Fillable New York It 2659 Form in PDF

The New York IT-2659 form is an essential document for partnerships and S corporations operating in New York State. It specifically addresses the estimated tax penalties related to underpayment or nonpayment of taxes owed on behalf of partners and shareholders, particularly those who are nonresident individuals or corporations. When filing this form, entities must provide their legal name, trade name, address, and employer identification number. The form requires the completion of several schedules that guide filers through the computation of any penalties incurred due to insufficient estimated tax payments. Notably, the IT-2659 includes a section for detailing the estimated tax owed for the current and prior tax years, along with a method for calculating penalties based on underpayment. Timeliness is crucial, as the form must be filed by April 15 of the following year, or by the due date of the entity's tax return, including any extensions. Filers are advised to include their payment with the form, ensuring that they follow the instructions carefully to avoid additional penalties. Understanding the intricacies of this form can help partnerships and S corporations stay compliant and avoid unnecessary financial burdens.

Preview - New York It 2659 Form

New York State Department of Taxation and Finance |

|

||||

Estimated Tax Penalties for |

|

||||

|

|

|

|||

Partnerships and New York S Corporations |

|||||

(For underpayment or nonpayment of estimated tax required to be paid on behalf of |

|||||

partners and shareholders who are corporations or nonresident individuals) |

|

|

|

||

|

|

|

|

|

|

For calendar year 2012 or iscal year beginning |

|

|

and ending |

|

|

(See instructions, Form IT‑2659‑I, for assistance) |

|

|

|

|

|

|

|

|

|

||

Print or type

Legal name

Trade name of business if different from legal name above

Address (number and street or rural route)

City, village, or post ofice |

State |

ZIP code |

Employer identiication number

Type of entity (mark an X in the applicable box):

Partnership

S corporation

Complete Schedules A through D on pages 2, 3, and 4, as applicable, to compute your penalty.

Staple check or money order here.

Pay amount shown on page 4, line 52. Include only the line 52

amount in your check or money order, and make payable to: COMMISSIONER OF TAXATION AND FINANCE

Payment enclosed

.00

File Form IT‑2659 by the later of April 15, 2013, or the due date of the partnership

or S corporation tax return for the year determined with regard to any extension of time to ile).

Do not attach or ile Form IT‑2659 with any other form.

Paid preparer must complete (see instructions) |

Date: |

||

Preparer’s signature |

Preparer’s NYTPRIN |

||

|

|

|

|

|

|

|

|

Firm’s name (or yours, if |

Preparer’s PTIN or SSN |

|

|

|

|

|

|

Address |

Employer identiication number |

||

|

|

|

|

|

|

Mark an X if |

|

|

|

self‑employed |

|

E‑mail: |

|

|

|

Mail this form and payment to: NYS TAX DEPARTMENT -

ALBANY NY

Sign your return here

Signature of general partner or member, elected oficer, or authorized person

Date |

Daytime phone number |

( )

E‑mail:

069001120094

Page 2 of 4

Schedule A – Computation of estimated tax underpayment (if any). All ilers must complete this part. Only include partners and shareholders who are subject to estimated tax paid on their behalf by the partnership or New York S corporation (see instructions).

Current year

1Total of all nonresident individual partners’ or shareholders’ distributive

|

or pro rata shares of 2012 income earned from New York sources.... |

1 |

|

.00 |

|

|

2 |

Total of all nonresident individual partners’ or shareholders’ shares of |

|

|

|

|

|

|

2012 partnership deductions allocated to New York (see instructions) |

2 |

|

.00 |

|

|

3 |

Subtract line 2 from line 1 |

3 |

|

.00 |

|

|

4 |

Individual tax rate (8.82%) |

4 |

|

.0882 |

|

|

5 |

Multiply line 3 by line 4 |

5 |

|

.00 |

|

|

6 |

Total of all nonresident individual partners’ or shareholders’ distributive |

|

|

|

|

|

|

or pro rata shares of 2012 partnership or S corporation credits |

6 |

|

.00 |

|

|

7 |

2012 estimated tax required to be paid on behalf of nonresident individuals (subtract line 6 from line 5) |

............. 7 |

||||

8 |

Total of all corporate partners’ distributive shares of 2012 income earned from NY sources |

