Fillable New York Et 133 Form in PDF

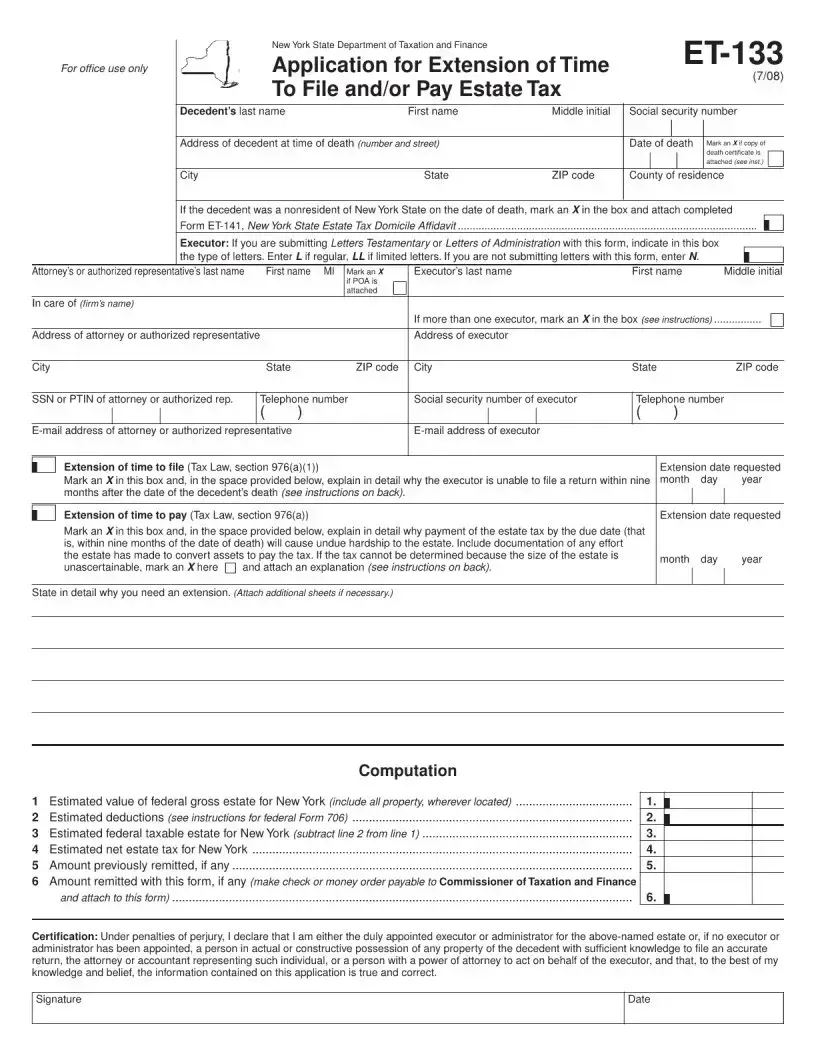

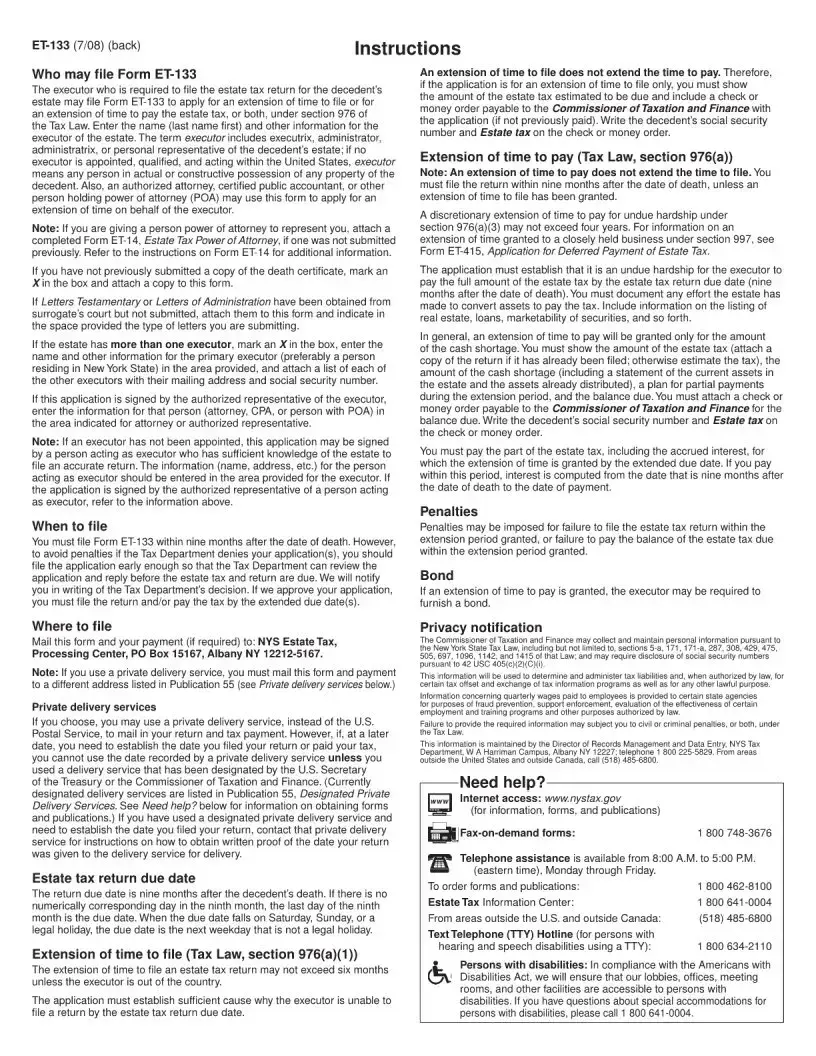

The New York ET-133 form serves as a crucial document for individuals handling the estate of a deceased person. Specifically designed for executors, this form allows them to request an extension of time to file the estate tax return and/or to pay the estate tax due. Executors must provide essential information about the decedent, including their name, Social Security number, and address at the time of death. Additionally, if the decedent was a nonresident of New York, the executor must attach the New York State Estate Tax Domicile Affidavit (Form ET-141). The form requires the executor to explain in detail the reasons for needing an extension, whether it be for filing or payment, and to document any efforts made to liquidate assets for tax payment. It also emphasizes the importance of submitting supporting documents, such as a death certificate and Letters Testamentary if applicable. By completing the ET-133 form accurately and submitting it within nine months of the decedent's death, the executor can avoid potential penalties and ensure compliance with New York tax laws. Understanding the nuances of this form is essential for navigating the complexities of estate administration effectively.

Preview - New York Et 133 Form

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose | The New York ET-133 form is used by the executor of an estate to request an extension of time to file or pay estate taxes. |

| Governing Law | This form is governed by New York Tax Law, section 976, which outlines the requirements for extensions related to estate tax filings. |

| Filing Deadline | The ET-133 must be submitted within nine months following the date of the decedent's death to avoid penalties. |

| Required Attachments | When submitting the ET-133, a copy of the death certificate and any relevant letters from the surrogate's court may need to be attached, depending on the circumstances. |

More PDF Templates

When Is Property Tax Due for 2023 - For residents of condos and co-ops in NYC, the RP-602C form is an important step in accessing the city's tax abatement opportunities.

Nyc Pw5 - The form serves as a legal document, binding the applicant to the rules and regulations governing after-hours construction work in NYC.