Fillable New York Dof 1 Form in PDF

The New York DOF-1 form, officially known as the Change of Business Information form, serves as a vital tool for businesses operating within the city. It is designed to facilitate updates to essential business details, ensuring that the Department of Finance maintains accurate records. When a business undergoes changes such as a name alteration, modification of ID numbers, or updates to billing and business addresses, this form must be completed and submitted. It covers various tax records that may be affected, including the General Corporation Tax, Unincorporated Business Tax, and Commercial Rent Tax, among others. The form requires businesses to provide both old and new information, including entity types and contact details. Additionally, it prompts users to indicate the reasons for the changes, which could range from a change of business activity to simply going out of business. Completing and submitting the DOF-1 form in a timely manner is crucial, as it helps prevent potential tax complications and ensures compliance with city regulations.

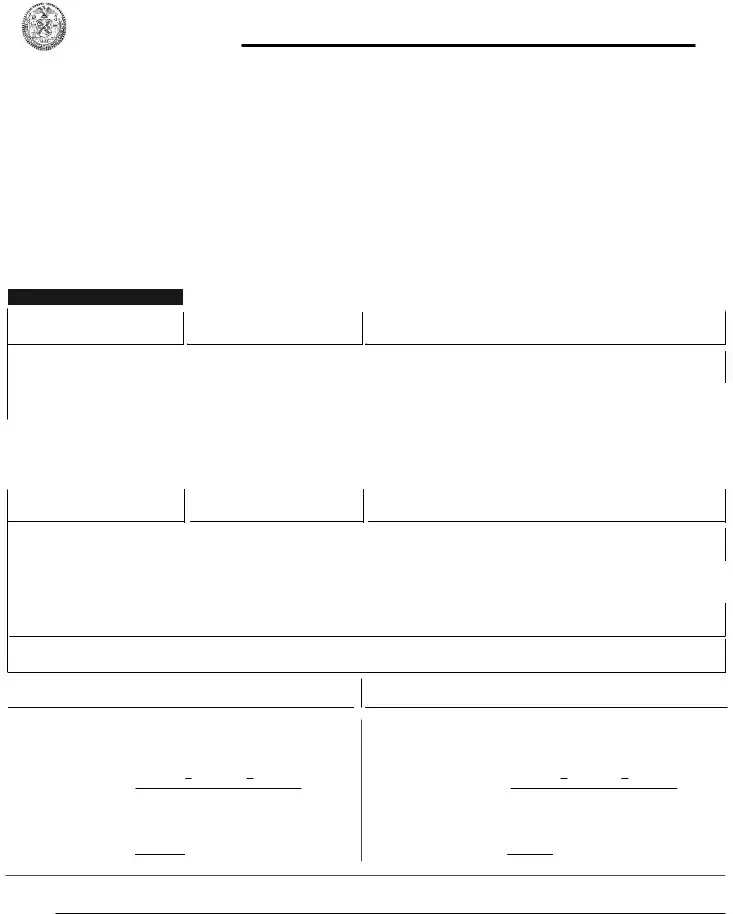

Preview - New York Dof 1 Form

FINANCE

NEW ● YORK

THE CITY OF NEW YORK DEPARTMENT OF FINANCE

n y c . g o v / f i n a n c e

D O F

1

NEW YORK CITY DEPARTMENT OF FINANCE

CHANGE OF BUSINESS INFORMATION

USE THIS FORM TO REPORT ANY CHANGES IN YOUR BUSINESS'S NAME, ID NUMBERS, BILLING OR BUSINESS

ADDRESS, OR TELEPHONE NUMBER. (SEE INSTRUCTIONS ON BACK BEFORE COMPLETING.)

SECTION I: TAX RECORD AFFECTED -

Check (✓) the box(es) below to indicate which business and excise tax records should be changed.

■ General Corporation Tax |

■ Unincorporated Business Tax |

|

■ Commercial Rent Tax |

■ Commercial Motor Vehicle Tax |

|

■ Banking Corporation Tax |

■ Retail Beer, Wine and Liquor License Tax |

|

■ Utility Tax |

■ Hotel Tax |

■ Other (Tax Type)____________________ |

SECTION II: BUSINESS INFORMATION - Enter in the spaces below the old, new (revised or changed) or

OLD I NFORM ATI ON

Entity ID (EIN or SSN)

Account ID (see instructions)

Trade Nam e (DBA, etc.)

Legal Nam eBusiness Telephone Num ber

|

|

|

|

|

|

|

( |

) |

||

|

|

|

|

|

|

|

|

|

|

|

|

Business Address |

|

|

|

|

City |

|

|

State |

Zip Code |

|

|

|

|

|

|

|

|

|

|

|

|

|

EFFECTIVE DATE |

|

|

|

|

|

|

|

|

|

NEW I NFORM ATI ON |

|

|

|

|

|

|

|

|

|

|

|

MON TH |

|

DAY |

|

YEAR |

|

|||

|

|

|

|

|

|

|||||

|

........................................................ |

■ Individual |

■ Partnership |

|

■ Corporation |

|

||||

|

Entity Type (check one) |

|

|

|||||||

Entity ID (EIN or SSN)

Account ID (see instructions)

Trade Nam e (DBA, etc.)

