |

SR |

|

|

|

|

|

|

|

Y |

|

S |

ZP |

|

|

|

|

|

tal |

Part

catinfreachplacefbusinessSNewYriteinstructinsattachriderifnecessar

|

letedress |

|

Rent |

Naturefivities |

Nfles |

WagesSalariesc |

uties |

|

|

|

|

|

|

|

|

|

|

NM |

SR |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Y |

|

S |

ZP |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NM |

SR |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Y |

|

S |

ZP |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NM |

SR |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Y |

|

S |

ZP |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NM |

SR |

|

|

|

|

|

|

|

Y |

|

S |

ZP |

|

|

|

|

|

tal |

Part

SingleReceiptsactrsinesslcatinPercentage Taxpayers must report their Business Allocation Percentage in this schedule for this return to be accepted.

Taxpayers who do not allocate business income outside New York City must enter 100% on Schedule C, Part 3, line 2. Taxpayers who allocate business income both inside and outside New York City must complete Schedule C, Part 3.

DESCRIPTION OF ITEM USED AS FACTOR

COLUMN A - NEW YORK CITY

COLUMN B - EVERYWHERE

|

1. Gross sales of merchandise or charges for services during the year |

|

|

1. |

|

|

|

|

|

|

|

|

|

|

|

|||||

|

2. BusinessAllocationPercentage(line 1a divided by line 1b rounded to the nearest hundredth of a percent). |

............................................................................. |

|

|

2. |

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SCHEDULE D |

Investment Capital and Allocation and Cash Election |

|

|

|

|

|

|

|

|

|||||||||

|

|

A |

|

|

|

B |

C |

D |

|

E |

|

|

|

F |

|

G |

||||

|

|

RPNNVM |

|

|

|

NfSharesr |

verage |

|

iabilitiestributable |

|

NetverageValue |

|

|

ssuerlcatin |

ValuelcatedtNY |

|

||||

|

|

|

|

|

|

untfSecurities |

Value |

|

tnvestntapital |

|

lunusclu |

|

|

Percentage |

lu |

xclu |

|

|||

|

|

SHSKSRYSRNY |

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1. |

talsncludingitenrider |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2. |

nvestntallcatinpercentage |

inedividedbline |

round to the nearest hundredth of a percent |

|

|||||

3. |

ash |

(To treat cash as investment capital, |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

you must include it on this line.) |

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

||

4. |

nvestntcapitaltalflinesand |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

*60242291*

60242291

ATTACH FEDERAL SCHEDULE C, SCHEDULE

Form |

|

Page 5 |

|

Name ___________________________________________________________________________ |

SSN _________________________________________ |

||

|

|

|

|

|

SCHEDULE E |

If you are taking a Net Operating Loss Deduction this year, please attach |

|

|

Form |

|

|

|

|

|

|

|

|

|

|

SCHEDULE F

The following information must be entered for this return to be complete. (See Instructions)

The following information must be entered for this return to be complete. (See Instructions)

1.Naturefbusinessrprfessin _________________________________________________ ____________________________________

2. |

NewYrStateSalesaxNuer |

_________________________________________ |

|

|

|

|

|||

3. |

idufileaNewYritnincrpratedsinessaxReturn |

frthefllwingars |

|

|

|

|

|||

|

2020: n Y |

n N |

2021: n Y |

n N |

|

|

|

|

|

|

f“N”statereasn |

__________________________________________________ ____________________________________________ |

|||||||

4. |

terhaddress |

__________________________________________________ ________________________ |

Zipde___________ |

||||||

5. |

fbusinessternatedduringthecurrenttaxablearstated |

ateternatedd |

|

||||||

|

tachastatentshwingdispsitinfbusinessprpert |

|

|

|

|

|

|

||

6. |

HasthenternalRevenueServicertheNewYrStateepartn |

tfaxatinandinanceincreasedrdecreasedantaxablei |

ncss |

|

|||||

|

reprtedinantaxperidrareucurrentlbeingaudited |

|

n Y |

n N |

|

|

|

||

|

fbwh |

|

n Internal Revenue Service |

|

Stateperidg________________ |

|

d________________ |

||

|

|

|

|

|

|

MM |

YY |

MM |

YY |

|

|

|

n New York State Department of Taxation and Finance |

Stateperidg________________ |

|

d________________ |

|||

|

|

|

|

|

|

MM |

YY |

MM |

YY |

7.f“Ytquestin

7a. rarsprirthasrNYeprtfederalSt |

|

|

|

atehangeinaxablencbeenfiled |

|

|

|

|

|

|

|

|

|

|

|

|

n Y |

n N |

|||||||||||||||||||||||

7b. rarsbeginningnrafterhasanandedreturn |

|

beenfiled |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

n Y |

n N |

|||||||||||||||||||||||

8. |

iducalculateadepreciatindeductinbtheapplicati |

|

nfthefederalleratedstRecverSeRS |

|

|

(see instr.) |

n Y |

n N |

|||||||||||||||||||||||||||||||||

9. |

Wereuaparticipantina“SafeHarbreasing”transactindu |

ringtheperidcveredbthisreturn |

|

|

|

|

|

|

|

|

|

|

|

|

n Y |

n N |

|||||||||||||||||||||||||

10.esthistaxparparentgreaterthan$franprese |

|

|

|

sinNYinthebrughfManhattansuthf |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

