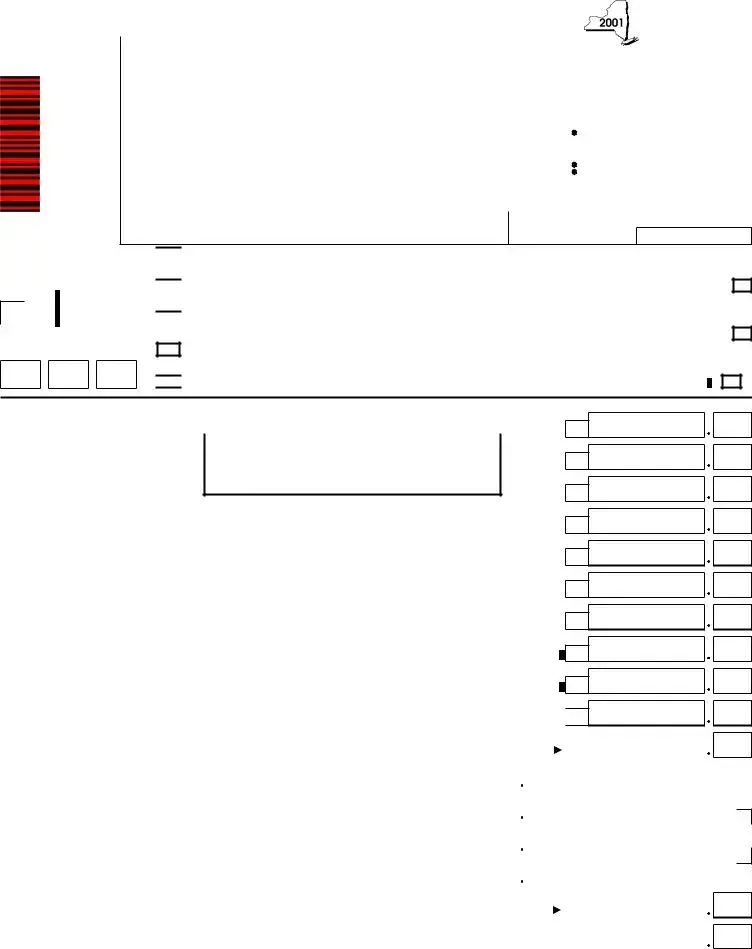

Fillable New York It 200 Form in PDF

The New York IT-200 form serves as the Resident Income Tax Return for individuals living in New York State, including those in the City of New York and the City of Yonkers. This form is essential for full-year residents who need to report their income, calculate their tax obligations, and claim any applicable credits or deductions. Taxpayers must provide their personal information, including their Social Security number and mailing address, to ensure accurate processing. The form includes sections for reporting various types of income, such as wages, taxable interest, and unemployment compensation. Additionally, it allows for the calculation of taxable income and the determination of state and local taxes owed. Taxpayers can also indicate their filing status, whether they are single, married, or head of household. Importantly, the IT-200 form is designed for straightforward use, with clear instructions guiding individuals through the process of completing their tax return. Understanding the components of this form is crucial for meeting tax responsibilities and potentially receiving refunds or credits.

Preview - New York It 200 Form

For office use only

|

|

New York State Department of Taxation and Finance |

|

|

|

|

|||||

|

Resident Income Tax Return |

|

|||||||||

|

|

New York State • City of New York • City of Yonkers |

|

|

|||||||

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|||

typeor |

Important: You must enter your social security number(s) in the boxes to the right. |

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

Your first name and middle initial |

Your last name |

|

|

|

|

t Your social security number |

|||||

|

|

|

|

|

|||||||

printor |

|

|

|

|

|

|

|

|

|

|

|

Spouse’s first name and middle initial |

Spouse’s last name |

|

|

|

|

t Spouse’s social security number |

|||||

|

|

|

|

|

|||||||

label, |

|

|

|

|

|

|

|

|

|

|

|

Mailing address (number and street or rural route) |

|

|

Apartment number |

NY State county of residence |

|||||||

|

|

|

|||||||||

Attach |

|

|

|

|

|

|

|

|

|

|

|

City, village or post office |

|

State |

|

ZIP code |

|

School district name |

|||||

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

||

Permanent home address (see page 14 ) (number and street or rural route) |

Apartment number |

School district |

|

||||||||

|

|

|

|

|

|

|

|

|

|

code number |

|

|

|

|

|

|

|

|

|

|

|

|

|

City, village or post office |

State |

|

|

ZIP code |

If taxpayer is deceased, enter first name and date of death. |

||||||

NY

(A) Filing À

status — mark an Á

status — mark an Á  “X” in

“X” in

one box: Â

Ã

Ä

Single

Married filing joint return

(enter spouse’s social security number above)

Married filing separate return

(enter spouse’s social security number above)

Head of household (with qualifying person)

Qualifying widow(er) with dependent child

(B)Were you a city of New York resident for all of 2001?

must file Form |

|

Yes |

|

|

|

No |

|

|

|

|

(C)Can you be claimed as a dependent

on another taxpayer’s federal return? |

|

Yes |

|

|

|

No |

|

|

|

|

|||

|

|

|

(D)If you do not need forms mailed to you next

year, mark an “X” in the box (see instructions, page 8) .......