Legal Nam eBusiness Telephone Num ber

|

|

( |

) |

|

|

|

|

Business Address |

City |

State |

Zip Code |

|

|

|

|

Billing Address c/o (no. and street)

City |

State |

Zip Code |

Reason(s) for change ▼

Change of business activity ▼

Check (✓) if appropriate

■

EFFECTIVE DATE

MON TH |

DAY |

YEAR |

ATTACH: Certificate of Dissolution (if corporation); Notarized Affidavit (if unincorporated business or partnership)

Did you file a final return? |

■ YES |

■ NO |

■INACTIVE IN NEW YORK CITY

EFFECTIVE DATE

MON TH |

DAY |

YEAR |

ATTACH: Form

Did you file a final return? |

■ YES |

■ NO |

SIGN →

HERE

Signature |

Title |

Date |

|

|

|

Once you complete this form, mail it immediately to: New York City Department of Finance, Account Examinations, 59 Maiden Lane, 19th Floor, New York, NY 10038. (If there are no changes to the above information, keep this form in your files. In the event a change occurs, complete the form and send it to us as soon as possible.)

Page 2 |

|

|

|

The purpose of Form

If there are currently no changes to your business's information, keep this form in your files. In the event a change occurs, complete the form and send it to us as soon as possible. If you need addition- al forms, call Customer Assistance at ( 212)

SECTION I - TAX RECORD AFFECTED

Indicate which business tax record should be changed by marking

a✔ in the appropriate box( es) in this section. If your change affects a tax not listed, check the box labeled "Other" and enter in the space directly to the right of it the tax type.

SECTION II - BUSINESS INFORMATION

Enter in the spaces available all old and new information regarding your business's operation.

In the OLD INFORMATION area, enter your:

ENTITY ID NUMBER This is the number that is currently used to identify your business tax account. It is the number that either appears on all Department mailing labels you are presently receiv- ing, or it is the number that you entered when you last filed a tax return. This identifying number must be entered in order for us to make any account changes.

Leave this area blank unless you are changing the tax records listed below. If you have more than one account ID number, list the account ID number in the appropriate line in the chart below.

IF THE BUSINESS |

THE ACCOUNT ID NUMBER |

TAX IS.... |

TO ENTER IS... |

|

|

➧ Commercial Rent Tax |

➧ Commercial Rent Tax Registration |

|

● |

____________________________________________________________ |

|

➧ Commercial Motor Vehicle |

➧ Commercial License Plate |

|

● |

____________________________________________________________ |

|

➧ Retail Beer, Wine and |

➧ License Number |

Liquor License Tax |

● |

____________________________________________________________ |

|

➧ Utility Tax |

➧ Utility Tax Registration |

|

● |

____________________________________________________________ |

|

➧ Hotel Tax |

➧ New York City Certificate |

●

____________________________________________________________

TRADE NAME This is the name that you use in conducting your normal

Your legal name is the name under which your business owns assets or incurs debts. For sole proprietorships, it is the name of the sole proprietor; for corporations, it is the name filed with the New York Secretary of State; and for partnerships, it is the legal name used in the partnership agreement.

The address where your major business activity is physically located.

The number where you can

usually be reached during normal business hours.

In the NEW INFORMATION area, enter the date the new information became effective. Enter your new or revised:

ENTITY TYPE This is the legal form of the taxpayer. Check either individual ( e.g., sole proprietor or

ENTITY ID NUMBER If yo u have rec ently rec eived an EIN ( Employer Identification Number) or have otherwise changed your identification number, enter the new number here. ( If there is no change, leave this space blank.)

ACCOUNT ID NUMBER ( SEE ABOVE)

TRADE NAME ( SEE ABOVE)

LEGAL NAME ( SEE ABOVE)

BUSINESS ADDRESS AND TELEPHONE NUMBER ( SEE ABOVE)

The address where you now want us to send all of your tax returns and notices. Be sure to include your street name and number, city and post office box number, if any. ( If there is no change, leave this space blank.)

Enter the specific reaso n( s) fo r sending us this form ( i.e., change of name, change of ID number, change of entity, change of address, etc.) .

Enter any other pertinent information that will help us to properly change information about your tax records. ( If you need more space, attach a sheet to this form.)

SIGNATURE Sign your name and enter your title and the date in the spaces provided. Send your completed form to:

NYC DEPARTMENT OF FINANCE ACCOUNT EXAMINATIONS

5 9 MAIDEN LANE, 1 9 TH FLOOR NEW YORK, NY 1 0 0 3 8

PRIVACY ACT NOTIFICATION

The Federal Privacy Act of 1974, as amended, requires agencies requesting Social Security Numbers to inform individuals from whom they seek this information as to whether compliance with the request is voluntary or mandatory, why the request is being made and how the information will be used. The disclosure of Social Security Numbers for taxpayers is mandatory and is required by sec- tion

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose of Form | The DOF-1 form is used to report changes in a business's name, ID numbers, billing or business address, or telephone number. |

| Governing Law | This form is governed by the laws of New York City, specifically under the Administrative Code of the City of New York. |

| Tax Records Affected | Users must indicate which tax records are being changed, such as General Corporation Tax or Unincorporated Business Tax. |

| Effective Date | Businesses must specify the effective date of the changes being reported on the form. |

| Submission Address | Completed forms should be mailed to the NYC Department of Finance, Account Examinations, at 59 Maiden Lane, 19th Floor, New York, NY 10038. |

| Privacy Notification | Disclosure of Social Security Numbers is mandatory for tax administration purposes, as required by federal and local laws. |

More PDF Templates

Nyc Rent Tax Return - Offers a worksheet for tenants paying rent for a period other than one month.

Required Onboarding Documents by State - Requirements and verification processes for New York City residency, including exceptions and waivers.

What Is a Fire Emergency Plan - Stresses the significance of the Fire Safety Plan in coordinating a methodical response to emergency situations, aiming to minimize harm and facilitate evacuation.