thStreetfrthepurpsefcarrngnantradebusinessp |

rfessinvcatinrcrcialactivit |

|

|

|

|

|

|

|

|

|

|

|

|

|

n Y |

n N |

|||||||||||||||||||||||

11. fwereallrequiredrcialRentaxReturnsfiled |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

n Y |

n N |

||||||||||||||||||||

|

|

PleaseenterlrdentificatinNuerrScialSecuritNuer |

|

whichwasusednthercialRentaxReturn |

__________________________ |

||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

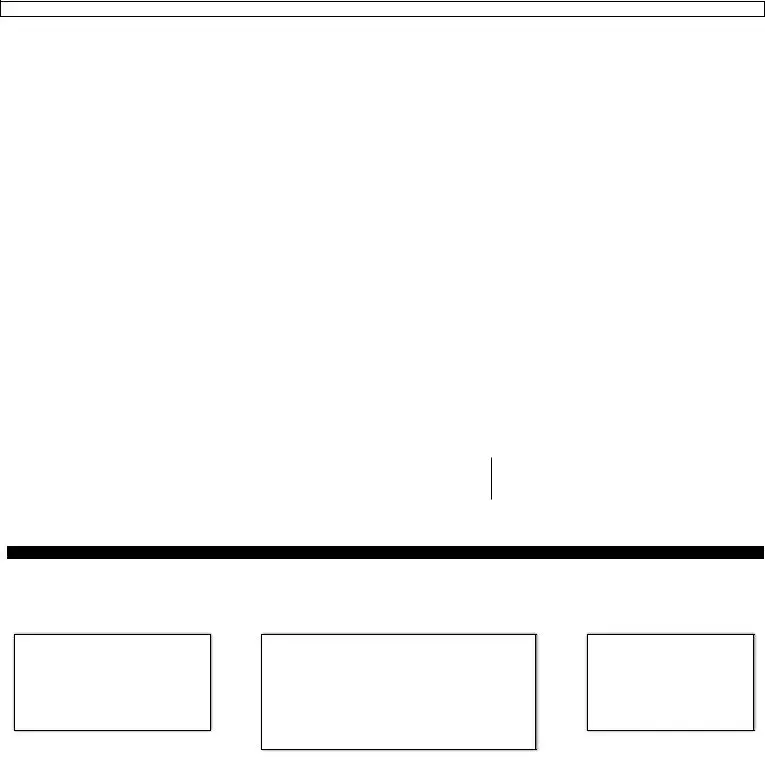

CERTIFICATION |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

I hereby certify that this return, including any accompanying rider, is, to the best of my knowledge and belief, true, correct and complete. |

irsildress |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

|

I authorize the Dept. of Finance to discuss this return with the preparer listed below. (See instructions) ......YES n |

_______________________________________ |

|||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SIGN |

|

|

Signatureftaxpar |

|

|

|

itle |

|

ate |

|

PreparersScialSecuritNuerrPN |

|

|

|

|

|

|

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||

|

HERE: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

PREPARER'S |

|

PreparersPreparer’s |

|

|

|

|

|

hecifself |

|

n |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

USE |

’ |

|

|

signatureprinted |

|

na |

ate |

|

✔ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

ONLY |

|

|

|

|

eld |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

irlrdentificatinNuer |

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

s irsna |

rursifselfld |

s dress |

|

|

|

|

|

s Zipde |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MAILING INSTRUCTIONS

Attach copy of federal Form 1040, Schedule C, Schedule

To receive proper credit, you must enter your correct Social Security Number on your tax return and remittance.

The due date for the calendar year 2022 return is on or before April 18, 2023.

For fiscal years beginning in 2022, file on or before the 15th day of the fourth month following the close of the fiscal year.

ALLRETURNSEXCEPTREFUNDRETURNS

NYMN

NNRPRSN

PX

NHNNY

REMITTANCES

PAY ONLINE WITH FORM

AT NYC.GOV/ESERVICES

OR

Mail Payment and Form

NYMN

PX

NYRKNY

RETURNSCLAIMINGREFUNDS

NYMN

NNRPRSN

PX

NHNNY

*60252291* 60252291

Form Characteristics

| Fact Name | Details |

|---|---|

| Form Purpose | Form NYC-202 is used for reporting unincorporated business taxes for individuals and single-member LLCs. |

| Tax Year | This form is specifically for the calendar year 2021. |

| Filing Deadline | The return is due on or before April 18, 2022. |

| Governing Law | The form is governed by the New York City Administrative Code. |

| Primary Identifier | Estates and trusts using an EIN must use Form NYC-202EIN. |

| Amended Returns | Taxpayers can file an amended return if they need to report a change from the IRS or New York State. |

| Signature Requirement | All returns must be signed to be valid. Instructions for signing are included on the form. |

More PDF Templates

Is Health and Welfare Pay Taxable - Detailed instructions accompany the form, guiding corporations through each step to ensure compliance and accuracy.

Department of Buildings Nyc - Ordinary plumbing tasks such as repairs, replacements, and installations outside the scope of major projects can be reported through this form, streamlining the documentation process for plumbers.