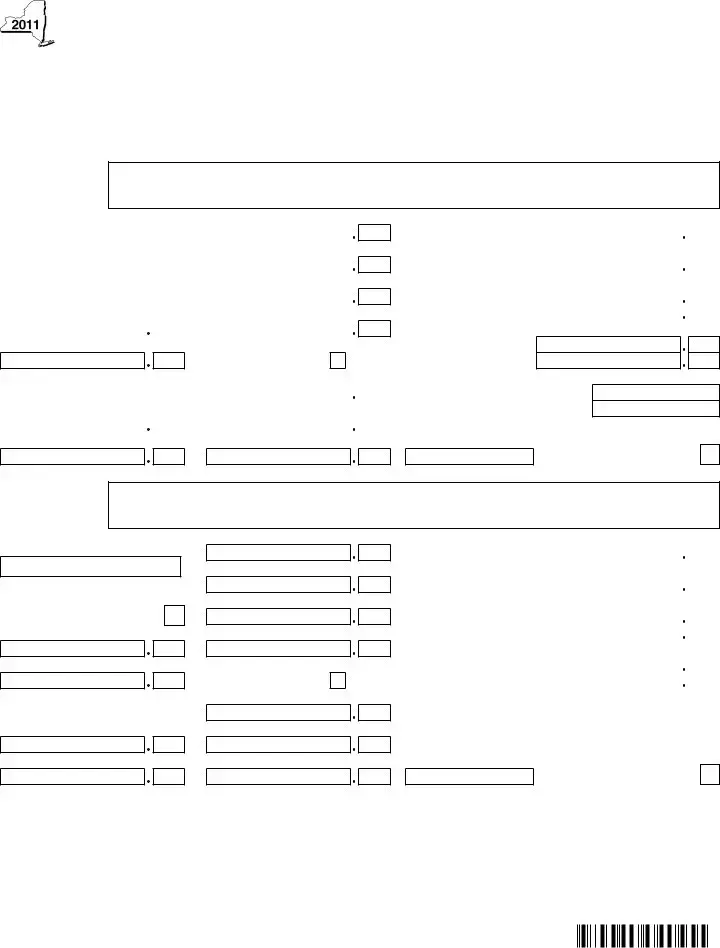

Fillable New York It 2 Form in PDF

The New York IT-2 form serves as a crucial document for individuals who are filing their state income taxes. This form summarizes W-2 statements for taxpayers and their spouses, providing a comprehensive overview of earned income and tax withholdings. It is essential to file the IT-2 as a complete page, ensuring that all W-2 records remain intact. Within the form, taxpayers will find designated boxes to fill in personal information, such as names and social security numbers, alongside details about their employers. Each W-2 record includes important figures, including wages, tips, and state income tax withheld, which are necessary for accurately calculating tax liabilities. Additionally, the form accommodates local tax information, making it vital for those residing in specific areas like New York City or Yonkers. Understanding the structure and requirements of the IT-2 form can significantly ease the tax filing process, allowing individuals to ensure compliance with state regulations while maximizing potential refunds.

Preview - New York It 2 Form

New York State Department of Taxation and Finance

Summary of

New York State • New York City • Yonkers

Do not detach or separate the

Taxpayer’s irst name and middle initial |

Taxpayer’s last name |

|

|

Your social security number |

|

|

|

|

|

Spouse’s irst name and middle initial |

Spouse’s last name |

|

|

Spouse’s social security number |

|

|

|

|

|

Box c Employer’s name and full address ( including ZIP code )

RECORD 1

|

|

|

|

|

|

|

|

|

Box 12a |

Amount |

Box b Employer identiication number ( EIN ) |

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Box 12b |

Amount |

This |

|

|

|

|

|

|

|

|

||

( MARK AN X IN ONE BOX ): |

|

|

|

|

|

|

Box 12c |

Amount |

||

Taxpayer |

|

|

Spouse |

|

|

|

||||

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

||||

Box 1 Wages, tips, other compensation |

Box 12d |

Amount |

||||||||

|

|

|

|

|

|

|

|

|

|

|

Code |

Box 15 State Box 16 State wages, tips, etc. ( for NYS ) |

|||||||

|

|

|

|

|

|

|

|

|

Code |

|

|

|

Box 17 New York State income tax withheld |

||||

|

|

|

|

|

|

|

|

|

Code |

|

|

|

Box 18 |

Local wages, tips, etc. ( SEE INSTR. ) |

|||

|

|

|

Locality a |

|

|

|

|

|

Code |

|

Locality b |

|

|

|

|

||

|

|

|

|

|

Box 19 |

Local income tax withheld |

|

|

Box 8 Allocated tips

Box 13 Statutory employee

Box 14 a Amount

|

Locality a |

|

Locality b |

Description |

Box 20 Locality name |

|

|

|

|

|

|

|

|

|

|

Locality a |

Box 10 |

Dependent care beneits |

|

|

|

Box 14 b Amount |

Description |

Locality b |

|||

|

|

|

|

|

|

|

|

|

|

|

Box 11 |

Nonqualiied plans |

|

|

|

Box 14 c Amount |

Description |

|

|||

Do not detach.

RECORD 2

Corrected (

Box c Employer’s name and full address ( including ZIP code )

Box b Employer identiication number ( EIN )

This

( MARK AN X IN ONE BOX ):

Taxpayer |

|

Spouse |

|

|

|

Box 1 Wages, tips, other compensation

Box 8 Allocated tips

Box 10 Dependent care beneits

Box 12a Amount

Box 12b Amount

Box 12c Amount

Box 12d Amount

Box 13 Statutory employee Box 14 a Amount

Box 14 b Amount

Code |

Box 15 State |

Box 16 |

State wages, tips, etc. ( for NYS ) |

|||||||

|

|

|

|

|

|

|

|

|

|

|

Code |

|

|

|

|

Box 17 New York State income tax withheld |

|||||

|

|

|

|

|

|

|

|

|

|

|

Code |

|

|

|

|

Box 18 |

Local wages, tips, etc. ( SEE INSTR. ) |

||||

|

|

|

Locality a |

|

|

|

|

|

||

Code |

|

Locality b |

|

|

|

|

|

|||

|

|

|

|

|

|

Box 19 |

Local income tax withheld |

|

|

|

|

|

|

Locality a |

|

|

|

|

|

||

|

|

|

Locality b |

|

|

|

|

|

||

Description |

|

|

Box 20 Locality name |

|||||||

|

|

|

|

|

|

Locality a |

|

|||

Description |

Locality b |

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

Box 11 Nonqualiied plans |

Box 14 c Amount |

Description |

Corrected (

1021110094

Please ile this original scannable form with the Tax Department.

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose | The New York IT-2 form is used to summarize W-2 statements for state tax purposes. It is essential for reporting income and tax withheld to the New York State Department of Taxation and Finance. |

| Filing Requirement | Taxpayers must file Form IT-2 as a complete page without detaching or separating any W-2 records. This ensures that all information is accurately processed. |

| Governing Law | The IT-2 form is governed by New York State tax laws, specifically under the New York Tax Law, which mandates the reporting of wages and tax withheld. |

| Information Needed | When completing the IT-2 form, taxpayers need their and their spouse's names, Social Security numbers, employer details, and W-2 information, including wages and tax withheld. |

More PDF Templates

Pay My Rent - Comprehensive list of authorized centers offering rent payment services to NYCHA residents.

Returning Plates to Dmv Ny - The AA-33 form allows appellants to request a review of the guilty verdict or just the penalty, without a transcript review.

Rp5217 - Submission of an inaccurately completed Rp 5217Nyc form can lead to significant legal and financial implications.