DollarsCents

1 |

Wages, salaries, tips, etc |

|

||

|

|

Reminder: Only |

|

|

2 |

Taxable interest income |

not reporting income such as IRA distributions, pensions/ |

.................. |

|

annuities, social security benefits, or capital gains may file |

||||

|

|

|

||

|

|

this form. All others, see page 5 of the instructions. |

|

|

3Ordinary dividends ....................................................................................................................................................

4Taxable refunds, credits, or offsets of state and local income taxes (also enter on line 12 below) ..............................

5Unemployment compensation ..................................................................................................................................

6Add lines 1 through 5 ................................................................................................................................................

7Individual retirement arrangement (IRA) deduction (see instructions, page 9) ............................................................

8Subtract line 7 from line 6. This is your federal adjusted gross income (see instructions, page 9) .........................

1

2

3

4

5

6

7

8

9 |

Public employee contributions (see instr., page 9) |

Identify: |

|

|

|

|

|

10 |

Flexible benefits program (IRC 125 amount) (see instr., page 9) |

Identify: |

|

9

10

10

|

Add lines 8, 9, and 10 |

|

|

|

|

|

|

|

|

|

|

|

11 |

|

|

|

|

|

|

11 |

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12 |

Taxable refunds, credits, or offsets of state and local income taxes from line 4 above |

|

12 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

Interest income on U.S. government bonds (see instructions, page 9) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

13 |

|

13 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

New York standard deduction (see instructions, page 9) |

|

|

|

|

0 |

0 |

|

|

|

|

|

14 |

|

14 |

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

15 |

Exemptions for dependents only (not the same as total federal exemptions; see instructions, page 10) |

|

15 |

0 0 0 |

|

0 |

0 |

|

2001 |

|||

|

|

|||||||||||

|

Add lines 12 through 15 (if line 16 is more than or equal to line 11, enter “0’’ on line 17 and skip to line 28) |

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|||||

16 |

|

|

|

16 |

|

|

||||||

|

Subtract line 16 from line 11. This is your taxable income (if $65,000 or more, stop; you must file Form |

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|||||

17 |

|

|

|

17 |

|

|

||||||

|

|

|

|

|

||||||||

011194 |

This is a scannable form; please file this original return with the Tax Department. |

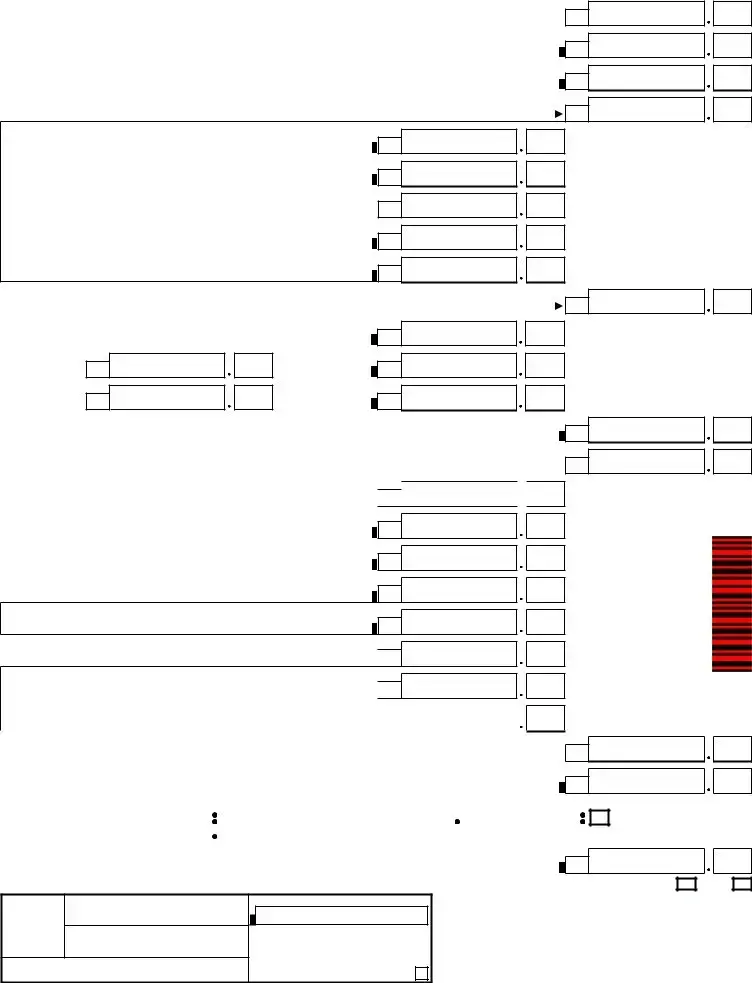

18Enter the amount from line 17 on the front page. This is your taxable income .....................................................

