Fillable New York Dtf 84 Form in PDF

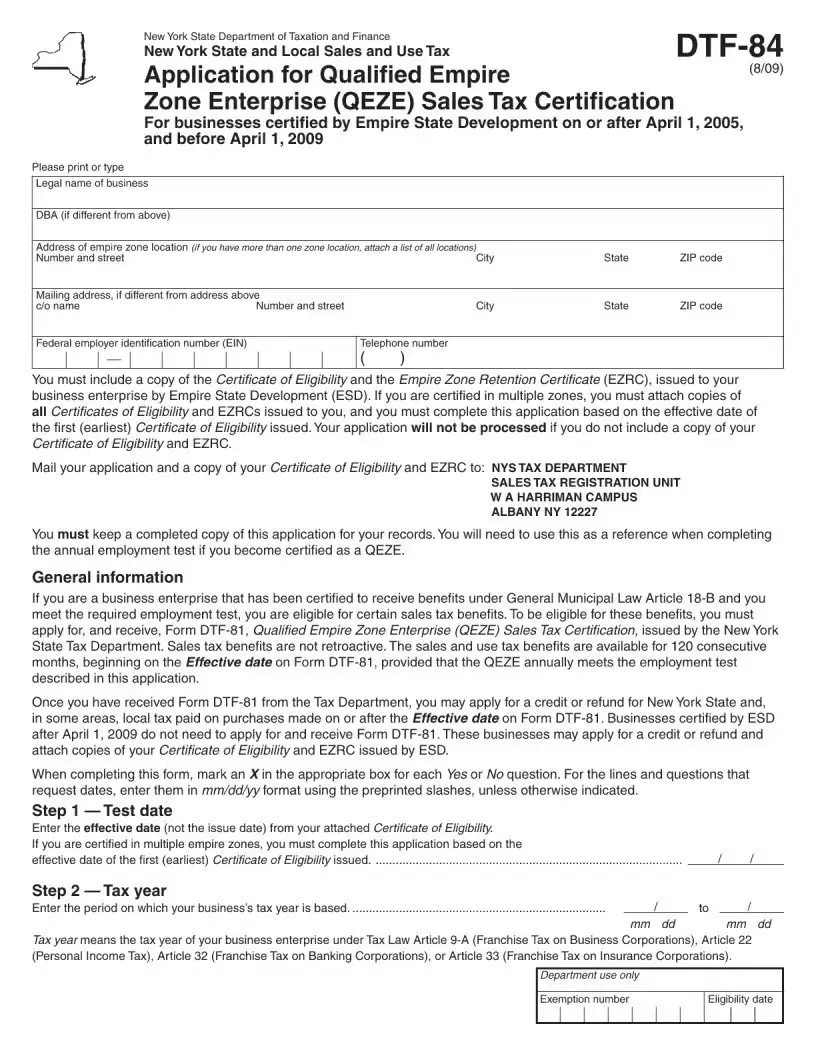

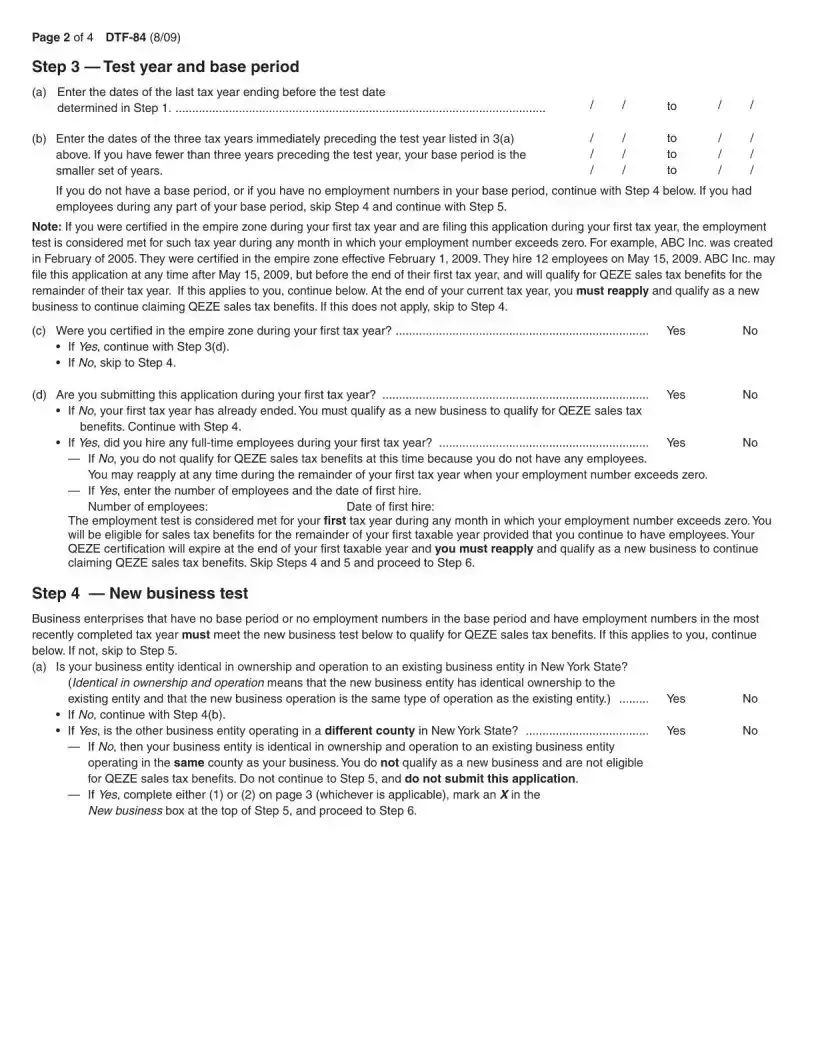

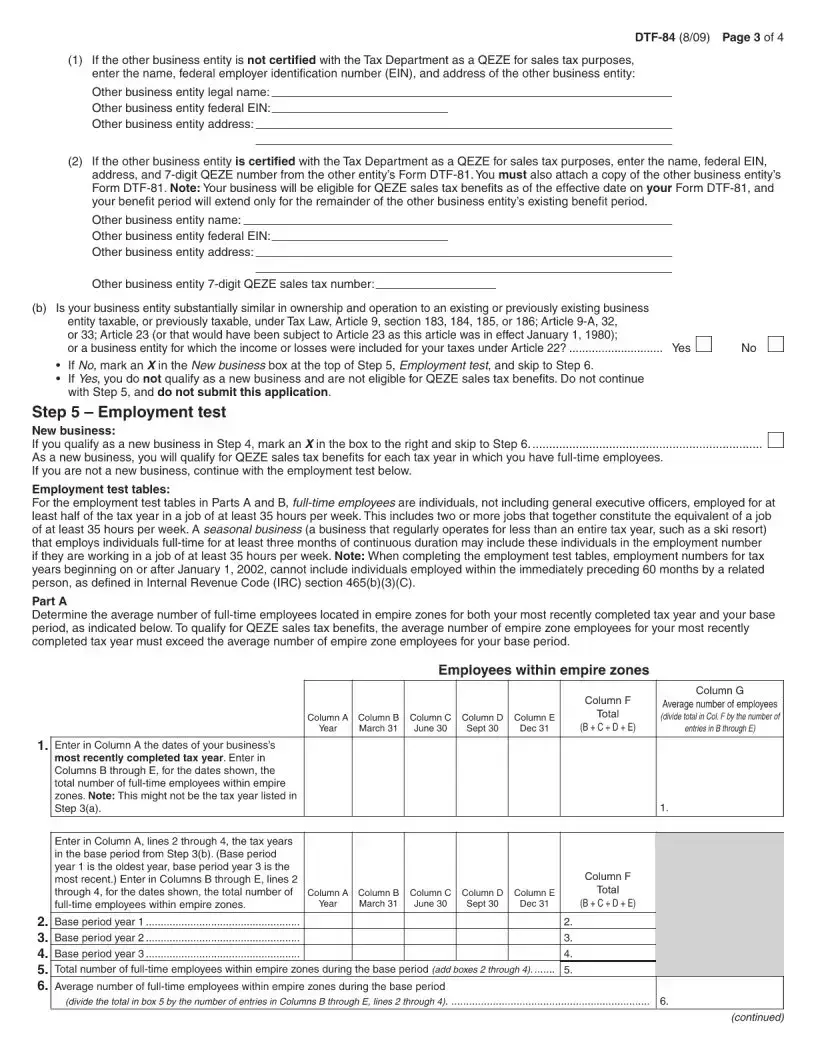

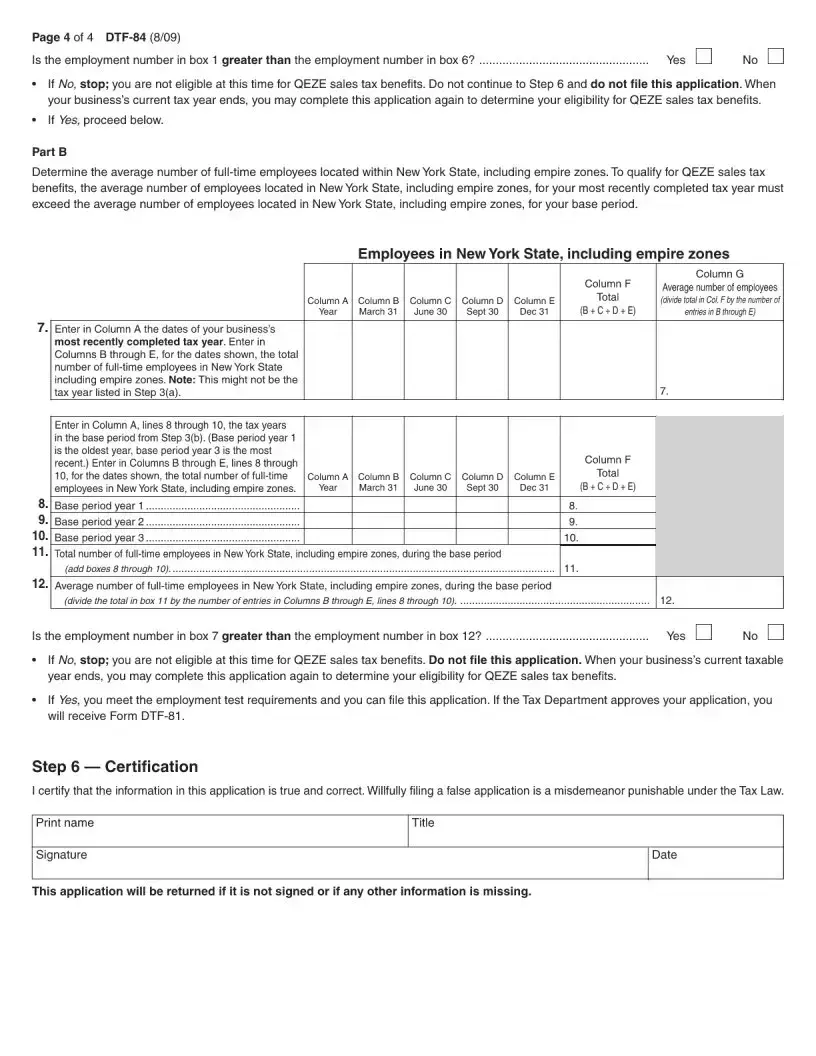

The New York DTF-84 form is a crucial document for businesses seeking sales tax benefits under the Qualified Empire Zone Enterprise (QEZE) program. This application is specifically designed for enterprises certified by Empire State Development between April 1, 2005, and April 1, 2009. To successfully complete the form, businesses must provide key information, including their legal name, address, and federal employer identification number (EIN). Additionally, applicants must include copies of their Certificate of Eligibility and the Empire Zone Retention Certificate (EZRC) issued by Empire State Development. This documentation is essential, as the application cannot be processed without it. The form also outlines the eligibility