8 |

|

.00 |

|

|

9 |

Corporation tax rate (7.1%) |

9 |

|

.071 |

|

|

10 |

Multiply line 8 by line 9 |

10 |

|

.00 |

|

|

11 |

Total of all corporate partners’ distributive shares of 2012 partnership credits |

11 |

|

.00 |

|

|

12 |

2012 estimated tax required to be paid on behalf of corporations (subtract line 11 from line 10) |

|

12 |

|||

13 |

Total estimated tax required to be paid for 2012 (add lines 7 and 12) |

|

|

13 |

||

14 |

90% of the estimated tax required to be paid for 2012 (multiply line 13 by 90% (.90)) |

14 |

||||

.00

.00

.00

.00

Prior year

15Total of all nonresident individual partners’ or shareholders’ distributive

|

or pro rata shares of 2011 income earned from New York sources .... |

|

15 |

|

.00 |

|

|

16 |

Total of all nonresident individual partners’ or shareholders’ shares of |

|

|

|

|

|

|

|

2011 partnership deductions allocated to New York (see instructions).. |

|

16 |

|

.00 |

|

|

17 |

Subtract line 16 from line 15 |

|

17 |

|

.00 |

|

|

18 |

Individual tax rate (8.97%) |

|

18 |

|

.0897 |

|

|

19 |

Multiply line 17 by line 18 |

|

19 |

|

.00 |

|

|

20 |

Total of all nonresident individual partners’ or shareholders’ distributive |

|

|

|

|

|

|

|

or pro rata shares of 2011 partnership or S corporation credits |

20 |

|

.00 |

|

|

|

21 |

2011 estimated tax computed for individuals (subtract line 20 from line 19) |

.......................................................... |

|

21 |

|||

22 |

Total of all corporate partners’ distributive shares of 2011 income earned from NY sources |

|

22 |

|

.00 |

|

|

23 |

Corporation tax rate (7.1%) |

|

23 |

|

.071 |

|

|

24 |

Multiply line 22 by line 23 |

|

24 |

|

.00 |

|

|

25 |

Total of all corporate partners’ distributive shares of 2011 partnership credits |

|

25 |

|

.00 |

|

|

26 |

2011 estimated tax computed for corporations (subtract line 25 from line 24) |

|

26 |

||||

27 |

Total estimated tax computed for 2011 (add lines 21 and 26) |

|

27 |

||||

|

If the sum of lines 17 and 22 is more than $150,000, and the entity is not primarily |

|

|

|

|||

|

engaged in farming or ishing, complete line 28 and continue with Schedule B. If the |

|

|

|

|||

|

sum of lines 17 and 22 is $150,000 or less, skip line 28 and continue with Schedule B. |

|

|

|

|||

28 |

Multiply line 27 by 110% (1.10) |

|

28 |

||||

.00

.00

.00

.00

Schedule B – Short method for computing the penalty. Complete lines 29 through 34 if you paid four equal estimated tax installments (on the due dates), or if you made no payments of estimated tax. Otherwise, you must complete Schedule C.

29If you were not required to make an entry on line 28, enter the lesser of lines 14 or 27.

|

If you were required to make an entry on line 28, enter the lesser of lines 14 or 28 |

29 |

.00 |

30 |

Enter the total amount of estimated tax payments made for 2012 |

30 |

.00 |

31 |

Total underpayment for the year (subtract line 30 from line 29; if zero or less you do not owe the penalty) |

31 |

.00 |

32 |

Multiply line 31 by .04976 and enter the result |

32 |

.00 |

33 |

If the amount on line 31 was paid on or after April 15, 2013, enter 0. If the amount on line 31 was paid |

|

|

|

before April 15, 2013, make the following computation to ind the amount to enter on this line: |

|

|

|

Amount on line 31 × number of days before April 15, 2013 × .00020 = |

33 |

.00 |

34 |

Penalty (subtract line 33 from line 32; enter here and on line 51) |

34 |

.00 |

(continued)

