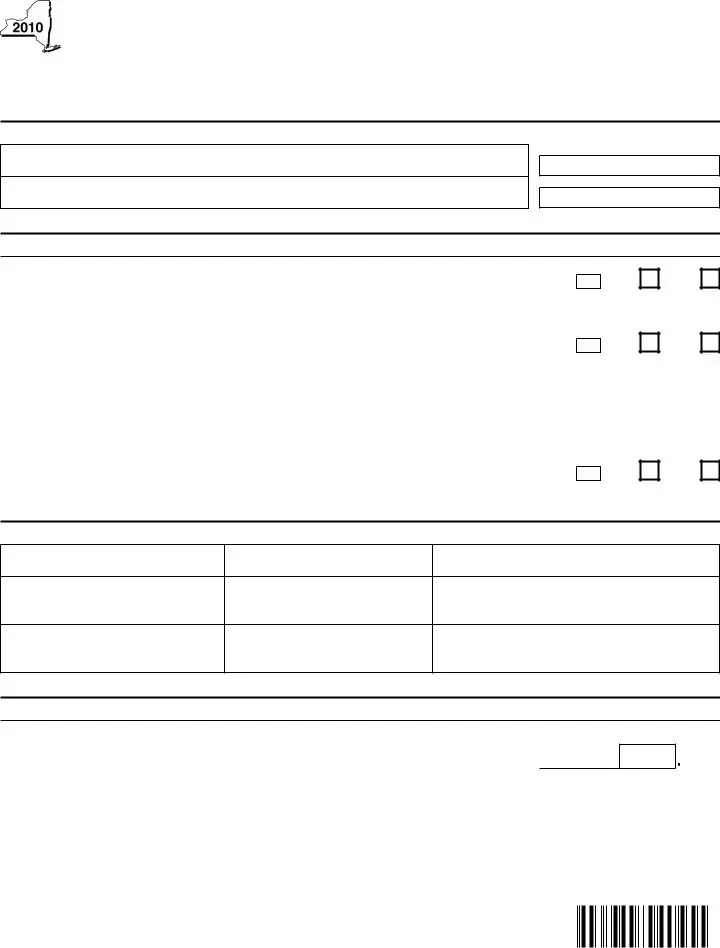

Fillable New York It 245 Form in PDF

The New York IT-245 form is a crucial document for active volunteer firefighters and ambulance workers seeking financial relief through tax credits. This form allows eligible individuals to claim a credit under New York State Tax Law, specifically Section 606(e-1), aimed at recognizing the invaluable contributions of these volunteers. To initiate the process, applicants must provide personal identifying information, including names and Social Security numbers, as well as confirm their residency status and active volunteer service throughout the tax year. Eligibility hinges on several criteria, such as whether the individual or their spouse has received a real property tax exemption for their volunteer work. If eligible, the credit amount can be $200 or $400, depending on the circumstances. Importantly, this form must be attached to the IT-201, the Resident Income Tax Return, to ensure proper processing. Understanding the requirements and steps involved in completing the IT-245 can help volunteers maximize their benefits while fulfilling their civic duties.

Preview - New York It 245 Form

New York State Department of Taxation and Finance

Claim for Volunteer Firefighters’ and Ambulance Workers’ Credit

Tax

Attach your completed Form

Step 1 — Enter identifying information

Your name as shown on return

Your social security number

Spouse’s name

Spouse’s social security number

Step 2 — Determine eligibility ( for lines 1 through 3, mark an X in the appropriate box )

1 Were you (and your spouse if iling a joint return) a New York State resident for all of this tax year? ......

If you marked an X in the No box, stop; you do not qualify for this credit.

2 Were you an active volunteer ireighter or ambulance worker for all of this tax year

who did not receive a real property tax exemption for these services ( see instructions )? ......................

If your iling status is , Married filing joint return, continue with line 3. For any other iling status:

If you marked an X in the No box, stop; you do not qualify for this credit. If you marked an X in the Yes box, continue with Step 3.

3If your iling status is , Married filing joint return, was your spouse an active volunteer ireighter or ambulance worker for all of this tax year who did not receive a real property tax exemption for

these services ( see instructions )? ............................................................................................................

If you marked an X in the No box at both lines 2 and 3, stop: you do not qualify for this credit.

1.

2.

3.

Yes

Yes

Yes

No

No

No

Step 3 — Enter qualifying information (see instructions)

Name of qualifying volunteer

Volunteer ire company/department

or ambulance company

Address of volunteer ire company/department or

ambulance company

Step 4 — Determine credit amount

4If you marked the Yes box at either line 2 or line 3, but not both enter 200.

If you marked the Yes box at both lines 2 and 3, enter 400 |

4. |

Enter the line 4 amount and code 354 on Form |

|

0 |

0 |

3541100094

Please file this original scannable form with the Tax Department.

Instructions

General information

What is the volunteer firefighters’ and ambulance workers’ credit?

The volunteer ireighters’ and ambulance workers’ credit is available to

You cannot claim the volunteer ireighters’ and ambulance workers’ credit if you receive a real property tax exemption that relates to your volunteer service under Real Property Tax Law (RPTL), Article 4, Title 2. However, if the property has multiple owners, the owner(s) whose volunteer service was not the basis of the exemption may be eligible to claim the credit.

If the credit exceeds your tax for the year, any excess will be refunded without interest.

Definitions

Active volunteer firefighter means a person who has been approved by the authorities in control of a duly organized New York State volunteer ire company or New York State volunteer ire department as an active volunteer ireighter of the ire company or department and who is faithfully and actually performing service in the protection of life and property from ire or other emergency, accident or calamity in connection with which the services of the ire company or ire department are required.

Volunteer ambulance worker means an active volunteer member of a New York State ambulance company as speciied on a

list regularly maintained by the company for purposes of the volunteer ambulance workers’ beneit law.

How do I claim the credit?

File Form

Do not attach this form to your return unless you are claiming the credit.

Specific instructions

See the instructions for your tax return for the Privacy notification or if you need help contacting the Tax Department.

Step 2 — Determine eligibility

If your iling status is Single, Married filing separate return,

Head of household, or Qualifying widower, complete lines

1 and 2. If your iling status is Married filing joint return, complete lines 1, 2, and 3.

Line 2 — If you received a real property tax exemption under the RPTL that relates to your volunteer service, mark an X in the No box.

Line 3 — If your iling status is , Married filing joint return, and your spouse received a real property tax exemption under the RPTL that relates to his/her volunteer service, mark an X in the No box.

Step 3 — Enter qualifying information

If you are an active volunteer for both a ire company/department and an ambulance company, enter the qualifying information for either the ire company/department or the ambulance company. Do not enter the information for both.

3542100094

Please file this original scannable form with the Tax Department.

Form Characteristics

| Fact Name | Fact Description |

|---|---|

| Purpose | The New York IT-245 form is used to claim a tax credit for active volunteer firefighters and ambulance workers. |

| Eligibility Requirements | To qualify, applicants must be full-year New York State residents and active volunteers who did not receive a real property tax exemption for their services. |

| Filing Instructions | Form IT-245 must be attached to Form IT-201, the Resident Income Tax Return, when claiming the credit. |

| Credit Amount | Eligible individuals can receive a credit of $200 if only one spouse qualifies, or $400 if both spouses qualify. |

| Governing Law | This form is governed by New York Tax Law, specifically Section 606(e-1). |

More PDF Templates

Ct-400-mn - Corporations must accurately calculate their estimated tax to avoid underpayment penalties, as dictated by the form’s guidelines.

Trsnyc Rw116 - Guides members through the process of accessing their Additional Member Contributions upon retirement.