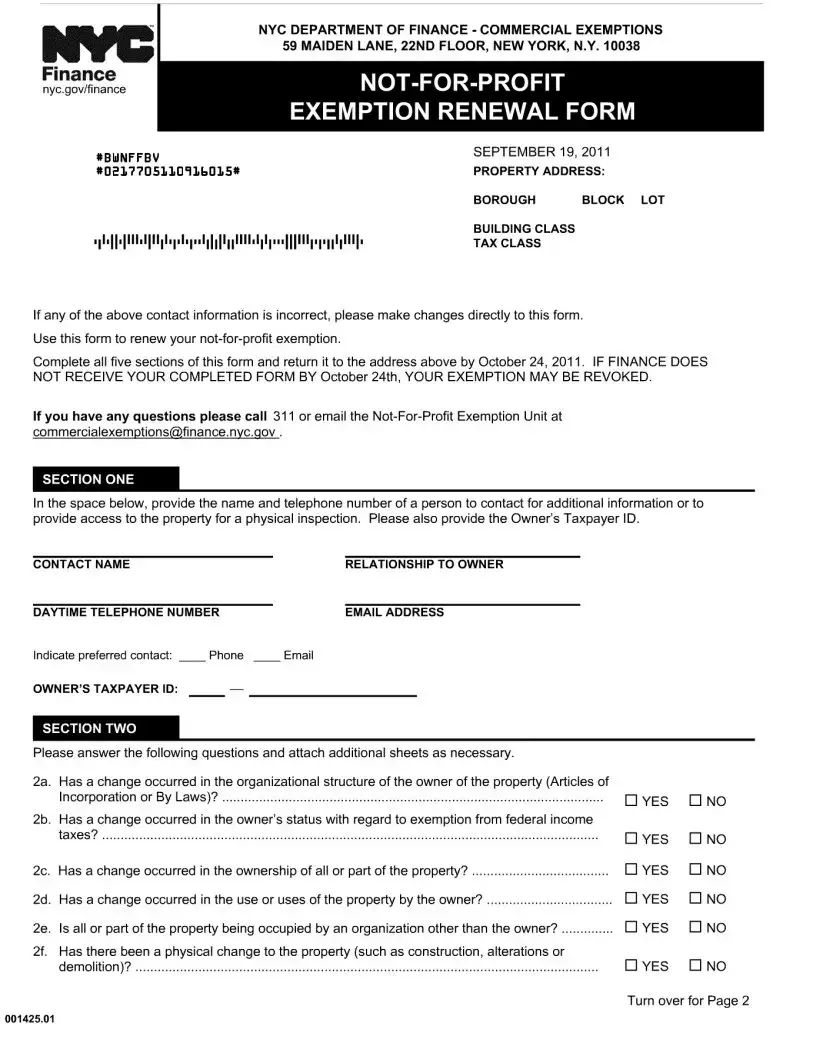

Fillable Non Profit Exemption Renewal Nyc Form in PDF

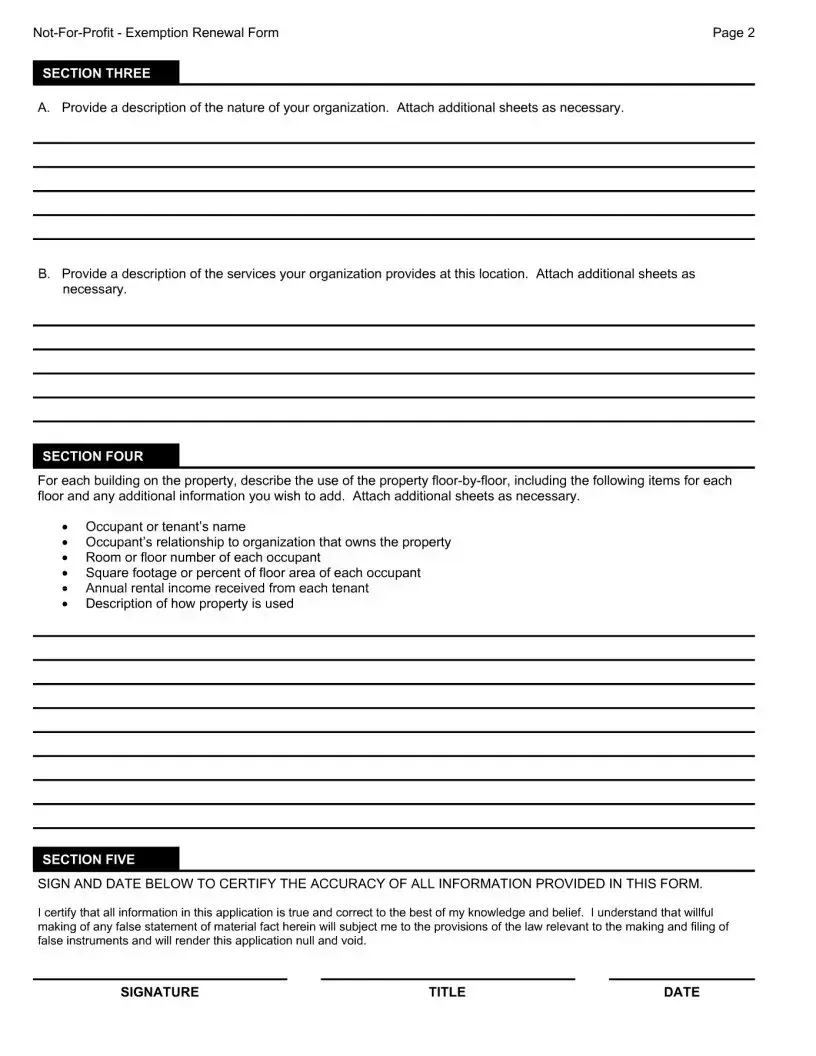

Renewing your not-for-profit exemption in New York City is an essential process for organizations seeking to maintain their tax benefits. The Non-Profit Exemption Renewal NYC form is a crucial document that must be completed accurately and submitted on time to avoid any disruption in your exemption status. This form consists of five distinct sections, each designed to gather important information about your organization and the property in question. You'll need to provide details such as the property address, borough, block, lot, and building class. Additionally, the form requires a point of contact for further inquiries, along with their telephone number and taxpayer ID. It’s important to disclose any changes in your organization’s structure, ownership, or property use, as these can impact your exemption eligibility. The renewal process also involves describing the services your organization offers and detailing how each building on the property is utilized. Lastly, a signature certifying the accuracy of the information provided is mandatory. Remember, submitting the completed form by the deadline is crucial; failure to do so may lead to the revocation of your exemption. For any questions, assistance is available through the city’s 311 service or by contacting the Not-For-Profit Exemption Unit directly.

Preview - Non Profit Exemption Renewal Nyc Form

Form Characteristics

| Fact Name | Fact Description |

|---|---|

| Purpose of Form | This form is used to renew the not-for-profit exemption for properties in New York City. |

| Submission Deadline | The completed form must be submitted by October 24, 2011, to avoid revocation of the exemption. |

| Contact Information | Applicants must provide a contact name, daytime telephone number, and taxpayer ID for the property owner. |

| Changes to Report | Applicants must disclose any changes in ownership, organizational structure, or property use. |

| Certification Requirement | Signatures are required to certify that all information provided is accurate and truthful. |

| Governing Law | The renewal process is governed by New York City’s tax exemption laws for not-for-profit organizations. |

More PDF Templates

What Is Lease Renewal - Mentions eligibility for reduced rent under the SCRIE or DRIE programs, subject to adjustments by these programs.

Nys Tax Exempt Form Hotel - Mandatory for government personnel to demonstrate their eligibility for tax exemption on lodging in New York State.