069002120094

|

|

|

|

|

|

|

|

Page 3 of 4 |

|||

|

|

|

|

|

|

|

|

|

|

|

|

Schedule C – Regular method |

|

|

|

|

|

|

|

|

|

|

|

Part 1 – Computing the underpayment |

|

|

|

|

|

|

|

|

|

|

|

|

Payment due dates |

|

A |

4/15/12 |

B |

6/15/12 |

C |

9/15/12 |

|

D |

1/15/13 |

35 |

Required installments (see instructions) |

35 |

|

.00 |

|

.00 |

|

|

.00 |

|

.00 |

36 |

Estimated tax paid |

36 |

|

.00 |

|

.00 |

|

|

.00 |

|

.00 |

Complete lines 37 through 39, one column |

|

|

|

|

|

|

|

|

|

|

|

at a time, starting in column A. |

|

|

|

|

|

|

|

|

|

|

|

37 |

Overpayment or underpayment from prior period .... |

37 |

|

|

|

.00 |

|

|

.00 |

|

.00 |

38 |

If line 37 is an overpayment, add lines 36 |

|

|

|

|

|

|

|

|

|

|

|

and 37; if line 37 is an underpayment, |

|

|

|

|

|

|

|

|

|

|

|

subtract line 37 from line 36 (see instructions) |

38 |

|

.00 |

|

.00 |

|

|

.00 |

|

.00 |

39 |

Underpayment (subtract line 38 from line 35) |

|

|

|

|

|

|

|

|

|

|

|

or overpayment (subtract line 35 from |

|

|

|

|

|

|

|

|

|

|

|

line 38; see instructions) |

39 |

|

.00 |

|

.00 |

|

|

.00 |

|

.00 |

Part 2 – Computing the penalty |

|

|

|

|

|

|

|

|

|

|

|

|

Payment due dates |

|

A |

4/15/12 |

B |

6/15/12 |

C |

9/15/12 |

|

D |

1/15/13 |

|

40 Amount of underpayment (from line 39) |

40 |

|

.00 |

|

.00 |

|

|

.00 |

|

.00 |

First installment (April 15 - June 15, 2012) |

|

|

|

|

|

|

|

|

|

|

|

41April 15 ‑ June 15 =

(61 ÷ 366) × 7.5% = .01249

|

|

|

- or - |

|

||||

April 15 ‑ |

|

|

= |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

( |

|

|

÷ 366) × 7.5% = |

. |

|

|

|

|

|

|

41 |

|

|||||

42 Multiply line 40, column A, by line 41 ............ 42 |

.00 |

|||||||

Second installment (June 15 - September 15, 2012)

43June 15 ‑ September 15 = (92 ÷ 366) × 7.5% = .01884

-or -

June 15 ‑ |

|

= ( |

|

÷ 366) × 7.5% = |

. |

|

43 |

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

44 Multiply line 40, column B, by line 43 |

44 |

.00 |

||||||

Third installment (September 15, 2012 - January 15, 2013)

45September 15 ‑ December 31 = (107 ÷ 366) × 7.5% = .02192

January 1 ‑ January 15 |

= (15 ÷ 365) × 7.5% = .00307 |

|

|

|

|||||

|

|

|

|

|

.02499 |

Total |

|

|

|

|

|

- or - |

|

|

|

|

|

||

|

|

|

|

|

|

|

|

||

September 15 ‑ |

|

|

= ( |

|

÷ 366) × 7.5% = |

. |

|

|

|

|

|

|

|

|

|

|

|

||

January 1 ‑ |

= ( |

|

÷ 365) × 7.5% = |

. |

|

|

|

||

|

|

|

|

|

|

|

Total |

45 |

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

||

46 Multiply line 40, column C, by line 45 |

|

|

|

|

|

||||

|

|

46 |

.00 |

||||||

Fourth installment (January 15 - April 15, 2013)

47January 15 ‑ April 15 = (90 ÷ 365) × 7.5% = .01848

-or -

|

January 15 ‑ |

|

= ( |

|

÷ 365) × 7.5% = |

. |

|

|

|

|

|

|

|

|

47 |

|

|||

48 |

Multiply line 40, column D, by line 47 |

............................................................................................................................ 48 |

.00 |

||||||

49 |

Penalty (add lines 42, 44, 46, and 48) |

49 |

.00 |

||||||

(continued)

