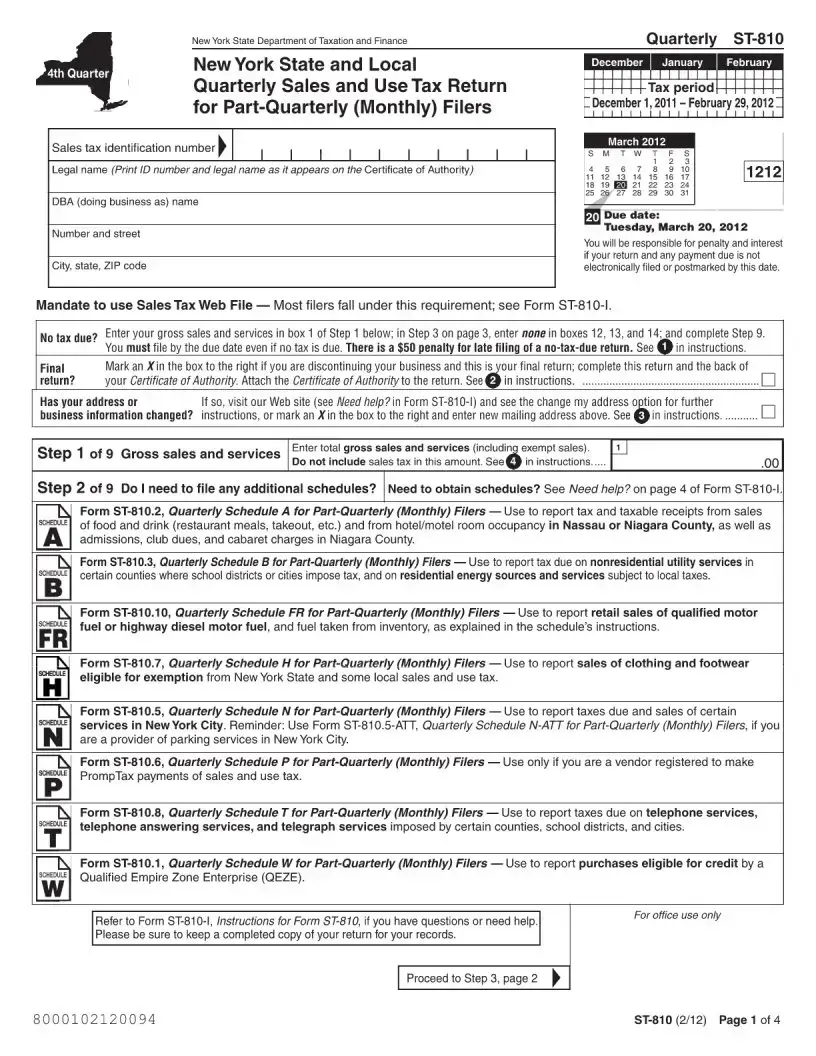

Fillable New York 810 Form in PDF

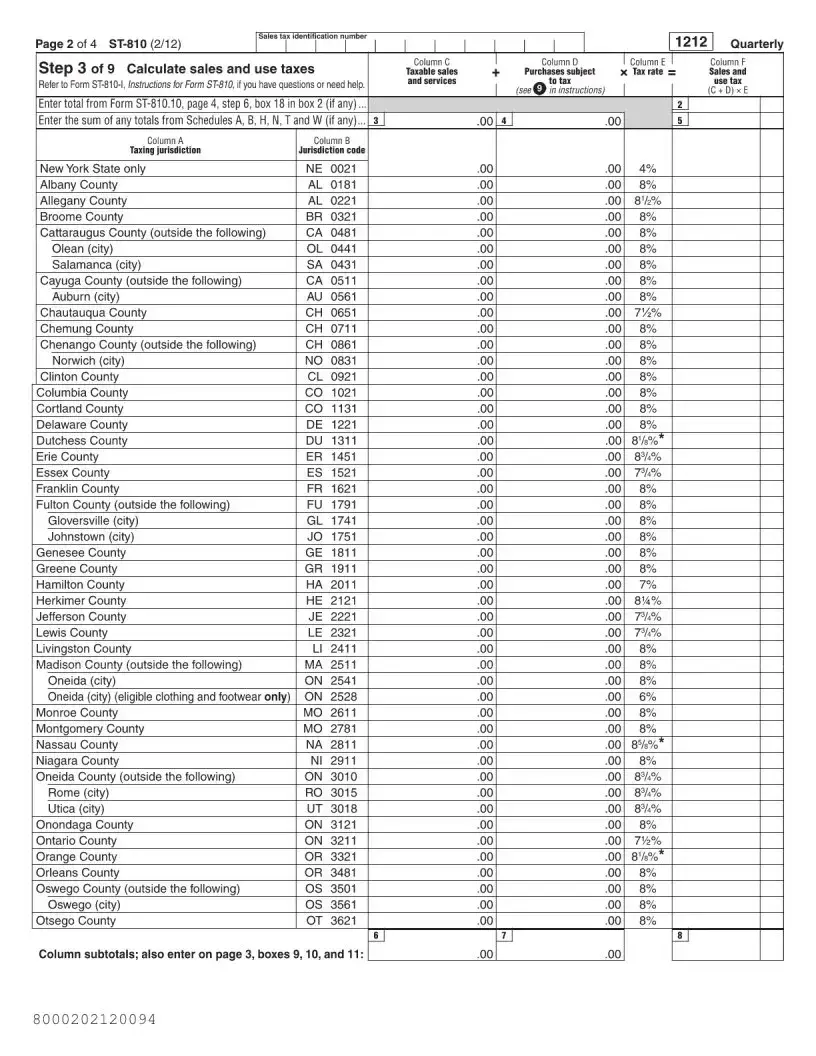

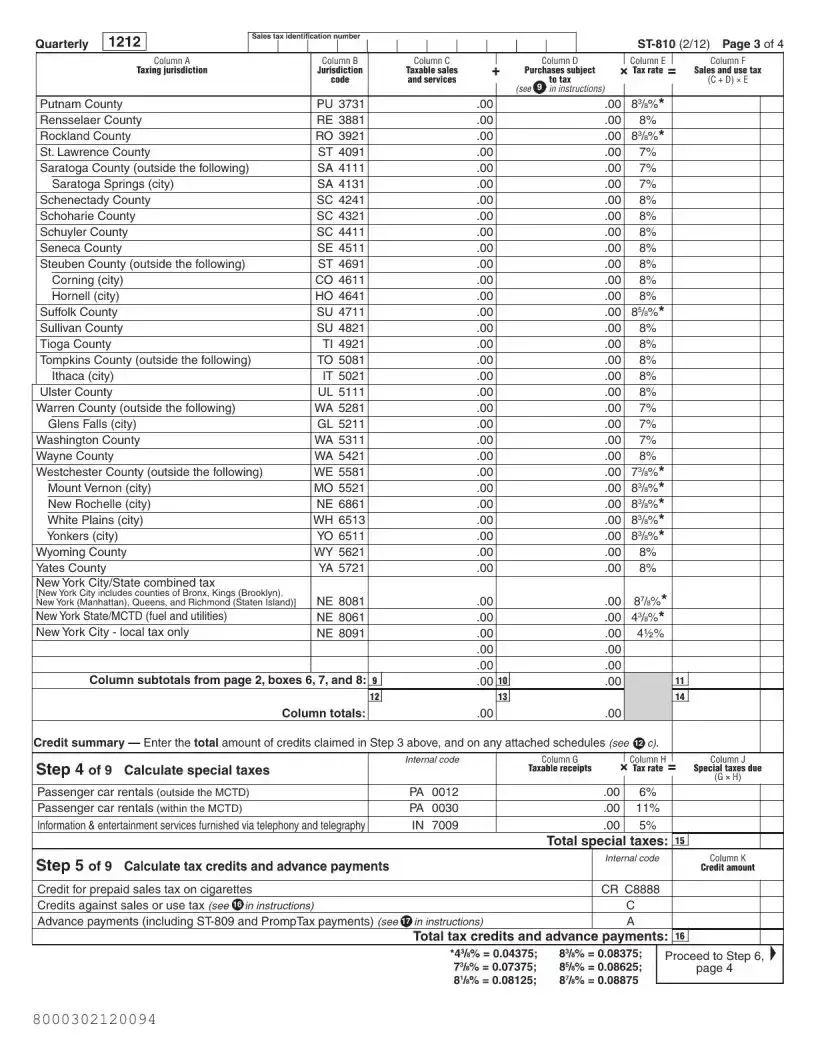

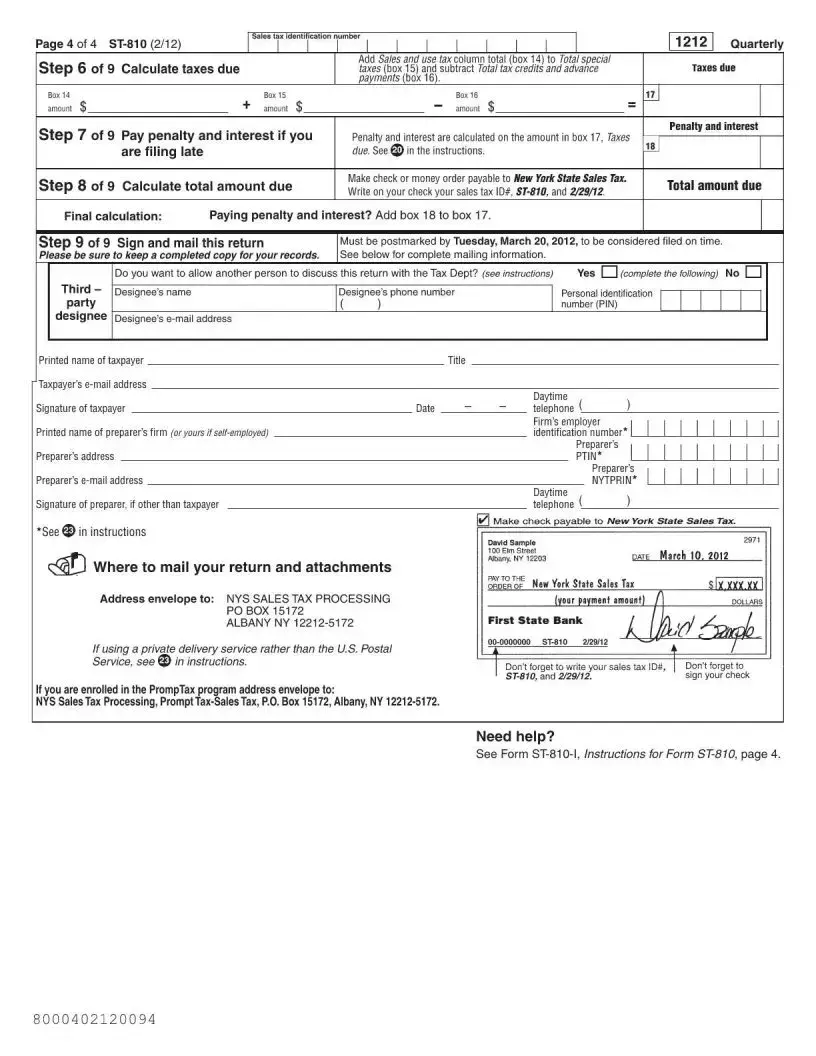

The New York State Department of Taxation and Finance requires businesses to file the ST-810 form, a crucial document for reporting quarterly sales and use tax. This form is specifically designed for part-quarterly filers, allowing them to detail their sales activities over a three-month period. Each quarter, businesses must provide their sales tax identification number, legal name, and address, ensuring that all information aligns with their Certificate of Authority. The ST-810 form includes various sections that guide the filer through reporting gross sales, taxable purchases, and calculating the appropriate sales and use taxes owed. Additionally, it mandates electronic filing for most businesses, emphasizing the importance of timely submissions to avoid penalties. If a business has no tax due, it is still required