19New York State tax on line 18 amount (use the State Tax Table, violet pages 41 through 48 of the instructions) .................

20New York State household credit (from table I, II, or III; see instructions, page 10) .........................................................

18

19

20

21 Subtract line 20 from line 19 (if line 20 is more than line 19, leave blank). This is the total of your New York State taxes |

21 |

22 City of New York resident tax on line 18 amount. (use City Tax Table,

white pages 49 through 56 of the instructions) ...............................................

22

23 City of New York household credit (see instructions, page 11) .....................

24 Subtract line 23 from line 22 (if line 23 is more than line 22, leave blank) .......

25 City of Yonkers resident income tax surcharge (from Yonkers

Worksheet, page 11 of the instructions) ........................................................

23

24

25

•This is a scannable form; please file this original return with the Tax Department.

26 City of Yonkers nonresident earnings tax (attach Form

26

27 Add lines 24 through 26. This is the total of your city of New York and city of Yonkers taxes |

27 |

Voluntary gifts/contributions

(see instructions)

Return A Gift

to Wildlife  28

28

Olympic

Fund  29

29

00

00

Breast Cancer Research Fund

Missing/Exploited Children Fund

Alzheimer’s

Fund

30

31

32

00

00

00

33Add lines 28 through 32. This is your total voluntary gifts/contributions ..................................................................

34Add lines 21, 27, and 33 ..............................................................................................................................................

35New York State child and dependent care credit (from Form  35

35

36 |

New York State earned income credit (from Form |

36 |

37 |

Real property tax credit (from Form |

37 |

38 |

College tuition credit (from Form |

38 |

39 |

City of New York school tax credit (see instructions, page 12) |

39 |

40Total New York State tax withheld (staple wage and tax statements; see instr., page 12)  40

40

41Total city of New York tax withheld (staple wage and tax statements; see instr., page 13)  41

41

|

|

|

|

42 Total city of Yonkers tax withheld (staple wage and tax statements; see instr., page 13) |

|

42 |

|

|

|

33

34

•Staple your wage and tax statements to the bottom front of this return. See Step 7, page 15 of the instructions, for the proper assembly of your return and attachments.

0 0

43Add lines 35 through 42 ............................................................................................................................................

44If line 43 is more than line 34, subtract line 34 from line 43. This is the amount to be refunded to you ........

If you choose to have your refund sent directly to your bank account, complete a, b, and c below |

|

|||||

|

|

a Routing number |

|

b Type: |

|

Checking |

|

|

c Account number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

45 If line 43 is less than line 34, subtract line 43 from line 34. This is the amount you owe (do not send cash; make your check or money order payable to New York State Income Tax; write your social security number and 2001 income tax on it) ..

43

44

Savings

45

46 I authorize the Tax Department to discuss this return with the paid preparer listed below. (Mark the Yes or No box; see page 14.)  Yes

Yes

No

No

Preparer’s signature

Paid

preparer’s

use only Firm’s name (or yours, if

Address

tPreparer’s SSN or PTIN

•Employer identification number

|

|

|

|

|

|

Date |

Mark “X” if |

|

|

|

|

|

|

|

Sign |

Your signature |

|

|

|

|

|

|

your |

|

||

Spouse’s signature (if joint return) |

|||

return |

|

|

|

here |

|

|

|

Date |

Daytime phone number (optional) |

||

|

|

( |

) |

012194 |

Mail to: STATE PROCESSING CENTER, PO BOX 61000, ALBANY NY |

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose | The New York IT-200 form is used by full-year residents to file their personal income tax returns in New York State. |

| Eligibility | This form is specifically for individuals who do not have to report certain types of income, such as IRA distributions or pensions. |

| Filing Requirements | Taxpayers must provide their Social Security numbers and indicate their filing status, such as single or married. |

| Governing Law | The IT-200 form is governed by the New York State Tax Law, specifically Article 22 of the New York Tax Law. |

More PDF Templates

How to Write a Formal Letter Asking for Donations - Navigate the donation request process with an eye on the guidelines provided by a company invested in charitable efforts.

How to Show Proof of Rent Payments - Translations into multiple languages ensure the accessibility of application guides, supporting New York City's diverse population.

Nycha 015 208 - By meticulously filling out and submitting the NYCHA 015 208 form, employees and applicants take a proactive step towards an inclusive work environment.