069003120094

Page 4 of 4

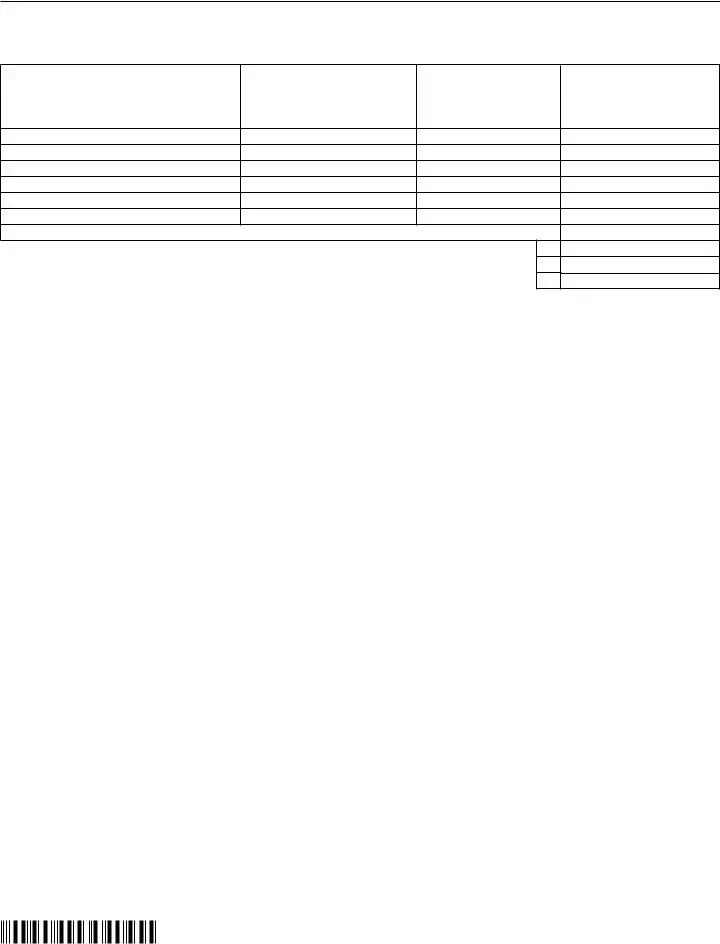

Schedule D – Failure to pay estimated tax on behalf of partners or shareholders who are corporations or nonresident individuals. Only include partners and shareholders who are subject to estimated tax paid on their behalf by the partnership or New York S corporation (see instructions). If you are listing more than six partners or shareholders, attach additional sheet(s) using the same four‑column format as in the chart below. Include all column D totals from additional sheets on the line provided.

A

Name of

partner/shareholder

B

Identifying number

(EIN/SSN)

C

Number of quarters (1‑4)

during the year estimated tax

was not paid

D

Column C × $50

Column D total from attached sheet(s) (if any) |

||

50 |

Penalty (total of column D) |

50 |

51 |

Penalty (from line 34) |

51 |

52 |

Total penalty (add lines 49, 50, and 51, as applicable; enter here and in Payment enclosed box on the front page) |

52 |

.00

.00

.00

069004120094

Form Characteristics

| Fact Name | Details |

|---|---|

| Purpose | The IT-2659 form is used to calculate estimated tax penalties for partnerships and New York S corporations. |

| Governing Law | This form is governed by New York State Tax Law, specifically for estimated tax requirements under Article 22. |

| Filing Deadline | Form IT-2659 must be filed by April 15, 2013, or by the due date of the partnership or S corporation tax return, whichever is later. |

| Payment Method | Payments should be made via check or money order, payable to the Commissioner of Taxation and Finance. |

| Required Information | Filers must provide the legal name, trade name, address, and Employer Identification Number (EIN) on the form. |

| Penalty Calculation | The form includes schedules to compute penalties based on underpayment of estimated tax for both individuals and corporations. |

More PDF Templates

Does New York Allow Section 179 Depreciation - The form includes provisions for adjusting the reported gains or losses on the disposition of property due to differences in depreciation deductions.

New York State Inheritance Tax - For estates subject to New York estate tax, the ET-133 form is an indispensable tool for managing financial obligations to the state.