to file the form to avoid incurring a late filing fee. The form also provides options for businesses that are discontinuing operations, as well as those needing to report specific types of sales, such as food and drink or utility services. Understanding the nuances of the ST-810 form is essential for compliance and to ensure that businesses meet their tax obligations accurately and efficiently.

Preview - New York 810 Form

Form Characteristics

| Fact Name | Details |

|---|---|

| Form Purpose | The New York ST-810 form is used for filing quarterly sales and use tax returns for businesses that are part-quarterly (monthly) filers. |

| Filing Frequency | Businesses must file this form quarterly, specifically for the months of December, January, and February. |

| Due Date | The return is due on March 20th for the previous quarter's sales and use tax reporting. |

| Penalties for Late Filing | A penalty of $50 applies for late filing of a return, even if no tax is due. |

| Mandatory Electronic Filing | Most filers are required to submit their returns electronically using the Sales Tax Web File system. |

| Change of Business Information | If a business changes its address or any other information, it must update this on the form and may need to attach a new Certificate of Authority. |

| Governing Law | The ST-810 form is governed by New York State Tax Law, specifically sections related to sales and use tax. |

| Record Keeping | It is crucial for businesses to keep a completed copy of their return for their records, as this may be needed for future reference or audits. |

More PDF Templates

Eviction Forms Ny - Information on obtaining language interpreter services at no cost for those who do not speak English fluently is included.

New Birth Certificate - The form specifies fees for additional searches beyond the initial two-year search included in the base cost.

Summons Response Form - A critique of Liberty Mutual Insurance Company's handling of arbitration demand notifications, leading to a procedural dismissal by the court.