criteria for sales tax benefits, which are available for a period of 120 consecutive months, contingent upon meeting an annual employment test. Moreover, businesses certified after April 1, 2009, have different requirements and do not need to apply for Form DTF-81. The DTF-84 form includes various sections that guide applicants through the process of reporting tax years, test dates, and employment numbers, ensuring that all necessary information is submitted accurately. Understanding the nuances of this form is vital for businesses aiming to leverage the benefits associated with the QEZE program.

Preview - New York Dtf 84 Form

Form Characteristics

| Fact Name | Description |

|---|---|

| Form Purpose | The DTF-84 form is used for businesses seeking sales tax certification as a Qualified Empire Zone Enterprise (QEZE) in New York. |

| Eligibility Period | Businesses must be certified by Empire State Development between April 1, 2005, and April 1, 2009, to qualify for the benefits outlined in this form. |

| Required Documentation | A copy of the Certificate of Eligibility and the Empire Zone Retention Certificate (EZRC) must be included with the application. |

| Governing Law | The form is governed by General Municipal Law Article 18-B, which outlines the qualifications and benefits for QEZE sales tax certification. |

More PDF Templates

Department of Buildings Nyc - The clarity provided by the form on what constitutes ordinary plumbing work helps Licensed Master Plumbers navigate the city's regulations with ease, promoting industry standards.

How to Answer a Summons - Enables plaintiffs to formally articulate their grievances and the outcomes they are seeking through the legal system.

Is Health and Welfare Pay Taxable - The choice between 31111293 and 31121293 versions allows for specificity based on the corporation's financial activities and requirements.